Bitcoin Price Prediction: Struggles at $43,400 Amid Fed’s Market Impact

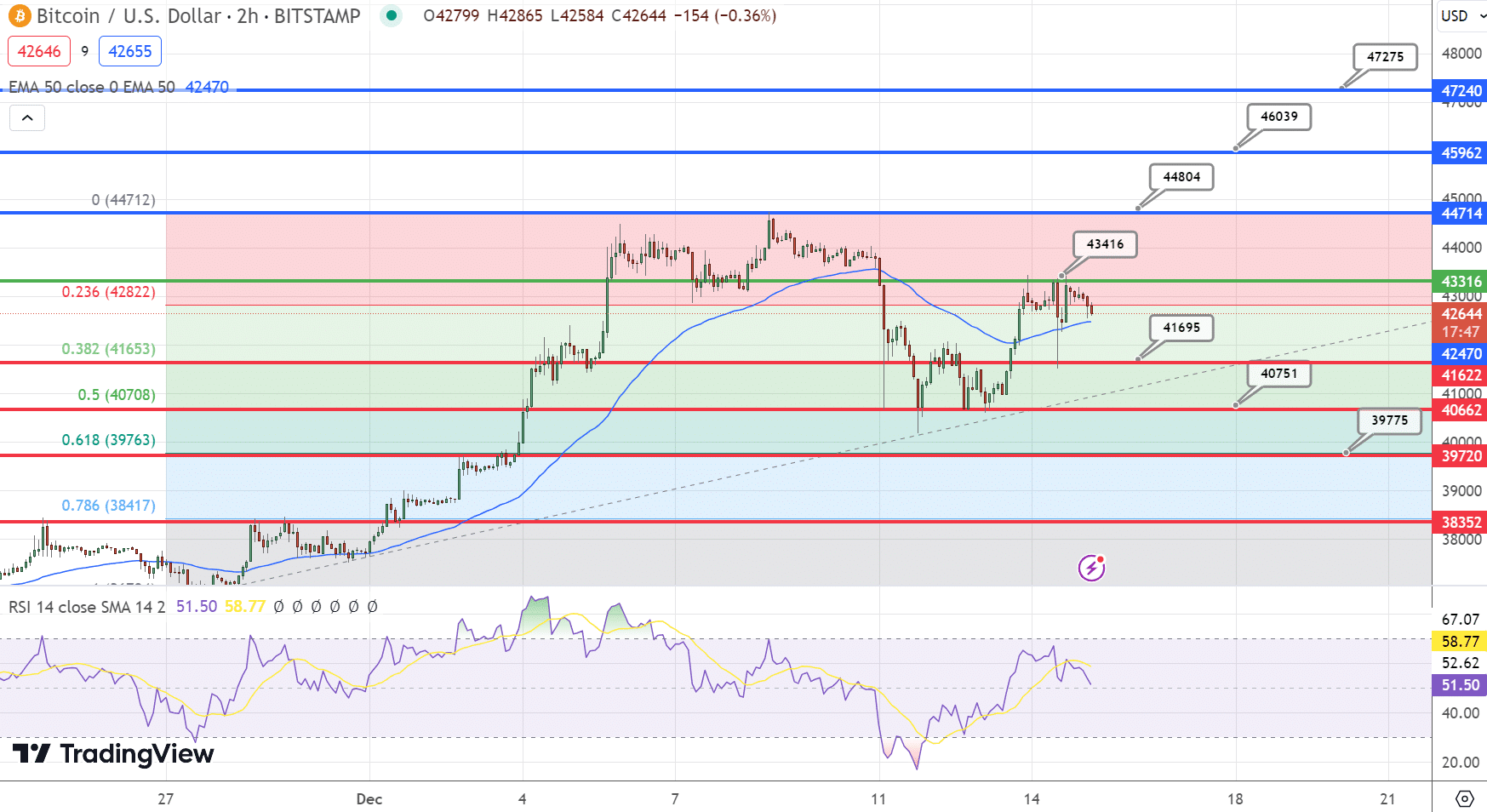

In the ever-shifting landscape of cryptocurrency, Bitcoin encounters resistance at the crucial $43,400 mark, forming a challenging double top pattern. This movement comes amid a backdrop of the Federal Reserve’s nuanced monetary balancing act, which has sent ripples across financial markets globally.

As the Fed navigates through a period of economic recalibration, its decisions are having a profound impact not only on traditional markets but also on the trajectory of Bitcoin.

As investors and traders closely monitor these developments, Bitcoin’s current position poses critical questions about its short-term and long-term price predictions in this complex financial narrative.

Fed’s Monetary Strategy: Market and Bitcoin Impact

The Federal Reserve has recently maintained its interest rates at around 5.25%-5.50%, marking the third consecutive session without a rate hike. This approach signifies a shift from the aggressive rate increases implemented since mid-2022 to combat inflation.

Fed Chair Jerome Powell, in his recent press conference, emphasized balancing inflation control and job market stability. Despite acknowledging improvements in employment, Powell expressed caution, indicating the possibility of policy tightening under ongoing economic uncertainties.

The U.S. Dollar Index (DXY) reacted with a 1.19% decline over two days, as market expectations of more aggressive Fed actions were unmet. Powell’s remarks about potential rate cuts in 2024 and the looming threat of a recession intensified this downward pressure.

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. "We're fully committed to returning inflation to our 2% goal," Fed Chair Jerome Powell said. https://t.co/yy0qOv80XN pic.twitter.com/q3bXkEhIUi

— CNBC (@CNBC) December 13, 2023

Despite positive indicators like the decline in initial unemployment claims to 202,000 and an unexpected uptick in November retail sales, the market’s focus remains on Powell’s cautious stance, anticipating potential rate reductions.

This cautious sentiment is overshadowing positive job and consumer spending data, leading to speculation about upcoming policy shifts.

Amid these developments, Bitcoin benefitted from the dollar’s weakness, climbing to $42,775, a 0.15% gain in 24 hours. Bitcoin’s price often inversely correlates with the US dollar’s value; hence, the dollar’s dip has corresponded with a 3.7% rise in Bitcoin over the past two days.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.