Bitcoin Prediction as Bulls Push Price Towards New Yearly Highs – Can BTC Hit $40,000 Soon?

Bitcoin (BTC) is pumping on Wednesday, as mass liquidations of leveraged traders’ positions continue to drive large swings in the market.

The BTC price was last trading around $37,700, up more than 6% on the day and around 7% versus Tuesday’s lows just above $35,000, with the latest market pump taking out leveraged short futures positions worth nearly $100 million so far for the day, according to Coinglass.

Bitcoin’s latest short squeeze comes a day after its brief dip to $35,000 wiped out leveraged long BTC positions worth close to $300 million.

While short position liquidations are certainly playing a role in Bitcoin’s latest pump, aggressive dip-buying following the BTC price’s slip earlier this week is likely playing a larger role.

Easing Macro Conditions Support Bitcoin

US inflation and retail sales data released this week both strongly support the narrative that the US Federal Reserve’s tightening cycle is over and that a rate-cutting cycle is around the corner, with US equity and government bond prices pumping and the US Dollar dumping as a result.

Bitcoin has in recent years performed best in an environment of falling stock prices, falling bond yields (yields fall when bond prices rise) and a declining dollar, so macro has been a major tailwind for the cryptocurrency this week, aiding its strong rebound from intra-week lows.

Meanwhile, optimism regarding the expected upcoming spot Bitcoin ETF approvals in the US remains palpable, adding to the reasons why investors remain eager to buy short-term dips in the BTC market.

And a still elevated gold price suggests that demand for safe-haven assets also remains strong as geopolitical tensions in the Middle East simmer amid Israel’s ongoing ground incursion into Gaza – Bitcoin has increasingly been viewed as a safe-haven asset in 2023, with BlackRock’s Larry Fink praising it for “digitizing gold” earlier this year.

Price Prediction – Where Next for Bitcoin (BTC)?

