Bitcoin Price Prediction as US Core Inflation Rate is Announced – Where is BTC Going Next?

The decision made by Binance, the largest cryptocurrency exchange in the world, to suspend bitcoin withdrawals due to high volumes and increased processing fees has created anxiety among traders and raised doubts about the future direction of Bitcoin’s price.

Despite the halt, the decrease in Bitcoin’s value was negligible, with the cryptocurrency dropping only 1% to $28,162, its lowest in nearly a week.

This update delves into the recent drop in Bitcoin prices and provides analysis of its implications for the overall cryptocurrency market.

On Wednesday. the focus will be on the US Core Inflation Rate will be in highlights, let’s keep an eye on it.

US Core Inflation Rate In Focus

The US consumer prices rose 5.0% year-over-year in March 2023, to a seasonally adjusted annual rate of 301.836, according to the Consumer Price Index (CPI).

The market had expected a growth of 5.2%, which would have resulted in 302.254 points, thus this decrease is in line with expectations.

As of this writing, headline inflation has fallen for nine straight months, and is already at its lowest level since May 2021.

Energy cost reductions have been the primary factor in the price drop.

Binance Halts Bitcoin Withdrawals Twice in 12 Hours Due to Heavy Volumes and High Fees

Binance has halted Bitcoin withdrawals again, explaining that they have a backlog of requests that needs to be processed.

The exchange had previously suspended BTC withdrawals on May 7 due to a supposed overflow of transactions on the blockchain.

Withdrawals were reinstated half an hour later. However, on May 8, Binance stated that it has suspended BTC withdrawals again due to a high number of pending transactions.

There are 400,000 pending transactions on the bitcoin network and binance halted transactions due to the congestion and high fees

— Crypto Tea (@CryptoTea_) May 7, 2023

I’ve been warning people of this for months and the righteous bitcoin maxis have kept their mouths shut because they can’t admit bitcoin has any… pic.twitter.com/jIopTRj7j8

According to reports, there are currently about 400,000 Bitcoin transactions awaiting processing in the mempool.

At the time when Binance halted Bitcoin withdrawals for the second time, the number of pending transactions in the mempool had increased to around 485,000.

BREAKING: #Binance outflow data confirms largest withdrawal in it's history, over 162,000 $BTC has left the exchange, valued at over $4.6 Billion.

— WhaleWire (@WhaleWire) May 7, 2023

Are Whales/Insiders jumping ship? 👀 pic.twitter.com/QSXYAEvHkt

The mempool is a space where transactions are temporarily held until they are verified by each node on the blockchain.

Currently, there are reports of approximately 400,000 transactions waiting in the Bitcoin mempool for processing, with the number increasing to around 485,000 at the time of the second Binance withdrawal halt.

These transactions are collectively valued at over $5 billion, and the high volume of unprocessed transactions prompted Binance to temporarily halt BTC withdrawals for the second time within 12 hours.

🚨 #BTC deposit and withdrawal services on #OKX are running fine. On chain transaction fee is currently high but our transactions are going through fine.

— OKX (@okx) May 7, 2023

💡Protip: If you want to save a few bucks, please use the lightning ⚡network. pic.twitter.com/VR2SUB6xXg

While Binance temporarily halted Bitcoin withdrawals for the second time due to a significant backlog of outstanding withdrawal requests, OKX reported that its Bitcoin deposit and withdrawal services were still operational despite high transaction fees.

However, the high volume of Bitcoin withdrawals added pressure on BTC/USD prices, causing them to fall below the $29,000 mark.

Bitcoin Withdrawals Unblocked by Binance Following Temporary Halt

Binance, the world’s largest cryptocurrency exchange, suspended Bitcoin withdrawals on Sunday and Monday due to a high volume of transactions and a surge in processing fees.

The exchange cited a backlog of pending transactions, as it had not offered miners a sufficient reward to process trades on the blockchain.

Binance resumed the service at a higher cost, replacing pending Bitcoin withdrawal transactions with a higher fee to ensure they are picked up by mining pools.

