Bitcoin Price Surprisingly Strong As Hot US Inflation Data Throws Fed Rate Cut Story Into Doubt – Where Next for BTC?

Despite hotter-than-expected inflation data, the Bitcoin price defied expectations and surged on Wednesday, even as the US Federal Reserve’s rate cut narrative was thrown into doubt.

The US Consumer Price Index (CPI) reported a 0.4% increase in March, exceeding the anticipated 0.3% rise. Core CPI metrics also surpassed forecasts.

This news sent US bond yields and the US dollar soaring, as traders reconsidered their bets on the US Federal Reserve’s rate cut.

The US 10-year yield reached its highest level since November, climbing nearly 20 bps. Meanwhile, The US Dollar Index (DXY) surged 1% to over 105, also hitting its peak since November 2023.

These big moves weighed heavily on US stock prices, with the S&P 500 last down around 1% on the day. The benchmark US equity index hit its lowest level in nearly four weeks earlier in the session.

Lower stock prices coupled with strength in yields and the US dollar typically spell weakness for crypto prices. That’s because crypto prices tend to have a strong positive correlation to stocks, and a negative correlation to yields and the USD.

The Bitcoin price’s bounce back to the $69,000s may have caught some traders off guard, suggesting that the cryptocurrency market is not as closely aligned with traditional financial markets as once thought.

Traders Pare Back on Fed Easing Bets

Expectations for easing from the US Federal Reserve has been a major driver of Bitcoin’s price appreciation this year.

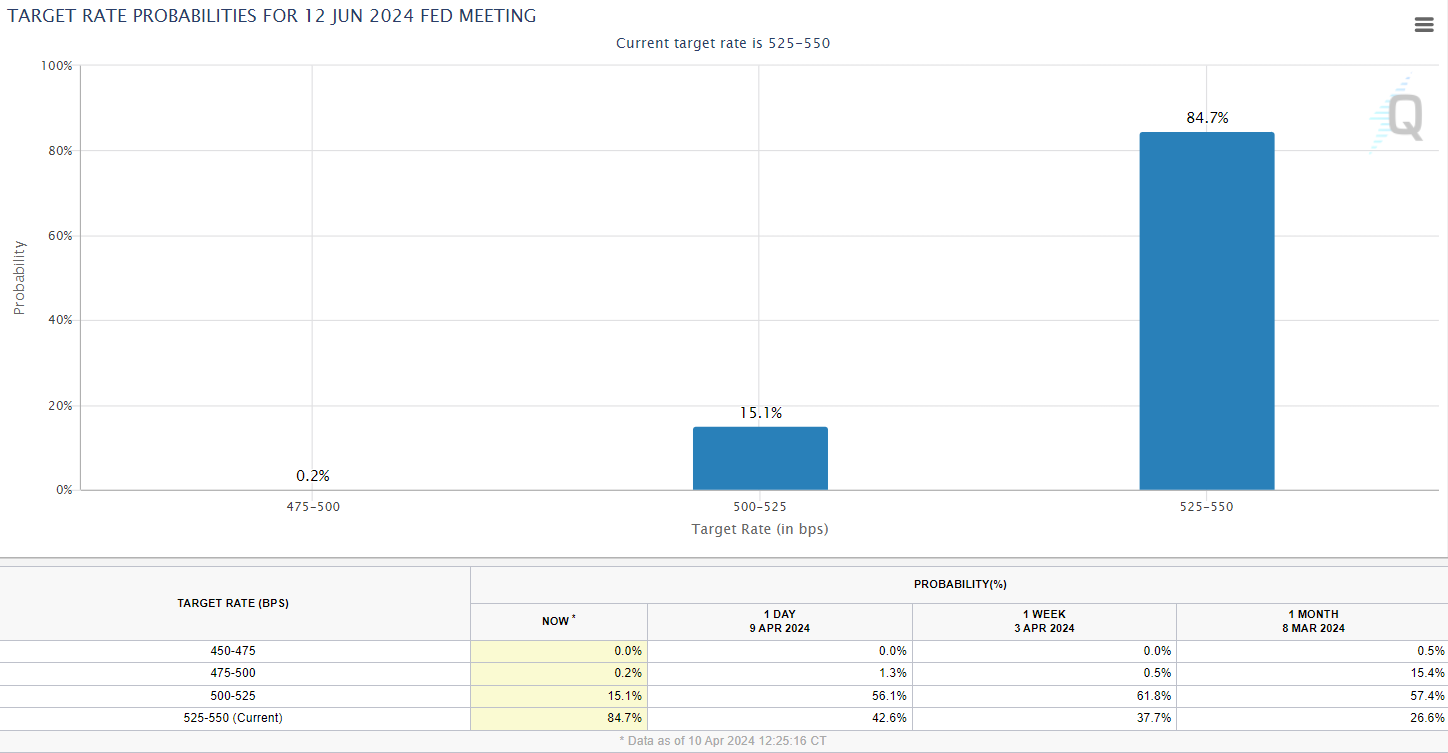

As noted, that narrative took a blow following the latest data. US interest rate futures markets currently are now only pricing a 15% chance that the Fed cuts interest rates by 25 bps to 5.0-5.25% in June, as per the CME’s Fed Watch Tool.

One month ago, US money markets were pricing a 57% chance of a rate cut in June.

That paring back of Fed rate cut bets comes following a string of stronger-than-expected US economic data releases. Wednesday’s hot CPI report follows strong ISM Manufacturing and jobs data last week.

And with the US economy still humming along nicely and inflation stuck well above the Fed’s 2.0% target, policymakers have been reluctant to express support for near-term rate cuts.

Where Next for the Bitcoin (BTC) Price?

Several factors may have contributed to Bitcoin’s resilience on Wednesday, despite the hotter-than-expected inflation data and the resulting sell-off in traditional financial markets.

One possible explanation is the growing belief that the large-scale selling of Grayscale Bitcoin Trust (GBTC) shares by bankrupt crypto estates is nearing an end.

Grayscale CEO Michael Sonnenshein told Reuters on Wednesday that outflows from the ETF may be reaching equilibrium, suggesting that this headwind for Bitcoin is diminishing.

Another possible explanation is the upcoming Bitcoin halving, which is scheduled to take place next Saturday.

The halving will reduce the issuance rate of new Bitcoins by 50%, from 6.25 BTC per block to 3.125 BTC. This is expected to reduce long-term sell pressure from miners and could be a bullish factor for the price of Bitcoin.

However, note that the halving’s short-term market impact is uncertain. In the past, the market has sometimes corrected sharply lower around the time of the halving. Therefore, some traders may be hesitant to make big bets ahead of this event.

Despite the uncertainty surrounding the halving, the long-term outlook for Bitcoin remains positive. The rising US deficit, the upcoming halving, and the potential for a Bitcoin ETF approval are all factors that could support the price of Bitcoin in the long term.

I don't believe this move fading the higher-than-expected CPI. Whether the Fed cut rates 25bps in June or not isn't the long-term driver of bitcoin prices right now. It's a marginal factor.

ETF flows + rising deficits matter more, and they are lining up very well for bitcoin.

— Matt Hougan (@Matt_Hougan) April 10, 2024

Additionally, Bitcoin’s resilience to the market’s paring back on Fed tightening bets suggests that when Fed rate cuts finally do arrive, the Bitcoin price is well-positioned to move higher.

Overall, while it is difficult to predict where the Bitcoin price will go in the short term, the long-term outlook remains bullish. Bitcoin could easily still hit $100,000 this year, but first, it will need to break out of its current consolidation pattern.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.