Bitcoin (BTC) Slips Back Towards $43,000 as Investor Digest Strong US Jobs Report, Monitor Expected Upcoming Spot ETF Approvals

Bitcoin (BTC) has fallen back to the south of the $44,000 level and is eyeing a test of $43,000 once again in wake of a stronger-than-expected US jobs report and as market participants eye the possibility of the approval of spot Bitcoin ETFs in the US within days.

The latest US jobs report showed that companies added slightly more employees than expected in December (216,000 versus median forecasts for 168,000), that the unemployment rate remained unchanged at 3.7% versus an expected rise to 3.8%, and that wages grew at a slightly faster-than-expected MoM pace of 0.4% versus projections for a 0.3% rise.

The robust data, whilst bolstering hopes that the Fed will be able to bring US inflation back to 2% without triggering a recession, failed to have an impact on the broader market.

Major US equity indices stabilized on Friday after a tough start to the year.

US government bond yields and the US Dollar Index (DXY) both also went sideways, not providing much by way of tailwinds or headwinds to the Bitcoin market.

The most important takeaway from the report for Bitcoin is that expectations for the Fed to start cutting interest rates in March remain elevated, with Fed easing a potentially important bullish narrative for BTC in 2024.

As per the CME’s Fed Watch tool, the US interest rate futures market implied the likelihood that the Fed will have lowered interest rates by at least 25 bps by March was last just under 75%, a tad higher than on Thursday.

Where Next for Bitcoin (BTC)?

