Bitcoin Represents 53% of Clients’ Portfolio Holdings in LatAm: Bitso

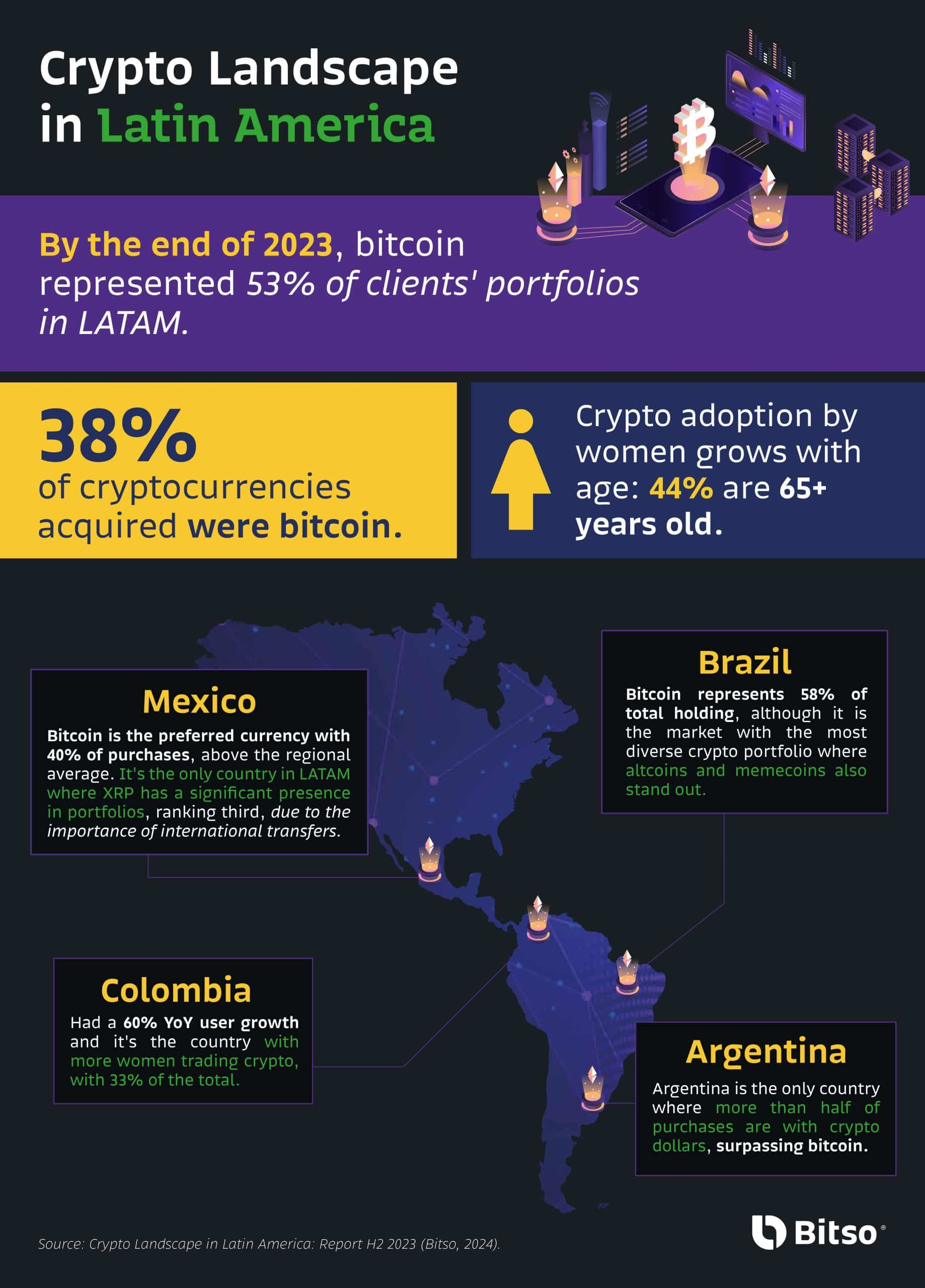

Bitcoin (BTC) makes up 53% of user portfolios in Latin America, reveals crypto exchange platform Bitso’s latest Crypto Landscape report.

“By the end of 2023, Bitcoin represented 53% of clients’ portfolios in Latin America,” the platform noted.

In the face of economic turbulence in the LatAm region, countries are increasingly shifting to cryptos as a deemed lifeline. As a result, Brazil showed 58% of total holding in Bitcoin, though the most diverse crypto portfolios were altcoins.

Mexican crypto users have placed Bitcoin as the preferred cryptocurrency with 40% of purchases, the report added.

“[Mexico] is the only country in LatAm where XRP has a significant presence in portfolios, ranking third, due to the importance of international transfers.”

Furthermore, the study also emphasized on the increasing participation of women, especially among older age groups, in the crypto space. 44% of female crypto adopters in the region are 65 age and above, the findings revealed.

Colombia and Brazil take the lead, Bitso analysed. Colombia has the highest number of women using the platform, who represent 33% of the total. Meanwhile, Brazil’s women crypto adopters have increased to 31% (up 4 percentage points from average women adopters at 27%.)

In Mexico, the second half of 2023 saw 37% of Bitcoin purchases with Mexican Pesos, were made by women.

Data also suggest that long-term crypto holders continue to hold their digital assets, waiting for a new ‘crypto summer’. The holding attitude demonstrates that consumers across the market trust and believe that the ecosystem will thrive.

Argentinians Prefer Digital Dollar than Bitcoin

Digital dollars including USDC and USDT were among the “fastest-growing” cryptos in the region, Bitso noted. About 26% of average portfolio of Argentina users were stablecoins, driven mainly by the economic environment.

“Argentina is the only country in the region in which the acquisition of digital dollars exceeds that of other cryptocurrencies, by almost 5 times, with 60% of total purchases, compared to 13% for Bitcoin.”

This is because the country’s annual inflation rate soared to 211.4% in 2023, creating an incentive for consumers to target more stable options to protect their money from devaluation.

“In Argentina, users tend to quickly get rid of their at money, as a consequence of the peso devaluation,” the report stressed.