Bitcoin Price and Ethereum Prediction: What’s Ahead in the Coming Week?

Bitcoin (BTC) and Ethereum (ETH) continue to suffer losses, with both cryptocurrencies displaying bearish signals at the start of the new week. The broader cryptocurrency market is also struggling, with Bitcoin and ETH each experiencing declines of over 6% in the past few days.

Other notable cryptocurrencies, including Litecoin (LTC) and Dogecoin (DOGE), also show negative sentiment.

Bitcoin price turns red below $23k, what could trigger a sharp drophttps://t.co/2tUyTjVysf#cawnews#caw 🌙🌙🌙 pic.twitter.com/nN0NxnY2IW

— CawNews 🌙 (@CawNews666) March 6, 2023

The consecutive release of strong US economic data has increased the likelihood of the Federal Reserve’s hawkish stance, which is one of the primary factors negatively impacting the cryptocurrency market, including Bitcoin.

Furthermore, the Silvergate incident has worsened the market’s losses. Meanwhile, Binance’s management expressed concern about regulatory issues related to their association with Binance US.

It is worth noting that Binance believes US authorities will view them as a single entity, which could result in regulatory hurdles, possibly leading to further Bitcoin losses.

There are 5 major crypto headwinds alarming the market right now. 🚨

— Miles Deutscher (@milesdeutscher) March 3, 2023

• Mt. Gox 142,000 $BTC unlock

• Shanghai upgrade $ETH withdrawals

• Silvergate collapse

• Macroeconomic shift

• Regulatory crypto clampdown

🧵: Here's how each headwind will affect the market.👇

Looking ahead, traders and investors are eagerly awaiting positive economic data from China, which is expected to be released this week and may help the cryptocurrency market to recover its strength.

What’s Ahead in the Coming Week?

Investors will be keeping an eye on two key economic events later today. Firstly, at 7:30 am, the release of Switzerland’s CPI month-on-month figure will be closely monitored. The market expects a 0.6% increase, compared to the previous month’s 0.5%.

📅📊 Big week ahead with NFP in highlights:

— Arslan B. (@forex_arslan) March 6, 2023

Monday, March 6 📅

🇨🇭CHF CPI m/m: 0.5% vs. 0.6%

🇨🇦CAD Ivey PMI: 55.9 vs. 60.1#forex #trading #economics #CAD #CHF #NFP

Secondly, at 3:00 pm, the release of Canada’s Ivey Purchasing Managers’ Index (PMI) will also be watched closely. The previous month’s reading was 60.1, and the market forecast for this month is 55.9.

On Friday, there are several key economic events to watch, including the release of employment data for Canada and the US. This includes the CAD Employment Change and Unemployment Rate, as well as the USD Average Hourly Earnings m/m, Non-Farm Employment Change, and Unemployment Rate.

Friday, March 10 📅

— Arslan B. (@forex_arslan) March 6, 2023

🇬🇧GBP GDP m/m: 0.1% vs. -0.5%

🇨🇦CAD Employment Change: 6.0K vs. 150.0K

🇺🇸USD Average Hourly Earnings m/m: 0.3% vs. 0.3%

🇺🇸USD Non-Farm Employment Change: 206K vs. 517K

🇺🇸USD Unemployment Rate: 3.4% vs. 3.4%#forex #trading #economics #GBP #CAD #USD

These data points are closely monitored by investors and traders as they can have a significant impact on the financial markets, including currencies and stocks.

Risk-Off Sentiment In Crypto Market

The global cryptocurrency market continued its downward trend over the weekend, as market players struggled to process the Silvergate situation. Bitcoin’s value fluctuated between $22,500 and $22,600 in the last 24 hours, representing a 1% drop.

Ethereum’s value also fell by 1% and is now below $1,600, mimicking the behavior of BTC. If the impact of Silvergate does not spread, we may see a gradual rebound in digital assets across the board.

However, the good news is that the entire crypto market cap remains above $1 trillion, providing some reassurance to crypto traders.

Crypto Breaking News D2

— Trade Coin D2 (@TradeCoinD2) March 6, 2023

$1.3 Billion Digital Asset Management Firm Says Crypto Market Set for Largest Ever Bull Cycle#tradecoin #tradecoind2 #tradecoind2_vn #Crypto #cryptomarket pic.twitter.com/CjVpnVQOLl

In addition, Binance’s management expressed concern about regulatory issues related to their association with Binance US, which is their subsidiary located in the United States.

Binance is apprehensive that US regulators may view the two entities as one, resulting in potential regulatory problems. This comes as regulatory oversight of Binance and the wider cryptocurrency industry is becoming more stringent.

Sluggish US Dollar Confuse Traders

Investors have been waiting for the Federal Reserve Chair Jerome Powell’s testimony and the release of February employment data, which could potentially affect the US central bank’s aggressiveness, resulting in mixed signals from the broad-based US dollar.

