Bitcoin Price Prediction as BTC Holds Steady at $26,500 Support – Are Bears Taking Control?

Key Points

- Bitcoin currently trades at $26,730 with a slight 24-hour increase and boasts a market cap of $521.58 billion.

- The 50-day EMA stands at $27,210, emphasizing a bearish sentiment as Bitcoin trades below this marker.

- A notable chart pattern, the double bottom breakout, has occurred at $26,900, which now acts as a resistance point.

Bitcoin, the world’s premier cryptocurrency, faced challenges in sustaining its value, plunging below the $27,000 threshold on Friday. In the last 24 hours, its price largely oscillated around the $26,600 mark.

The recent depreciation is largely tied to the unveiling of the US Consumer Price Index (CPI) for September. This index rose by 0.4%, surpassing the projected 0.3%.

This unexpected surge in the CPI catalyzed a sell-off in risk-prone assets, encapsulating cryptocurrencies.

#BITCOIN 2-hr. Chart Analysis

— AskToRahulSingh©️ (@AskToRahulSingh) October 13, 2023

As per present $BTC movements, it will be stucked between $26.9k to $26.5k , if it's moving into this scale up to 2-3 up-down cycles, then major chances to break-out $26k mark soon with in next 48 hrs.

While, $BTC already moving under #BearishFlag… pic.twitter.com/qJI6e5vmFg

Concurrently, the US Dollar rallied by 0.8% after the US CPI release, marking another significant element pressuring the cryptocurrency realm downwards.

This scenario underscores a heightened investor prudence, a sentiment casting shadows not merely on the crypto space but also on the conventional financial arenas.

Bitcoin Price

On October 13, Bitcoin’s current trading price stands at $26,730, reflecting a marginal gain of 0.10% over the last 24 hours.

With a significant 24-hour trading volume of $13.54 billion, Bitcoin confidently holds its dominant position as the #1 cryptocurrency on CoinMarketCap. The live market capitalization for Bitcoin is an impressive $521.58 billion.

As of now, approximately 19.51 million BTC coins are in circulation, inching closer to its predetermined cap of 21 million BTC.

Bitcoin Price Prediction

In terms of the 4-hour chart, the pivot point for Bitcoin (BTCUSD) is identified at $26,536. On the upside, Bitcoin confronts its first line of resistance at $28,000, followed by resistances at $29,062 and $30,574.

On the downside, support is placed firmly at $25,426, with further supports at $23,891 and $22,876, respectively.

Two significant technical indicators provide insights into the current market trend. The Relative Strength Index (RSI) is marked at 37, leaning towards the bearish side.

Meanwhile, the 50-day Exponential Moving Average (EMA) is $27,210. With the current trading price below this EMA value, it underscores a short-term bearish trend in the market.

Recent chart analysis has revealed an intriguing pattern: a double bottom breakout at the $26,900 mark. Interestingly, this very level now seems to serve as a resistance for Bitcoin.

Such patterns suggest a testing phase for the digital currency as it grapples with overcoming this resistance.

Conclusively, Bitcoin’s trajectory seems bearish as it remains under the $27,210 mark. However, a breakthrough above this threshold can tilt the trend in favor of the bulls.

Short-term predictions anticipate Bitcoin challenging the aforementioned resistance levels in the forthcoming trading sessions.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

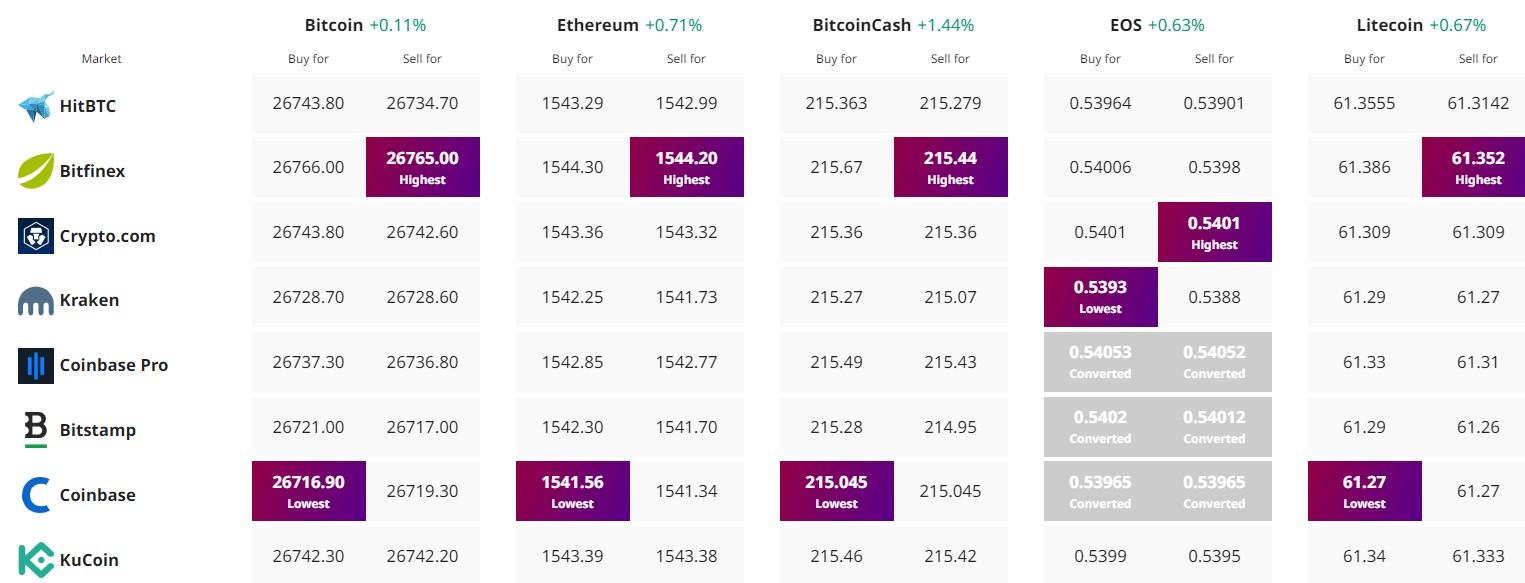

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.