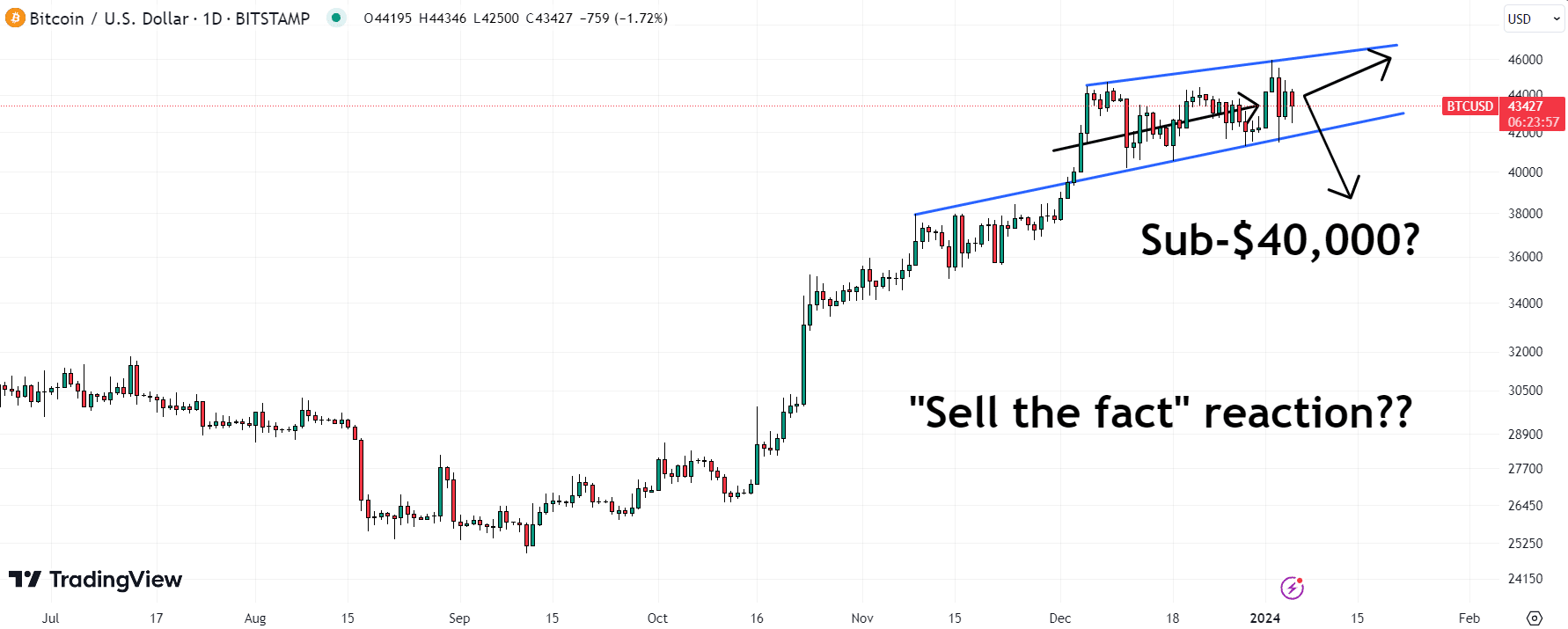

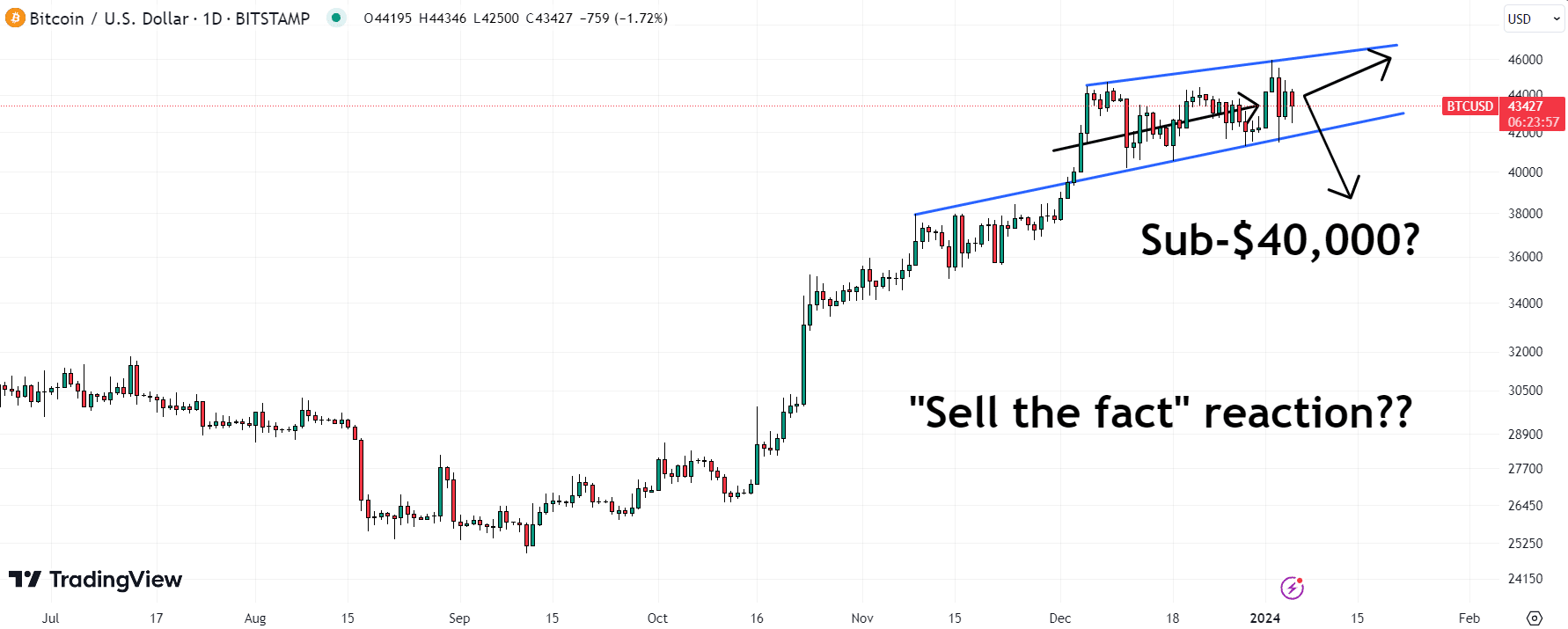

At current levels in the $43,300s, Bitcoin is trading around the mid-point of this week’s $41,500-$46,000 range.

And the market is likely to remain tentative and consolidative ahead of the expected approval of spot Bitcoin ETFs by the US SEC, which most analysts are betting will come in before the 10th of January.

It is widely agreed that approval of spot Bitcoin ETFs in the US is a long-term bullish factor for the Bitcoin market.

Approval of a spot product signifies a regulatory stamp of approval no BTC as an asset and will make it substantially easier for institutional investors to get direct exposure to Bitcoin.

This is expected to unlock a wave of new demand.

That being said, some are concerned that, in wake of BTC’s massive more than 70% run-up since October’s lows, there is a risk that the market will experience a so-called “sell-the-fact” reaction to spot ETF approval.

This describes a scenario where an asset experiences a bullish run ahead of an anticipated bullish event, only for traders to then aggressively start taking profit once that bullish event is confirmed, triggering a sell-off.

For now, Bitcoin remains in a bullish trend channel and if spot ETF approval is followed by larger-than-expected initial demand for BTC spot products from investors, Bitcoin could continue its run towards the 2022 highs in the $48,000s.

But if the current uptrend is broken, a retest of sub-$40,000 levels is a possibility.

But any setback to sub-$40,000 would likely be short-lived and could provide an excellent opportunity for dip buyers.

The Bitcoin issuance rate halving, which is coming up in April, has historically proceeded massive run-ups in the BTC price.

Fed interest rate cuts could further bolster tailwinds this year.

Bitcoin looks set to continue following in the footsteps of its usual approximately four-year market cycle (a 1-year bear market followed a three-year bull run).

14 months have now passed since Bitcoin bottomed out in the $15,000s in 2022, with the price having since pumped around 180%.

New all-time highs above $69,000 remain very much a possibility for 2024.