Bitcoin Mining Difficulty Zooms to All-Time High, But BTC Price Moves Faster

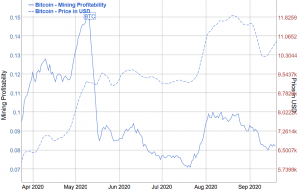

After the Bitcoin (BTC) mining difficulty jumped sharply today, mining has become 20% more difficult than right before the third BTC halving in May. However, in the same period of time, the price of the most popular cryptocurrency rallied by 27%, saving miners’ profit margins.

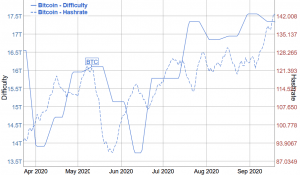

On Sunday morning (UTC time), mining difficulty, or the measure of how hard it is to compete for mining rewards, jumped by 11.35% to 19.31 T, hitting a new all-time high.

This increase was the second-highest in more than a year as the BTC network had to adjust the average block time which was below the normal 10-minutes time recently. This week, it even hit 8 minutes, meaning that after increasing the computational power of the BTC network, known as hashrate, miners managed to find a new block and claim the BTC 6.25 reward faster.

The mining difficulty of Bitcoin is adjusted around every two weeks, or every 2016 blocks, to be precise. The higher the difficulty, the less profitable Bitcoin mining is as the costs of finding a block increase.

However, even after this measure reached its new all-time high and is now 20% bigger than before the halving in May this year when the BTC block subsidy was cut in half to BTC 6.25 per block, the price of bitcoin helped somewhat offset the increased costs. In the same period of time, BTC jumped by around 27%, while hashrate is up by almost 9%, also reaching a new all-time high in September.

__

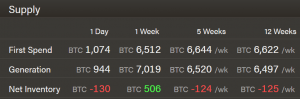

Meanwhile, on the difficulty adjustment day, miners sold more BTC than they generated in the past 24 hours. As reported, miners want to get the best price for their bitcoins but still need to cover operational expenses: “They are generally not long-bitcoin, but are market savvy.”

At the time of writing (06:08 UTC), BTC trades at USD 10,966 and is unchanged in a day. The price is up by 4% in a week, trimming its monthly losses to 7.5%.

__

Learn more: 4 Reasons Bitcoin May Hit USD 1-5 Trillion Market Cap in 10 Years