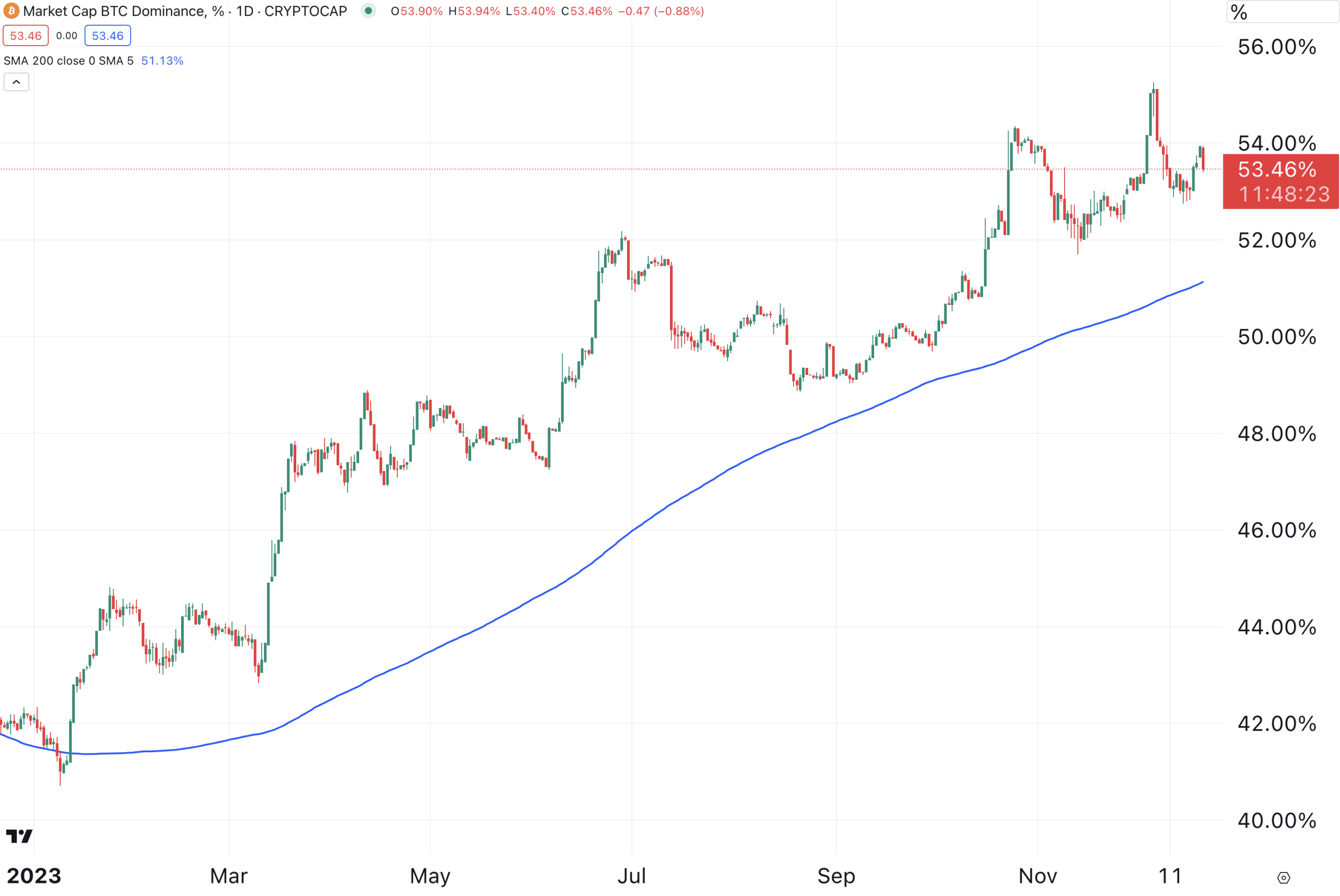

Bitcoin Dominance Reaches 2-Year High, Exceeding 53%

Bitcoin’s share of the overall crypto market capitalization, known as the Bitcoin dominance, has reached a 2-year high at over 53%.

According to data from TradingView, the Bitcoin (BTC) dominance has risen from 52% to over 53% over the past week, after having traded as high as 54% in October and 55% earlier in December.

The Bitcoin dominance has increased consistently throughout 2023, and is now around levels not seen since April 2021, the data showed.

Meanwhile, the TradingView chart also showed that the uptrend for the Bitcoin dominance, which has been in place since the beginning of the year, still remains intact, with the dominance having traded nicely above its 200-day moving average throughout the year.

