Bitcoin Price Prediction as BTC Revisits $24,000 Zone – Here’s the Next Support Level to Watch

As Bitcoin‘s price revisits the $24,000 zone, many investors and traders are wondering what the future holds for the cryptocurrency. The recently released minutes from the Federal Reserve’s Federal Open Market Committee (FOMC) meeting held on January 31-February 1 indicate a mix of hawkish and dovish perspectives among its members. However, there was no indication of a pause in the US central bank’s ongoing rate hiking cycle.

Bitcoin Price Continues to Decline Following the Publication of FOMC Minutes

The recently released meeting minutes from the Federal Reserve indicate that while there are some signs of inflation slowing down, it is not enough to negate the need for future interest rate hikes. Although the January 31-February 1 meeting ended with a smaller rate increase than previous ones, officials emphasized that inflation remains a major concern.

FOMC Minutes didn't do much today because markets already know the Feds stance and have largely priced it in with a 5.5% terminal rate and no pivot in 2023.

— Fabian D. (@_FabianHD) February 23, 2023

Imo this is probably the extent of the repricing we will see in the Dollar and yields for the next couple weeks. https://t.co/y2ZEEVE7uP pic.twitter.com/Z1ML6ewaV0

The minutes stated that inflation “remained well above” the Fed’s 2% target, and this was compounded by “very tight” labor markets, leading to continued upward pressure on wages and prices.

Therefore, the Fed raised the fed funds rate by 0.25 percentage points, the smallest increase since the tightening cycle began in March 2022, resulting in a target range of 4.5%-4.75%. However, the minutes also revealed that the slower pace was accompanied by a high degree of anxiety that inflation remained a threat.

Impact of FOMC

The Federal Reserve’s decision to raise interest rates and their concerns about inflation may have an impact on the Bitcoin and cryptocurrency market. As the Fed tightens monetary policy, it could lead to a decrease in liquidity and a strengthening of the US dollar, which could negatively impact the price of Bitcoin and other digital assets.

On the other hand, some investors view Bitcoin as a hedge against inflation and may choose to invest in it as a way to protect their wealth from the eroding effects of inflation. Additionally, if rising interest rates lead to a sell-off in the stock market, it could create more demand for alternative investments like Bitcoin, as investors look for higher-yielding assets with less correlation to traditional markets.

Overall, the impact of the Fed’s decision on the cryptocurrency market is complex and could go either way.

Increasing BTC Accumulation Coincides with Decreasing USDC Holdings

Following the collapse of FTX and the resulting market turbulence in 2022, many traders lost their Bitcoin holdings. To protect their liquidity, most traders liquidated their BTC positions and invested in stablecoins like USDC. As a result, USDC holdings surged while BTC holdings declined, as per a recent analysis by Santiment. However, the tide seems to have turned for both assets.

Santiment’s data shows that there has been a recent increase in the amount of USDC being invested in Bitcoin. In the last two months, the number of addresses holding between 100,000 and 1 million USDC has decreased by 7.8%. Additionally, the graph indicates that USDC withdrawals are being reinvested in Bitcoin.

🐳 It appears that #USDCoin has played a key role in #crypto's fluctuations, particularly since the #FTXbankruptcy in early November. The amount of addresses holding 100K-100M $USDC by 2,001 (-7.8%) in just the past 2 months as money shifted back to $BTC. https://t.co/d8S7lkohNZ pic.twitter.com/4aumdwdzAS

— Santiment (@santimentfeed) February 21, 2023

The recent trend of increasing USDC investment in Bitcoin could potentially have a positive impact on BTC’s price. As more traders and investors allocate their USDC holdings to Bitcoin, it could create more demand for the cryptocurrency, leading to a potential increase in its value.

Bitcoin Price

As of now, the current live price of Bitcoin is $24,207, and its 24-hour trading volume is $28.9. Over the last 24 hours, Bitcoin has increased by 0.47%. According to CoinMarketCap, Bitcoin holds the top spot, with a live market capitalization of $467 billion. It has a circulating supply of 19,299,243 BTC coins, and the maximum supply is 21,000,000 BTC coins.

On the 2-hour timeframe, Bitcoin is currently showing an ascending triangle pattern, with an upward trendline acting as support around the $24,000 mark. However, if Bitcoin’s price falls below this level, the next support level is expected to be around $23,400. In addition, the RSI and MACD indicators are currently in the selling zone, which is creating additional selling pressure on Bitcoin.

Looking ahead, Bitcoin’s immediate resistance level is at $24,500. If buying pressure increases, it could lead to a breakout above this level, opening the way for BTC to test the next resistance level at $25,200.

Bitcoin Alternatives

CryptoNews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. The report provides valuable insights to help investors make well-informed investment decisions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

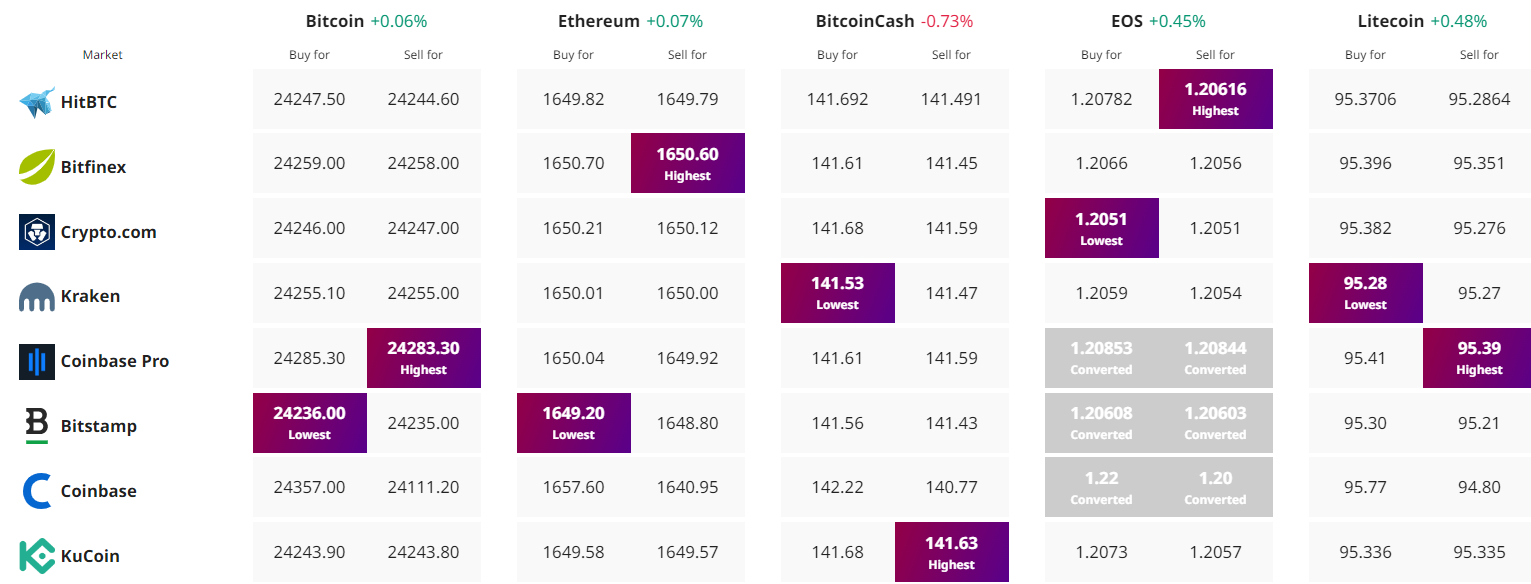

Find The Best Price to Buy/Sell Cryptocurrency