Bitcoin Price Prediction as BTC Price Reverses on Anticipation That BlackRock To Apply for Spot Ethereum ETF – Here Are the Key Levels to Watch

While it continues to trade roughly 1% higher on the day, Bitcoin (BTC) has seen an abrupt reversal back from the new year-to-date highs it hit close to $38,000 and was last trading just above $36,000.

Traders put the abrupt reversal down to reports that BlackRock had set up a new corporate entity called the iShares Ethereum Trust in Delaware, prompting a rotation of funds from Bitcoin into Ether.

BlackRock set up the iShares Bitcoin Trust seven days prior to applying to create a spot Bitcoin ETF with the SEC in June, and so the spike in the ETH price plus rotation out of BTC appears to reflect optimism that spot Ethereum ETFs are set to receive approval shortly after spot Bitcoin ETFs.

Ether has significantly underperformed Bitcoin in recent weeks and throughout 2023, up 70% year-to-date versus Bitcoin’s gains of over 120%.

Part of this differential in performance has been because optimism about spot Bitcoin ETF approvals, so with BlackRock seemingly now making moves to set up a spot Ether ETF, ETH is potentially set to close the gap on Bitcoin in the weeks and months ahead, hence the rush to gain exposure to the cryptocurrency.

Are Spot Ethereum ETFs Bearish for Bitcoin (BTC)?

Of course, while the news of BlackRock’s moves to set up a spot Ethereum ETF have weighed on Bitcoin has weighed on the BTC price intra-day, this isn’t bearish news for Bitcoin.

Some bears might argue that a greater choice of ETF to invest in (i.e. spot Bitcoin ETFs and spot ETH ETFs) might mean that less funds end up flowing into the highly anticipated spot Bitcoin ETFs.

But news that BlackRock is making moves to set up spot Ethereum ETFs is very much in fitting with the bullish narrative that financial institutions are set to increase their adoption of crypto in the coming years (Bitcoin, Ether and other cryptocurrencies).

