Bitcoin Wallets with $1K Balances Jump 20% Since Start of 2024: Fidelity

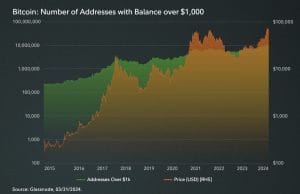

The number of Bitcoin wallets holding $1,000 or more has shot up 20% since the beginning of 2024, according to Fidelity Digital Assets.

In a report released Monday, Fidelity indicated ongoing accumulation among these smaller addresses, reaching a record high of 10.6m on March 13. Compared to 2023, the number of addresses holding over $1,000 has nearly doubled, rising about 101% from 5.3m.

This indicates a sustained increase in the number of smaller addresses acquiring and holding Bitcoin, despite the upward trend in prices.

“This may be representative of a growing distribution of bitcoin and its adoption among the “average” person,” the report said.

However, Fidelity cautioned that the accuracy of the figure might be affected by price appreciation during the period and address consolidation.

As of April 25, Bitcoin has surged by 89% in the past six months and last traded around $64,150.

Self-Custody Gains Traction After Exchange Issues

The report also revealed the amount of Bitcoin held on exchanges, which has been decreasing since its peak in 2020.

Driven by various exchange failures in 2022 and other problematic exchange practices, self-custody has become increasingly popular among Bitcoin holders throughout 2023. This trend persisted in Q1 2024, with exchange balances declining further to nearly 2.3m BTC.

This marks a nearly 30% decrease from all-time highs and a 4.2% decline over Q1 2024. However, the decrease in exchange balances does not necessarily indicate a corresponding increase in self-custody.

Fidelity said the drop in available Bitcoin on exchanges will be a significant measure to monitor in 2024, emphasizing the importance of alternative custody methods like self-custody.

Hodler Outflows Challenge Traditional Bitcoin Halving Pattern

The report also discussed changes in the net position of hodlers, who typically hold Bitcoin for the long term.

From Q3 to Q4 2023, the average net position dropped from 40,442 Bitcoin to 31,376, with a notable decline at the end of 2023. Despite a slight recovery in late February, this group continued to experience significant outflows, possibly influenced by Bitcoin’s new all-time high.

This occurrence before the halving is unusual compared to past cycles, suggesting that these investors may perceive Bitcoin as being heavily overvalued before the halving. Current outflows amount to about 124,001 Bitcoin.