Bitcoin Price Prediction as Bulls Push BTC Up From Recent Bottom at $26,200 – Where is BTC Heading Next?

Bitcoin, the leading cryptocurrency, experienced a recent dip that saw its price reach a bottom at $26,200.

Bitcoin, the leading cryptocurrency, experienced a recent dip that saw its price reach a bottom at $26,200.

However, a surge of bullish activity has propelled BTC back up, raising questions about its future trajectory.

Traders and investors eagerly await insights into where Bitcoin is headed next. Will its upward momentum continue, or is there potential for a reversal?

In this Bitcoin price prediction, we will explore various factors and trends to provide a Bitcoin price prediction and shed light on the future direction of BTC.

Bitcoin Price Prediction

In analyzing the technical aspects of Bitcoin, we observe a persistent absence of notable price movements. Bitcoin maintains its trajectory within a well-defined range, bounded by an upper limit near the 26,800 level and a lower limit around 26,300.

A closer analysis of the 4-hour timeframe reveals the presence of doji candles followed by candles with limited movement.

This pattern reflects a prevailing sense of indecision among investors, as they await a compelling fundamental trigger to catalyze a breakout.

Nevertheless, the current landscape sees Bitcoin confined within a narrow trading range, lacking a significant catalyst for directional movement.

Should Bitcoin succeed in surmounting the resistance level at 26,600, it can potentially target the subsequent level at 27,350.

Notably, this upside potential finds support in the existence of a triple tap pattern discernible in the 4-hour timeframe.

It is important to recognize the inherent challenges of surpassing triple tops; however, heightened demand for Bitcoin may serve as a propelling force behind a breakthrough.

In such a scenario, Bitcoin would encounter further resistance levels at 27,450 and 28,300.

Conversely, a breach below the support level at 26,250 would pave the way for a downside movement, with potential targets at subsequent support levels of 25,900 and 25,400.

Considering leading and lagging technical indicators, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) exhibit oscillatory behavior within the buying and selling zones.

This underscores the ongoing indecision prevailing among investors. Moreover, the four-hour candles of Bitcoin demonstrate fluctuations around the 50-period Exponential Moving Average (EMA), signifying a lack of a clear market direction.

In light of these technical observations, vigilance is advised at key levels of interest, specifically at 26,750 and 26,250, as they hold the potential to serve as breakout points. While Bitcoin remains ensconced within its current range, consolidation is expected to persist.

However, a breakout from this range would present lucrative trading opportunities, irrespective of the direction Bitcoin ultimately follows.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring the handpicked collection of the top 15 most promising digital assets to monitor in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, guaranteeing that you have access to professional recommendations and valuable insights.

Stay ahead of the curve and uncover the potential of these cryptocurrencies as you navigate the constantly evolving landscape of digital assets.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

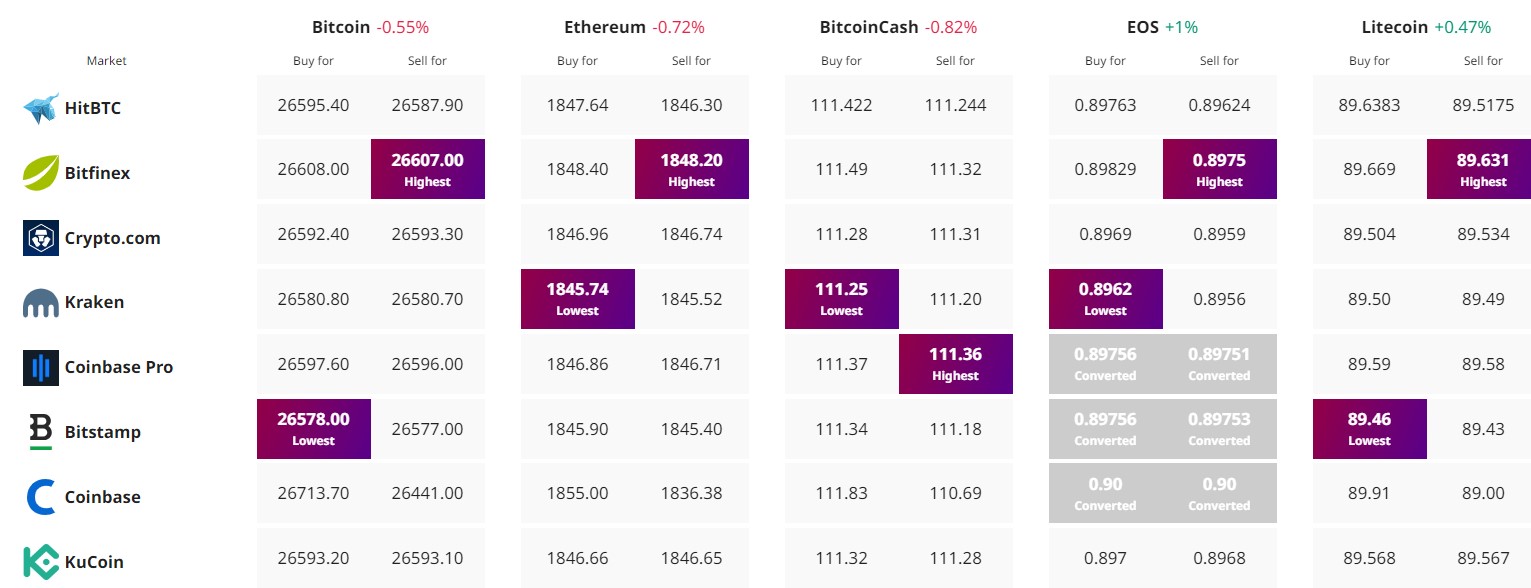

Find The Best Price to Buy/Sell Cryptocurrency