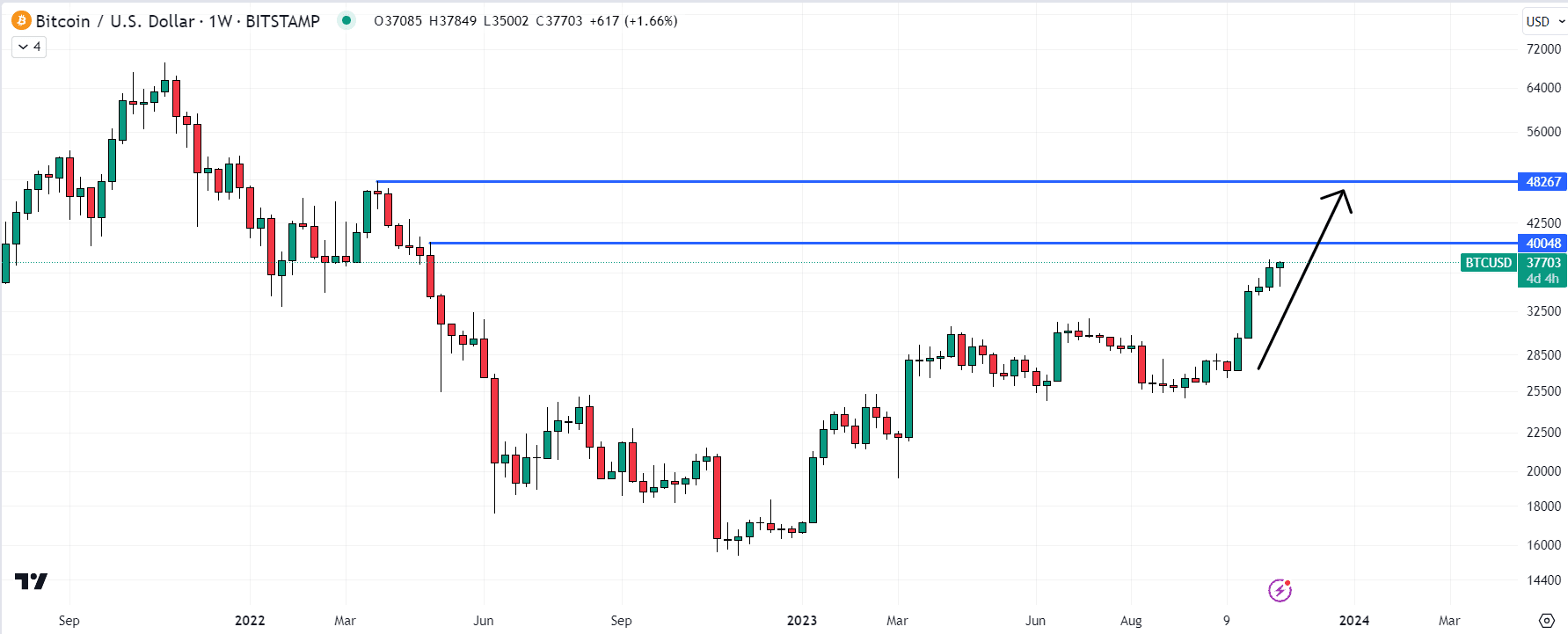

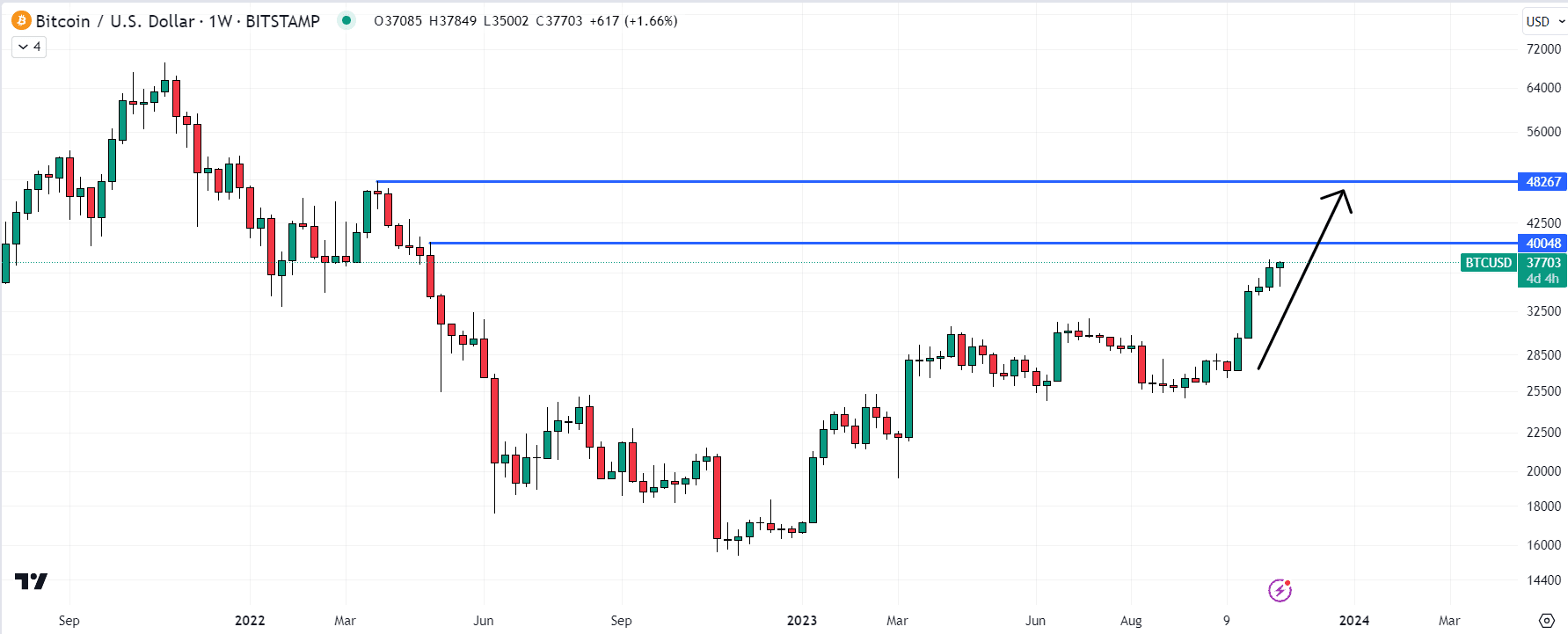

If Bitcoin is able to burst above the yearly highs it printed near $38,000 last week, the door is open to a near-term push towards the key psychological $40,000 level, which also marks the early May 2022 highs.

Assuming the Bitcoin bulls are able to remain in control, the next major level the bulls will target is the 2022 highs at $48,000.

Crypto Alternatives to Consider

Bitcoin’s outlook is very strong right now.

But those looking for a better probability of near-term gains, an alternative high-risk, high-reward investment strategy to consider is getting involved in crypto presales.

This is where investors buy the tokens of upstart crypto projects to help fund their development.

These tokens are nearly always sold cheaply, and there is a long history of presales delivering huge exponential gains to early investors.

Many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.