Bitcoin’s value dropped slightly to $28,162, its lowest point in almost a week due to the halt.

Bitcoin Price

Bitcoin’s value has shown a continuous bearish trend and has fallen below the $28,000 support level during the US trading session as confirmed by technical indicators like RSI and MACD.

The cryptocurrency is currently heading towards the $28,000 support level after its failure to surpass the 50-day exponential moving average.

A further drop below this level could lead to BTC targeting $27,700.

While the RSI has been oversold, the trend line at $28,350 breached by BTC indicates that the bearish momentum is likely to continue.

Investor’s who are looking to sell may want to consider doing so if Bitcoin falls below the $28,500 level, with a target price of $27,750.

However, if BTC manages to successfully break above the $28,500 level, it could potentially reach $29,000 or even $29,750.

Top 15 Cryptocurrencies to Watch in 2023

The Cryptonews Industry Talk team has put together a list of the top 15 cryptocurrencies for 2023, each showcasing considerable growth potential in both the short and long term.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

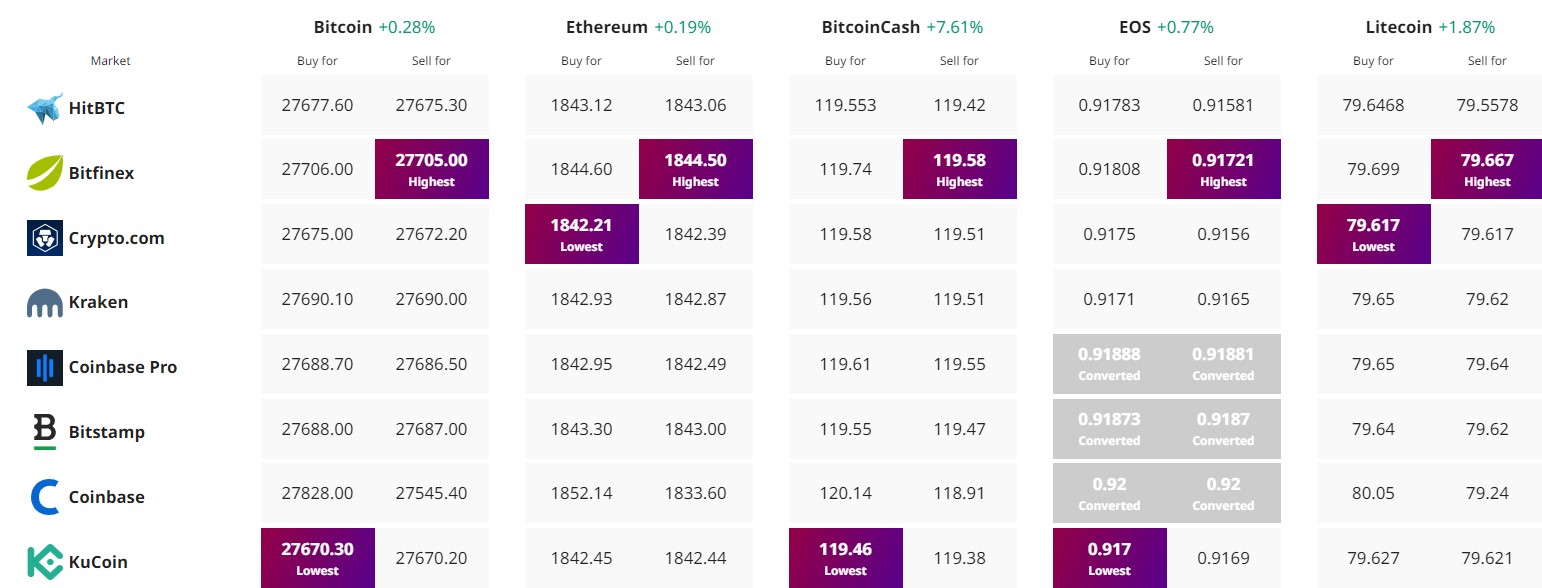

Find The Best Price to Buy/Sell Cryptocurrency