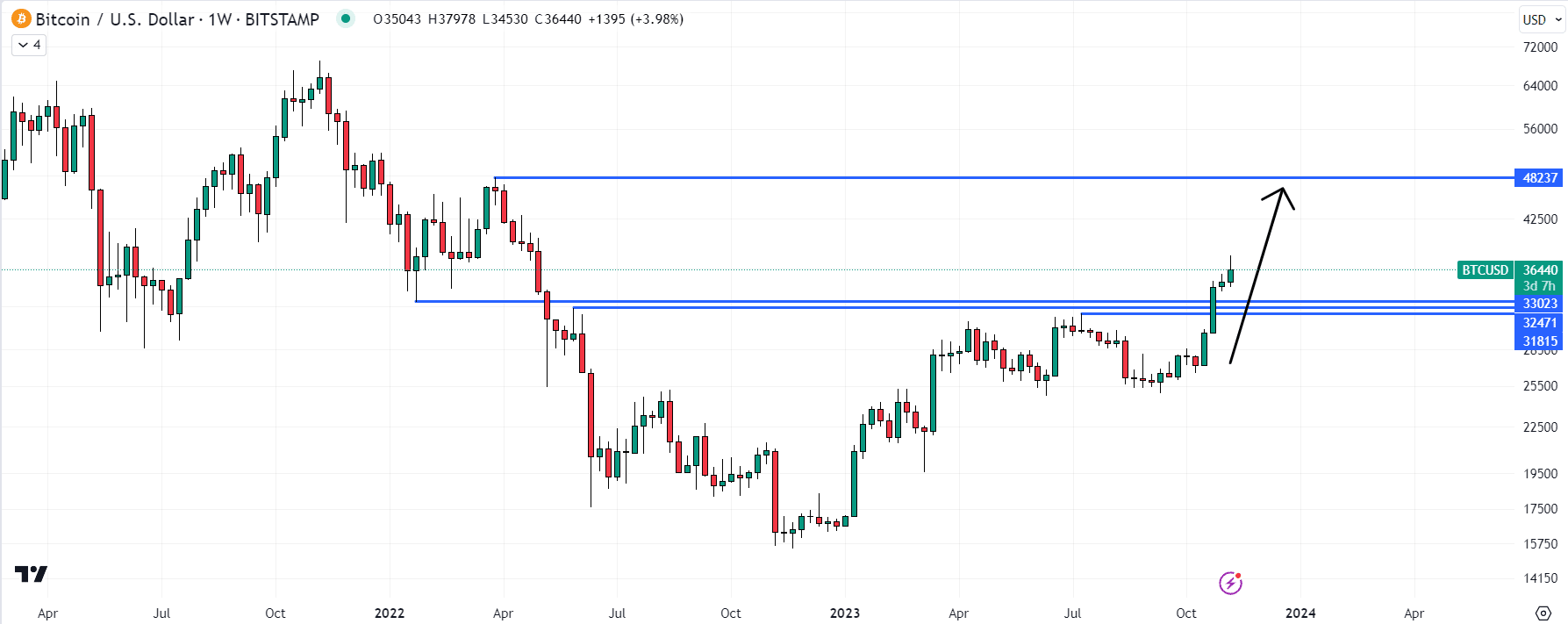

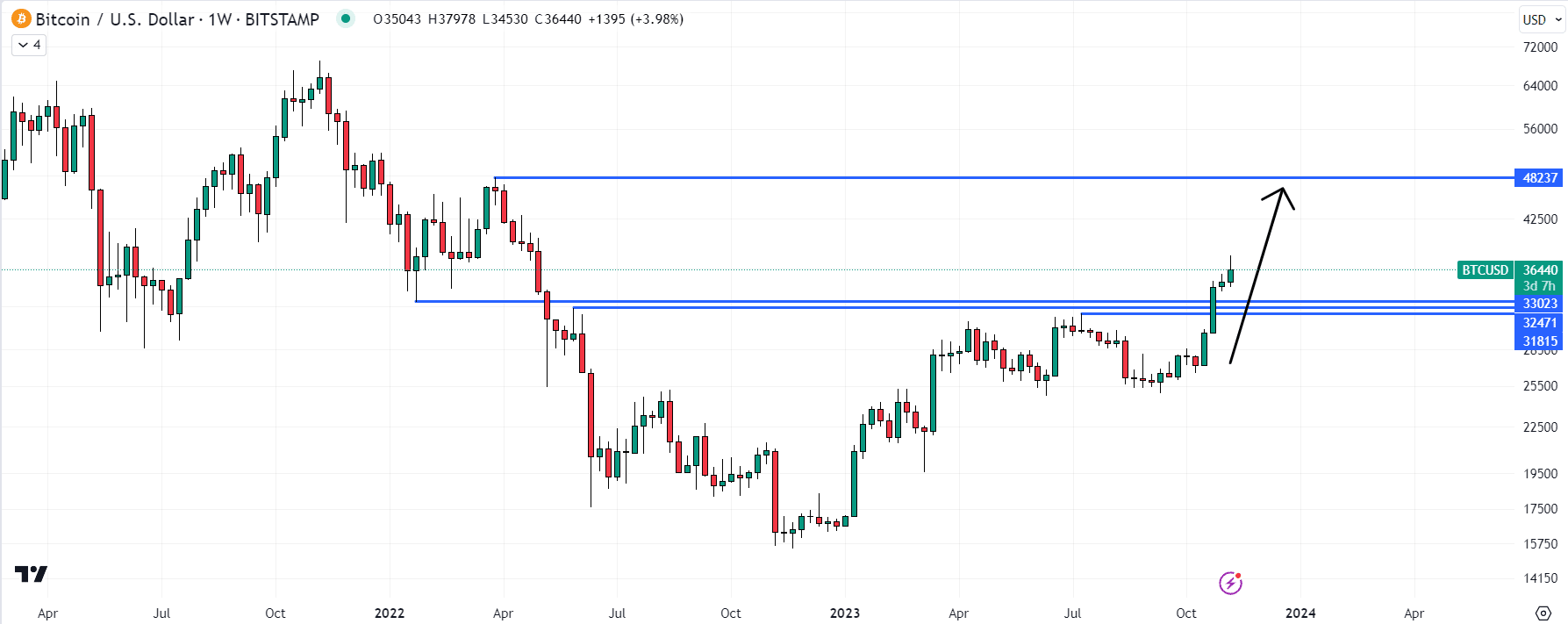

Where Next for Bitcoin (BTC)? Watch These Key Levels

It appears that the pullback from close to $38,000 to briefly under $36,000 is being used as an opportunity by the Bitcoin bulls to add to their long positions, with Bitcoin having already bounced from earlier US session lows in the $35,800 area to around $36,400.

Optimism about near-term spot Bitcoin ETF approvals is set to remain at a fever pitch, with the latest reports suggesting that the SEC is actively working with digital asset manager Grayscale regarding their spot Bitcoin ETF application in wake of suffering a legal defeat against the firm earlier in the year over their prior rejection of Grayscales spot Bitcoin ETF applications.

That means that dips are likely to remain buying opportunities for tactically-minded investors.

With the macro backdrop seemingly having taken a decisive turn for the better, with US stocks in an uptrend following an ugly October and US government bond yields seemingly now in a downtrend after hitting multi-decade highs in recent months on bets the Fed’s rate hike tightening cycle is over, there is plenty of room for both Bitcoin, Ether and the broader crypto market to perform well in unison.

Macro traders will be eyeing commentary from Fed Chair Jerome Powell later on Wednesday and on Thursday in wake of investors interpreting his post Fed policy announcement comments last week dovishly, and in wake of last week’s surprisingly weak US data.

As long as markets continue to bet that the Fed’s tightening cycle is over, the conditions for a continued rally in US stocks and fall in US yields remain in place, which would add tailwinds to the crypto markets which looks set to also continue benefitting from optimism about spot ETF approvals.

In wake of Bitcoin having decisively broken to the north of $31,000-$33,000 resistance last month, the cryptocurrency seemingly remains odds on to challenge the next key resistance level just above $48,000, which would mark a further 33% gain from current levels.