Bitcoin Price Prediction: Dollar Instability, De-Dollarization Effects, China’s Concerns

The BTC/USD is currently experiencing a decline of 0.25%, with its trading price at $26,025. Amidst the backdrop of dollar instability, there arise significant challenges to the ongoing efforts of de-dollarization, ultimately posing potential ramifications for Bitcoin’s prices.

Furthermore, despite China’s disapproval, the dollar continues to maintain its standing, even in light of events at the Jackson Hole Symposium.

Notably, a majority of economists foresee a lack of rate increases throughout 2023, with any potential rate cuts expected to be postponed until March 2024.

The Impact of Dollar Instability on De-Dollarization and BTC Prices

Zain Vawda, a market analyst at DailyFX, explains how recent currency instability in China, Russia, and Argentina undermines efforts towards de-dollarization.

Trust is a core issue, as the USD’s stability, reliability, and liquidity remain unrivaled since the gold standard era. These nations struggle to maintain stability in their local currencies, raising doubts about their ability to unite under a single currency against the dominant dollar.

Global dedollarization efforts face a credibility challenge as currencies of the nations leading the movement take a beating.

— Jose Aguirre (@JoseAgu67679961) August 20, 2023

Slumps in the ruble, yuan, and Argentine peso underscore how the US dollar is a more reliable currency, an expert told Insider.

The BRICS currency proposal faces hurdles ahead of the economic bloc summit. Internal discord among the member countries is the main challenge to charting a clear de-dollarization strategy.

Investor sentiment could weaken as uncertainty looms over the viability of alternative currencies to challenge the USD’s supremacy, potentially leading to a decline in BTC prices. BTC often thrives on financial disruption and uncertainty.

Dollar Maintains Strong Position at Jackson Hole Despite Disappointment from China

The strength of the dollar, driven by anticipated interest rate hikes, is adding to the pressure on Bitcoin’s prices today. All eyes are on the Jackson Hole symposium, where discussions about global economic shifts and interest rate policies are influencing market sentiment.

China’s recent rate cut disappointment, along with the fluctuations of its yuan, is further complicating the situation.

Dollar gains intact as China disappoints, traders eye Jackson Hole https://t.co/33GB2r0Pem pic.twitter.com/jJ2mzJI9L6

— CNA (@ChannelNewsAsia) August 21, 2023

Investors are navigating a complex landscape of policy decisions and economic trends, which are contributing to the current downward movement of BTC.

As markets await insights from the symposium and monitor central bank actions, Bitcoin’s value responds to these intricate financial dynamics.

Economists Predict No Rate Increases Until 2023, With Possible Cuts in March 2024

A decrease in BTC/USD might also be attributed to the ongoing changing economic projections. As economists anticipate no rate hikes until March 2024, according to a recent Reuters poll, market sentiment is uncertain.

The upcoming Jackson Hole Economic Symposium, where Fed Chair Jerome Powell will speak, holds significant weight in shaping the outlook. This coincides with a prevailing belief that the Federal Open Market Committee (FOMC) won’t raise rates this September, further influencing the current market dynamics.

The symposium’s insights, alongside economic indicators, contribute to Bitcoin’s current downward movement, reflecting the intricate relationship between monetary policies and cryptocurrency values.

Consensus Pause: Majority of Economists Predict No Rate Hikes for 2023, With Cuts Delayed Until March 2024 https://t.co/rTl2Sx46OS

— Bobby L. Somers (@BobbyLSomers) August 20, 2023

A decrease in BTC/USD could be due to changing economic projections. Uncertainty prevails as economists predict no rate hikes until March 2024, and the upcoming Jackson Hole Economic Symposium holds significant weight in shaping the outlook.

The prevailing belief that the FOMC won’t raise rates this September is further influencing the market dynamics. Economic indicators and the symposium’s insights contribute to Bitcoin’s current downward movement, reflecting the intricate relationship between monetary policies and cryptocurrency values.

Bitcoin Price Prediction

Bitcoin is currently experiencing some difficulty as it encounters resistance near the $31,000 mark. However, it is managing to stay just above this level at around $31,050. There is a bullish engulfing candle on the daily timeframe, which suggests that a bullish trend may be in the cards.

The current resistance for Bitcoin is at $31,350, but if it manages to break through this level, the next target could be at $32,500 or even higher, at $34,150.

Bitcoin’s positive sentiment is indicated by various technical indicators, such as the relative strength index (RSI) and moving average convergence divergence (MACD). Moreover, the upward trend is supported by the 50-day exponential moving average.

In terms of downside risks, immediate support can be expected at around $30,500 or possibly $29,650. If the price breaks below $29,650, there may be a decline towards $28,650 or even lower to $27,900.

Hence, it is important to keep a close eye on the $31,000 level as it could signal a buying trend for Bitcoin.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

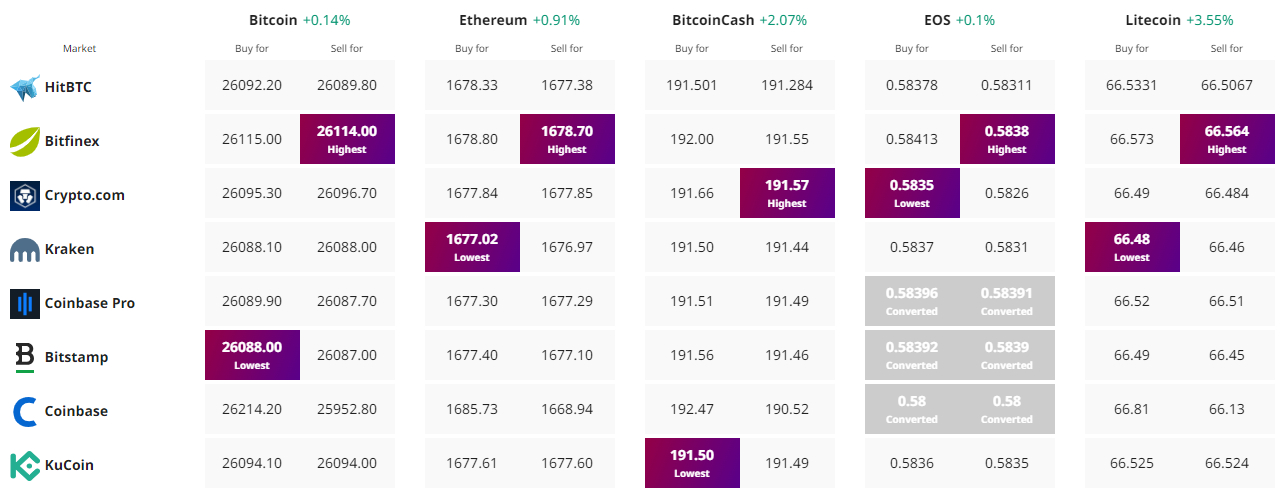

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.