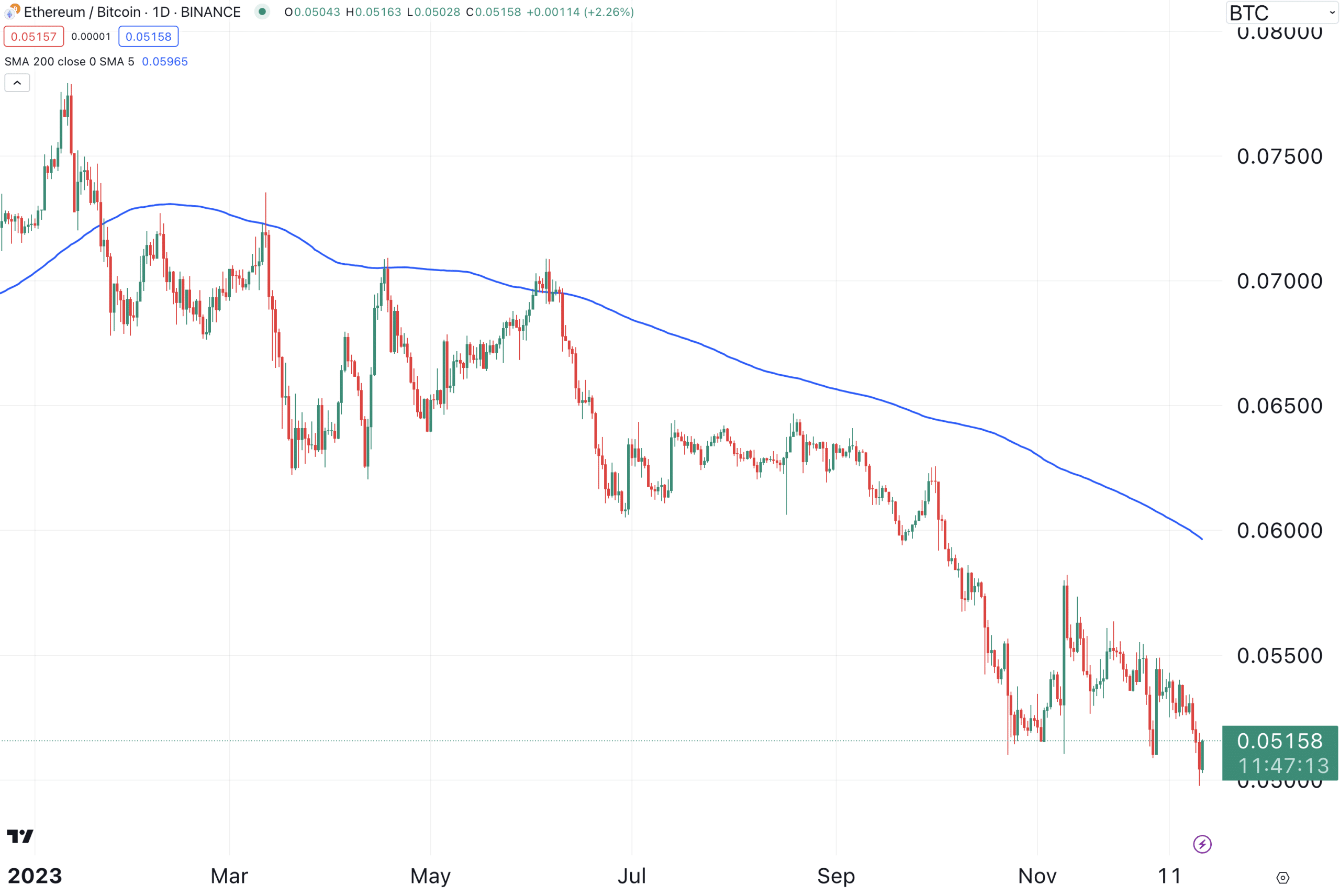

Bad year and bearish outlook for ETH/BTC

In the past, Bitcoin bull runs have tended to be accompanied by even stronger runs in altcoins, and perhaps most prominently in Ethereum’s native token Ether (ETH).

This year, however, the trend appears to have changed in Bitcoin’s favor, with the ETH/BTC trading pair moving lower and some speculating that Solana (SOL) is taking over for ETH as the fastest horse in this market cycle.

The underperformance of ETH relative to BTC has caused some traders to take on bearish bets, with the veteran trader Peter Brandt saying publicly this week that he has shorted the asset.

“[…] if the rising wedge in Ethereum complies with the script, the target is $1,000, then $650,” Brandt wrote on X on Monday.

Classical chart patterns in price charts are not sacred – they fail to perform according to the textbooks all the time

But, if the rising wedge in Ethereum $ETH complies with the script, the target is $1,000, then $650

I shorted ETH on Friday — I have a protective B/E stop pic.twitter.com/76CciT3PE5

— Peter Brandt (@PeterLBrandt) December 18, 2023

Since January this year, ETH/BTC has fallen by more than 28%, from 0.0723 BTC per ETH to 0.0516 as of this writing.

Over the same time period, Bitcoin’s price in US dollar terms is up by 167%, while Ether’s US dollar price is up by 90%.