Bitcoin to Sub-$20,000 Next? Here’s What Options Markets Say About the BTC Price Outlook

Cryptocurrency markets have slipped on Tuesday in tandem with US stock prices as US yields and the US dollar rise in wake of hawkish commentary from US Federal Reserve Chairman Jerome Powell at the first day of his semi-annual testimony before the US Congress on Tuesday.

Powell warned that the Fed could lift interest rates higher and at a faster pace than previously signalled. Analysts interpreted Powell’s remarks as an opening of the door to a possible 50 bps rate hike at this month’s policy meeting.

Bitcoin was last trading just above $22,000 following its first dip beneath that level since mid-February earlier in the session and was last down about 1.5% on the day. Technicians pointed out that Tuesday’s drop means Bitcoin has now broken below an uptrend that had been in play since mid-January, opening the door to a potential retest of February’s lows in the $23,000s and perhaps even the 18th January low in the $20,300s.

Certainly, the 14-Day Relative Strength Index (RSI) suggests that there is plenty of room further downside before Bitcoin reaches a point of being oversold. Bitcoin’s RSI was last around 40, with a score below 30 seen as signifying that market conditions have become overly bearish.

Some bears think that a retest of Bitcoin’s 200-Day Moving Average and Realized Price (the average price at which each Bitcoin last moved on the blockchain) in the $19,700-800 region is a possibility. Crypto futures traders certainly seem to have turned more bearish, with the futures margin funding rates having turned negative in recent days to a degree not seen since early January.

US interest rates rising higher and at a faster pace than previously signaled, as Powell warned was a possibility, depends upon how hot upcoming US economic data is. Crypto traders will now be nervously monitoring this week’s US jobs data, hoping the data doesn’t reveal too strong a labor market. The current stronger-than-expected US labor market is viewed as a challenge for the Fed, who are trying to get inflation under control.

If the jobs data does come out on the stronger side, this could trigger further downside in crypto as traders increase bets on a 50 bps rate hike from the Fed later this month. That would likely worsen sentiment in the crypto market.

Options Markets Still Sanguine on Volatility Risks

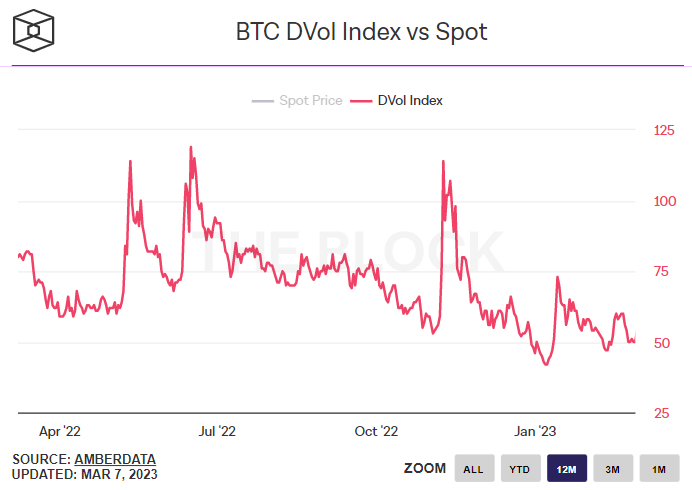

Despite concerns that a further hawkish repricing of Fed tightening expectations could provoke fresh cryptocurrency market volatility, Bitcoin options markets continue to signal that price risks remains limited. For example, Deribit’s Bitcoin Volatility Index (DVOL) remained unchanged at 51 on Tuesday, still not too far above January’s record lows of 42, according to data presented by The Block. Deribit is the dominant exchange for cryptocurrency derivatives.

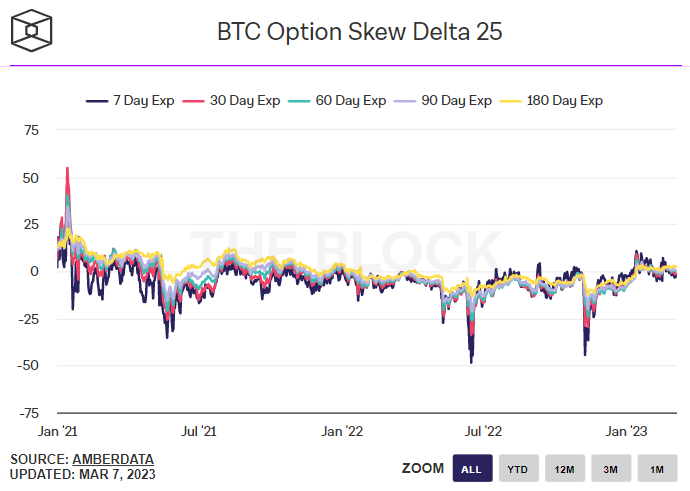

Meanwhile, the 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days also largely continue to go sideways, within recent ranges and, for the most part, still pretty close to zero, indicating a fairly neutral market positioning bias. In fairness, the 25% delta skew for shorter-term expiries like the 7 and 30-day are slightly negative at around -1.5, while the 180-day is at around 2.4, implying the market is a little more optimistic on the medium to long-term Bitcoin price outlook than in the short-term.

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is stronger demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

Options markets are sending a message that a major near-term collapse in prices is unlikely. That could suggest that Bitcoin will find strong dip-buying interest if/when it retests key support areas, like around $21,400, in the $20,300s or in the $19,700-800 area.