Bitcoin Price Prediction: BTC Slides 4.50% Amidst Mixed Market Sentiment

The price of Bitcoin has experienced a decline of 4.50% in the last seven days as mixed market sentiment continues to impact its performance.

Bitcoin, the leading cryptocurrency, has faced a challenging period as investors grapple with conflicting views and uncertainties in the market.

This recent drop in Bitcoin’s value highlights the volatility and sensitivity of the cryptocurrency to various factors affecting the overall sentiment in the market.

BlackRock CEO Larry Fink Warns of US Endangering Dollar’s Reserve Currency Status

The CEO of BlackRock, the world’s largest asset manager, has issued a warning about the United States endangering the status of the dollar as a reserve currency.

He cited destabilizing factors such as the debt limit dispute, the potential for a national default, and the risk of credit rating downgrades as reasons for concern.

Additionally, he predicted that the Federal Reserve would implement at least two more interest rate increases.

The head of BlackRock expressed apprehension about the impact of the “drama” surrounding the debt ceiling on confidence in the dollar as the world’s reserve currency.

In a statement, he cautioned, “I think we’ll find a solution, but let’s be clear: The US is endangering its position as a reserve currency.”

Blackrock CEO Laurence Fink warns that the U.S. debt ceiling drama is eroding global trust in the dollar. Could this be a tailwind for #Bitcoin? As the U.S. risks its reserve currency status, investors might turn to finite-supply safe havens like BTC. #cryptocurrency #btc… pic.twitter.com/HQAAJ4NdRU

— Digital Economy Insights (@ahmedzein12) June 1, 2023

A deal suspending the $31.4 trillion debt ceiling for the US government was signed into law by President Joe Biden on Saturday, effectively averting a potential default.

Before this, Treasury Secretary Janet Yellen had warned that failure by Congress to take action by June 5 would result in the Treasury being unable to meet all of the government’s financial obligations.

The passing of the agreement to extend the debt ceiling on Friday led to a rise in US equities. President Joe Biden signed the legislation on Saturday to prevent a national collapse.

CZ: Dollar-Based Stablecoins Strengthen USD, Applauds DeSantis

Binance’s CEO, Changpeng Zhao, commonly known as CZ, expressed the belief that dollar-based stablecoins would contribute to strengthening the US dollar. CZ also praised Governor Ron DeSantis, who supports the crypto industry.

During a recent “Ask-me-Anything” session on Twitter, CZ criticized the regulatory framework for cryptocurrencies in the United States.

He voiced concerns about the lack of transparency and instances of regulation by enforcement, claiming that Binance has been a victim of such practices.

We're live on Twitter Spaces with @cz_binance!

— Binance (@binance) May 31, 2023

Have a question for him?

Tune in and raise your hand to ask ⬇️https://t.co/zNnAgdrP9L

According to CZ, the CEO of the world’s largest cryptocurrency exchange, the United States possesses both advantages and disadvantages.

Being a democracy with strong foundations and freedom of expression, the country holds power in various domains.

However, when it comes to cryptocurrency acceptance, the US faces certain drawbacks, as explained by the entrepreneur.

CZ advised that the more stablecoins with a US dollar basis there are, the more widely the dollar will be accepted. Restricting such stablecoins would limit the international use cases for the US currency, particularly within the crypto community.

Although CZ admitted to not following American politics closely due to his busy schedule, he commended Florida Governor Ron DeSantis for his pro-crypto stance.

Zhao stated his admiration for DeSantis, considering him “wonderful.” He also mentioned Hester Peirce, the commissioner of the Securities and Exchange Commission (SEC), and Francis Suarez, the “fantastic” mayor of Miami, as notable figures sharing a positive attitude towards cryptocurrencies.

Dollar-based #stablecoins to increase use cases for the U.S. #currency, #CZ says.

— Bitcoin.ETH💚🌙 (@MiccartA) June 4, 2023

Dollar-Based Stablecoins to Strengthen Greenback, CZ Says, Thinks DeSantis ‘Is Great’#cryptoworld #cryptocurrencies #btc #cryptoinvestor #invest #forexlifestyle #cryptotrading #cryptos #bitcoin pic.twitter.com/AIwGXour79

Changpeng Zhao, the CEO of Binance, recently discussed the ongoing financial challenges encountered by Binance and other companies in the cryptocurrency sector worldwide.

His comments regarding the regulatory hurdles faced by the crypto industry in the world’s largest economy contributed to added pressure on the value of Bitcoin.

Bitcoin Price Prediction

Bitcoin is presently experiencing strong support near the $26,750 level, which is strengthened by a triple bottom pattern, suggesting a possible bullish reversal.

Furthermore, the hourly timeframe reveals a trend line that is providing support at this level, further enhancing the probability of an upward movement.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators indicate bullish conditions, supporting the potential reversal scenario.

Moreover, the resistance level of around $27,350 exerts upward pressure on Bitcoin’s price.

Despite the prevailing bearish trend, there is potential for Bitcoin to experience a bullish breakout above the $26,750 level.

In such a scenario, it would be important to monitor the next resistance levels, which are located around $26,950 and $27,650.

A significant breakthrough above the $27,350 level can drive Bitcoin’s price toward $27,650 and possibly even higher, reaching levels around $27,900 or $28,000.

For today’s trading, keeping an eye on the $27,000 support level is crucial.

A breach below this level could indicate a continuation of the bearish trend.

Conversely, if Bitcoin surpasses the $26,750 level, the next price movement will likely lean toward the bearish side.

Top 15 Cryptocurrencies to Watch in 2023

If you’re interested in getting involved with a cryptocurrency project during its early phase, it is advisable to explore presale tokens.

The team at Cryptonews Industry Talk has curated a comprehensive list of the most promising coins in 2023, providing valuable information about these projects.

This list is regularly updated on a weekly basis, featuring new altcoins and ICO projects, so it’s recommended to revisit it for the latest additions.

Stay informed and stay tuned for exciting opportunities in the crypto space.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

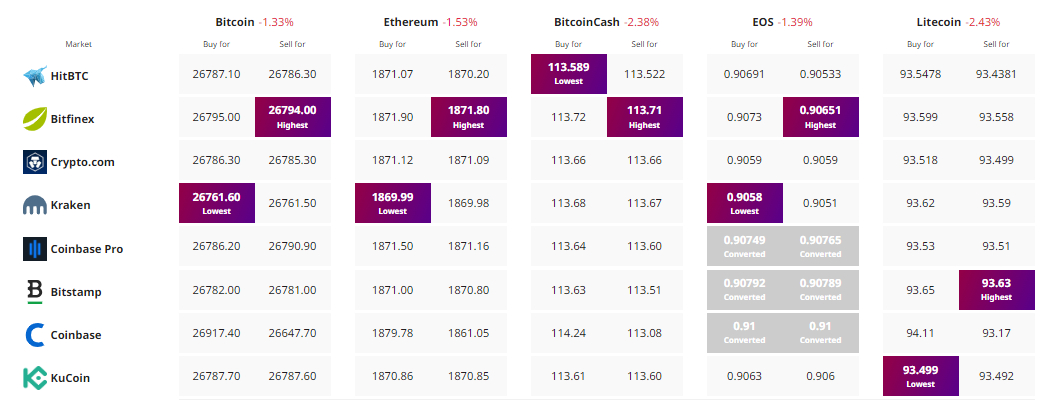

Find The Best Price to Buy/Sell Cryptocurrency