Bitcoin Up In a Year Again: Hits USD 11,000, Grows Dominance

It took one day for the most popular cryptocurrency, bitcoin (BTC), to climb from the long-awaited USD 10,000 level to USD 11,000, increasing its dominance in the market and showing positive returns in the past 12 months again. However, BTC is still not the best performer even among the top 10 coins.

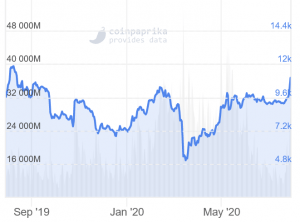

At pixel time (04:40 UTC), BTC trades at USD 10,953, correcting lower from USD 11,306, reached in the last hours of Monday. The price is now up by 7% in a day, 19% in a week, 22% in a month, and almost 14% in a year. Last time BTC was at this level is August 2019, when it reached USD 12,000 once more before starting its journey to USD 6,900.

BTC price chart:

Meanwhile, since Sunday, BTC dominance, or the percentage of the total market capitalization, has increased by more than 2 percentage points, to 62%.

However, while ethereum (ETH) is down today (-1.3%), major altcoins such as bitcoin cach (BCH) (+9%), litecoin (LTC) (+9.6%) outperformed BTC on both daily and weekly charts.

This BTC rally “has [many] interesting implications and is notably in sync with the rally seen in gold and silver, both of which are benefiting from COVID-19 driven stimulus packages,” according to Joe DiPasquale, CEO of crypto fund manager BitBull Capital.

He added that as gold trades near its all-time high reflecting decreasing market confidence in current economic policies, bitcoin appears to present an attractive alternative investment opportunity for investors.

“Meanwhile, bitcoin FOMO [fear of missing out] is currently on display as BTC dominance is rising again and [altcoins] are posting losses as BTC rallies today. The FOMO, coupled with increasing volumes indicates that this rally may finally push bitcoin to conclusively beat yearly highs,” the CEO said.

He also suggested that market participants may want to follow the US Federal Reserve’s meeting on Wednesday for policy announcements and keep an eye on gold, silver, and equities to assess market sentiments.

Co-founder and Partner at crypto hedge fund Spartan Capital, Kelvin Koh, added that a “small move in BTC” has already created ruptures in a number of speculative DeFi assets with some falling over 20% in a day.

“A further rotation of capital into $BTC and $ETH will likely expose some of the DeFi projects that are overhyped,” he said.

__

Learn more: Bitcoin Correcting Gains, Major Altcoins Look Bullish