Bitcoin Price Prediction: BTC Under $27K amid Fed’s Stance, Options Expiry, & ETF Awaits

Bitcoin (BTC) was unable to maintain its upward rally from the previous week and remained below the $27,000 mark on Monday.

In fact, the overall cryptocurrency market was valued at $1.04 trillion at the time of this report, indicating a 1.08% drop in the past 24 hours.

However, this dip came in response to the US Federal Reserve’s recent hawkish position during its September meeting, which suggested a rate hike and a sustained period of higher interest rates in the near future.

#BTC ANALYSIS September 25

— Blue Sky (@bacuong87) September 25, 2023

– With the decreasing structure on the H4 frame that I received periodically before, early this morning #BTC had a downward trend towards the 26k price range as I expected. Please refer to today's #BTC commentary!

* On the W1 frame: The W1 candle that… pic.twitter.com/Dn8Mlpukwr

It’s important to note that the crypto market is currently experiencing a bearish trend, especially after the Federal Reserve’s recent statements. Bitcoin (BTC) has seen a 1.4% decline since Monday and is now trading below the $26,300 mark.

Technically, the $26,000 support level holds significant importance because if it fails to sustain, it may trigger further selling pressure for BTC.

Additionally, the market is anticipating increased volatility for BTC as $3 billion worth of Bitcoin options are set to expire on September 29th.

Bitcoin Options Expiry: Potential Impact on Price and Market Dynamics

It’s important to note that the losses in BTC might not last long as there will be approximately $3 billion worth of Bitcoin options and $1.8 billion in Ether options due to expire on September 29th.

This event can cause more trading and price turbulence, similar to traditional finance. However, the Bitcoin Volatility Index has recently shown a slight increase, indicating more dynamic market conditions.

WARNING: Expiry Date of $3 Billion Options on Bitcoin is Approaching! Beware of Volatility!

— 👔 Ney Mons| #Investor | #Investing Enthusiast (@getfinanceboost) September 23, 2023

As we know, options expiries often lead to significant trading activity, which may affect prices. As a result, institutional investors will use advanced strategies to manage volatility, which could impact Bitcoin’s value.

Therefore, we are uncertain about the impact of the options expiry on the BTC price, which could be both positive and negative. It’s worth noting that increased trading and potential price turbulence can cause short-term fluctuations.

However, institutional investors employing strategies to manage volatility could also stabilize or positively impact the price. Traders should be ready for potential fluctuations, particularly as the month and quarter end.

Potential Approval of Bitcoin Spot ETF: Impact on BTC Price and Market Influx

Another factor that could help BTC price is the potential approval of a Bitcoin spot ETF. Mark Yusko, CEO of Morgan Creek Capital Management, predicts it could attract a massive $300 billion into the market, providing a secure entry for institutional investors.

🚀 #Bitcoin's Parabolic Future 🚀

— BuzzBeatHQ 🚀 (@mely_buzz) September 18, 2023

Mark Yusko, founder of Morgan Creek Capital, predicts a parabolic rise for BTC as $300 billion in institutional capital is set to pour in. He highlights the significance of Bitcoin's halving cycles, adding a zero to its fair value after each.… pic.twitter.com/nHxf4Pideo

Bloomberg’s Eric Balchunas is more conservative, estimating a $150 billion influx upon approval. Currently, there are ten active spot Bitcoin ETF filings, excluding Grayscale’s application to convert GBTC into a spot Bitcoin ETF.

This approval could boost confidence and ease regulatory concerns, positively impacting Bitcoin’s market. Therefore, the potential approval of a Bitcoin spot ETF will likely boost BTC’s price by attracting billions of dollars from institutional investors.

Bitcoin Price Prediction

Examining Bitcoin‘s technicals, it’s evident that the cryptocurrency is concluding with resilience, maintaining a position just above the key support level of 26,000—also viewed as a psychological benchmark.

Consistent closes above this threshold suggest a robust potential for a bullish rebound.

If the market manages to breach the immediate resistance at 26,200, BTC could pursue the subsequent target of 26,500 and potentially extend towards 26,700.

Conversely, a breach below the upward channel, which has been supportive around the 26,000 level, could expose BTC to price declines reaching 25,500 or even 25,300. An extended downtrend might push the BTC price towards 25,004.

On the flip side, should a bullish trend persist, surpassing 26,700 could elevate BTC towards the 27,600 mark.

For today, the 26,000 level is anticipated to serve as a pivotal point, with expectations of continued interactions between bullish and bearish positions.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

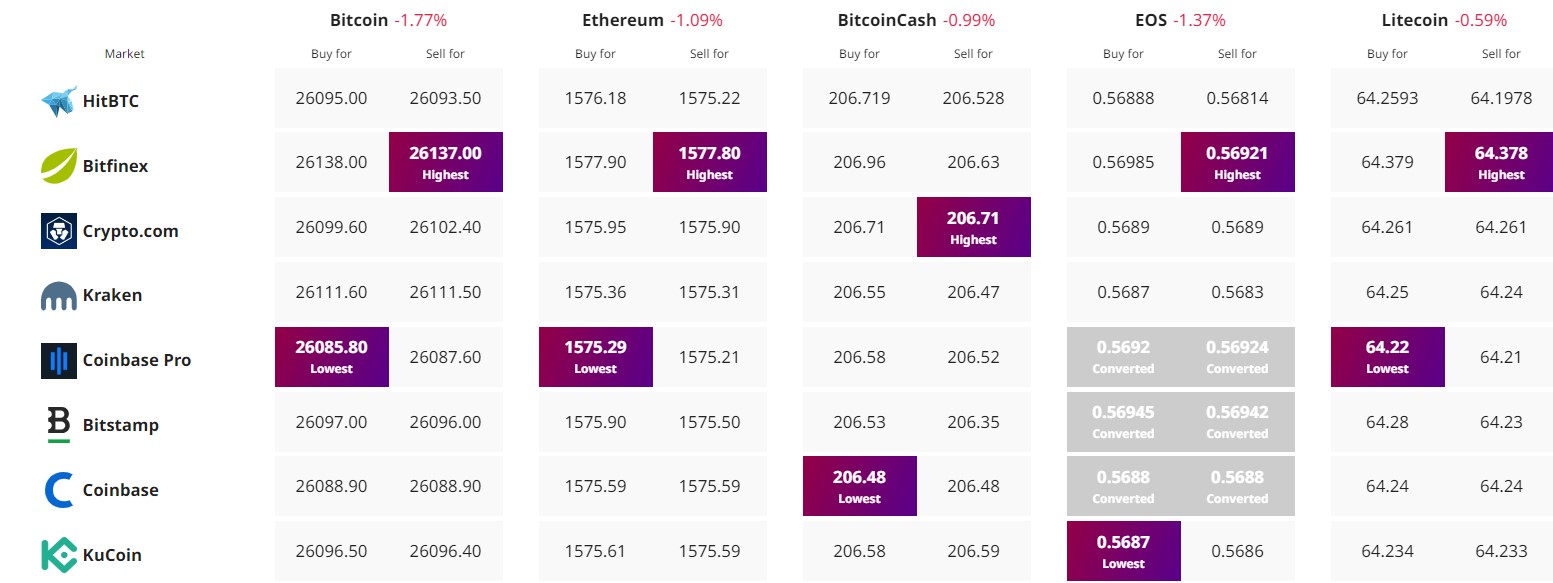

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.