The dollar has been range-bound around 104.560, and the dollar index, which measures the currency against six major peers, was down 0.057% at 104.560. However, the index remained close to its seven-week high of 105.36, which was achieved last week.

US dollar liquidity is on the rise so far in March (~+100bn inflows)

— tedtalksmacro (@tedtalksmacro) March 6, 2023

Liquidity leads, price lags! #Bitcoin pic.twitter.com/ySzT356mLI

The slight drops in the value of the US dollar could potentially offer some relief to the cryptocurrency market by helping to reduce its losses.

Bitcoin Price

The current price of Bitcoin stands at $22,357.71, with a 24-hour trading volume of $18,546,058,671. Over the last 24 hours, Bitcoin has experienced a decline of 0.26%.

Based on technical analysis, the BTC/USD pair is currently consolidating within a narrow trading range of $22,000 to $22,500. A violation of this range has the potential to drive further price action in the Bitcoin market.

If the price breaks above the $22,500 level, there is a possibility for a bullish breakout, which could expose BTC to the $22,800 or even $23,250 levels. However, if support continues to hold around the $22,000 or $21,750 mark, there is a chance for a rebound.

Ethereum Price

The current value of Ethereum is $1,570, with a trading volume of $6.7 billion over the last 24 hours. Over the previous 24 hours, Ethereum has experienced a 0.15% decline in its value.

From a technical standpoint, the ETH/USD pair is currently trading within a narrow range between the levels of $1,550 and $1,580.

If the price of Ethereum falls below the $1,560 level, it may face support at the $1,500 mark. However, it should be noted that there is significant resistance at the $1,620 or $1,680 levels, which could limit any further price declines.

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s curated list of the top 15 altcoins to watch in 2023. The list is frequently updated with new ICO projects and altcoins, so make sure to visit often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

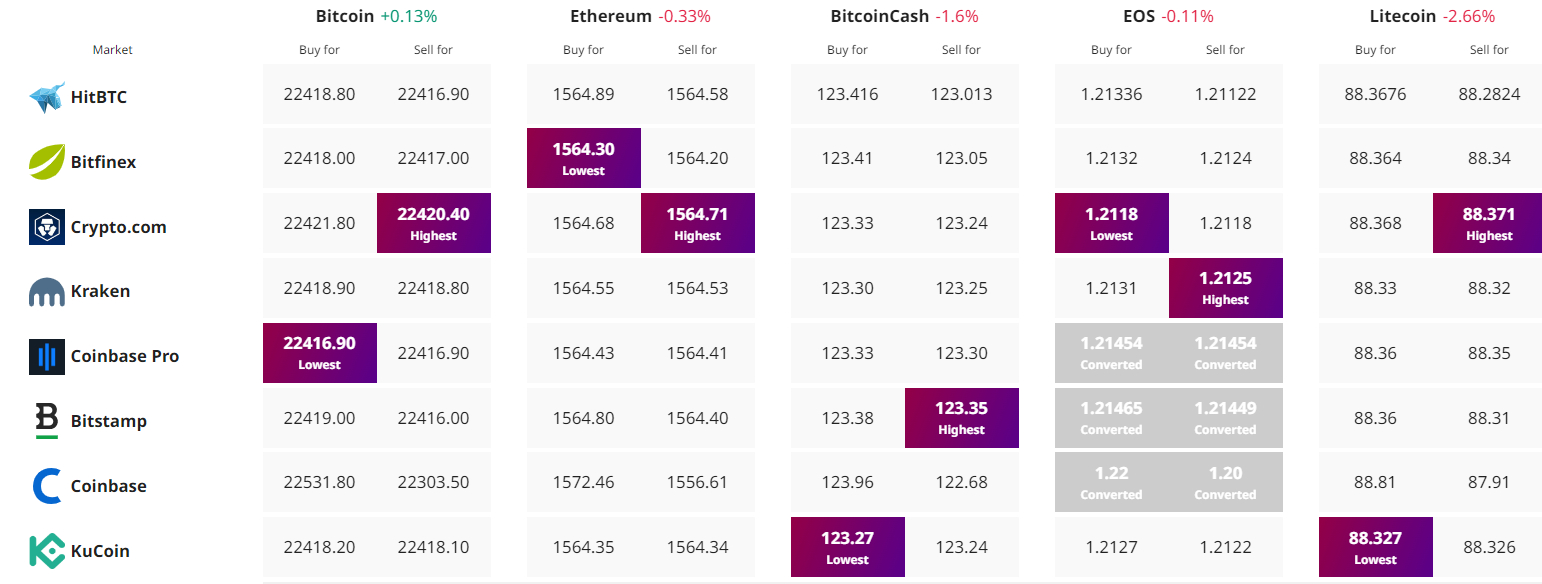

Find The Best Price to Buy/Sell Cryptocurrency