Bitcoin Price Prediction: BTC Nears $38K, Bull Run & ETF Hopes Up

Meanwhile, the crypto regulatory landscape faces renewed scrutiny in Hong Kong as news surfaces of the Hounax exchange founders’ disappearance, allegedly absconding with $19 million.

Amidst these tumultuous developments, Bloomberg analysts strike a hopeful note, eyeing January for a possible breakthrough in Bitcoin ETF approval, which could herald a new chapter for Bitcoin’s integration into mainstream finance.

Fed Policy Shift Fuels Bitcoin’s Surge Past $38K

Bitcoin’s remarkable resurgence has propelled it past the $38,000 mark, signaling a revitalized interest in the cryptocurrency market. The surge is being driven by expectations of a Federal Reserve policy shift toward lowering interest rates amidst subsiding inflation.

#BriefIs: Bitcoin surges above $38,000 on hopes of Fed policy shift, eyes bull run.

📰 Investing(dot)com

— Brief Is (@BriefIsOfficial) November 29, 2023

Benefiting from an upbeat market sentiment after a challenging 2022, Bitcoin has seen a value increase of 129% this year. Remarks by Fed Governor Christopher Waller, hinting at potential rate cuts, further bolster the bullish outlook for risk assets, including cryptocurrencies. Consequently, Bitcoin’s price is currently experiencing an uptick.

Hounax Scandal: Exchange Founders Flee with Millions

In a startling revelation, the founders of Hounax, an unregistered cryptocurrency exchange based in Hong Kong, have reportedly absconded with $19 million, impacting 145 users. This incident marks the second substantial cryptocurrency debacle in the city within a span of two months.

The local regulatory authority, the Securities and Futures Commission (SFC), faces criticism over perceived regulatory lapses in the burgeoning crypto sector. Hounax is alleged to have lured investors by falsely claiming ties to Coinbase’s original technical team and brandishing a Canadian Money Services Business license.

Hong Kong crypto regulators are under fire again after the creators of the Hounax exchange allegedly disappeared with $19 million. https://t.co/z588ULDwxP

— FORTUNE (@FortuneMagazine) November 28, 2023

Despite SFC’s early warning in November, investors’ funds were purportedly withdrawn post-deposit. This scandal trails the disappearance of $120 million from the unlicensed JPEX exchange in September. Calls for tighter regulations by advocates, including lawmakers, may sway public sentiment in the cryptocurrency market.

January Hope: Bloomberg Foresees Potential BTC ETF Approval

Amidst ongoing speculation, Bloomberg analysts project a promising horizon for Bitcoin ETFs, anticipating regulatory green lights as early as January 2024. The SEC’s expedited timeline, advancing decisions by 34 days, hints at a strategic alignment for potential approvals by January 10, 2024.

Bloomberg’s ETF experts, James Seyffart and Eric Balchunas, gauge a 90% likelihood of sanctioning spot Bitcoin ETFs by this date. Seyffart’s analysis underscores the supportive nature of recent SEC delays, while Joe Carlasare, a seasoned commercial litigator, forecasts a more conservative approval window around March 2024.

UPDATE: Franklin has submitted an updated prospectus for their spot #Bitcoin ETF

Earlier today (tweet below) i said that Franklin was the only filer that had not yet submitted an amended S-1. It just dropped a minute ago. https://t.co/YuCrnTFKgx pic.twitter.com/wtVLxUlASf

— James Seyffart (@JSeyff) November 28, 2023

Despite varying expert opinions, the imminent prospect of January approvals, potentially between January 5 and 8, injects optimism into the Bitcoin market, mirroring the uptrend in its valuation driven by these favorable regulatory prospects.

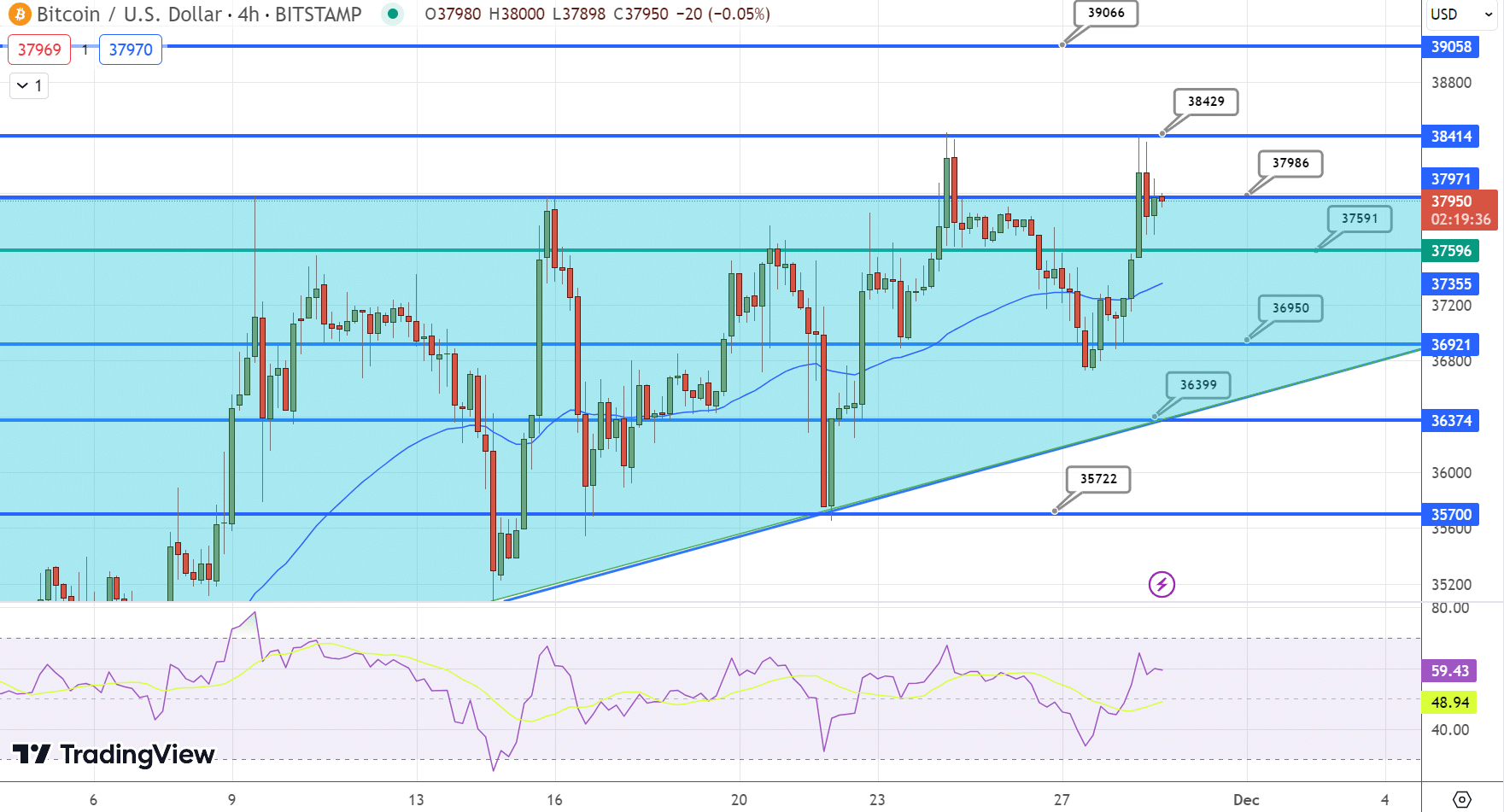

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.