Bitcoin (BTC) Price Pumps Above $47,000 As ETF FOMO Explodes – Where Next Is It Headed Next?

The Bitcoin (BTC) price just vaulted above $47,000 for the first time since April 2022 as FOMO comes in ahead of the expected approval of spot Bitcoin ETFs by the US SEC later in the week.

Bitcoin is up 7% on the day, taking its gains since the start of the year to 11%.

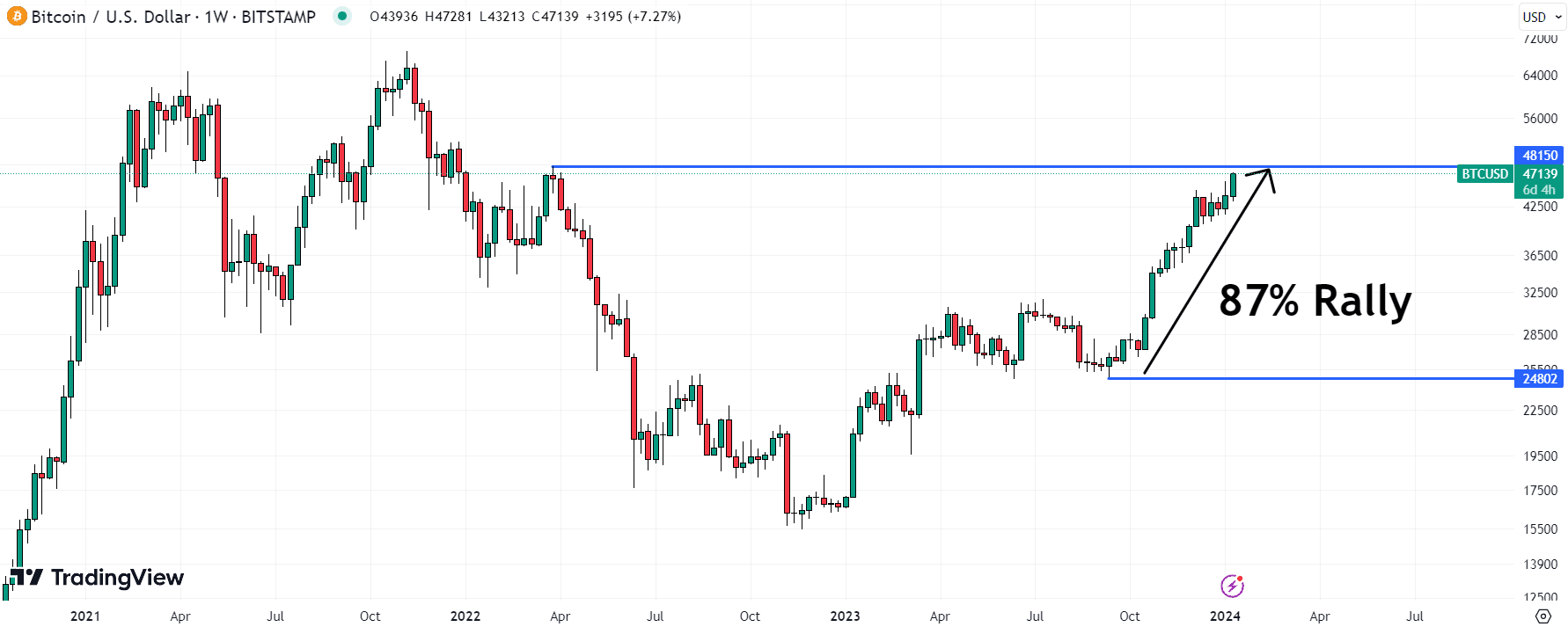

That means the Bitcoin (BTC) price is now up a staggering 87% from its September 2023 lows at $25,000.

The consensus expectation amongst market participants is that the SEC will approve multiple spot Bitcoin ETFs by Wednesday.

⚠️ Looking like Weds now for Bitcoin etf descion, expected to be approved – Kate Rooney on CNBC

— *Walter Bloomberg (@DeItaone) January 8, 2024

Spot Bitcoin ETF Approval Growing FOMO

Various US spot Bitcoin ETF applicants including BlackRock, Grayscale and Fidelity updated their filings once again on Monday.

Moreover, various applicants also revealed the fees they plan to charge ETF investors.

The #Bitcoin ETF Fees:

Grayscale: 1.50%

Hashdex: 0.90%

Valkyrie: 0.80%

Invesco Galaxy: 0.59%

Wisdomtree: 0.50%

Fidelity: 0.39%

Blackrock: 0.30%

Franklin: 0.29%

Ark: 0.25%

VanEck: 0.25%

Bitwise: 0.24%#BitcoinETF #BitcoinETFs— LondonCryptoClub (@LDNCryptoClub) January 8, 2024

These headlines have clearly helped pump fear of missing out (FOMO) of potential Bitcoin price upside amongst market participants.

Most crypto market analysts, investors and observers view the long-awaited approval of spot Bitcoin ETFs in the US as likely to be a historic moment for the Bitcoin market.

The approval of spot Bitcoin ETFs will be interpreted as a regulatory thumbs up from regulators in the world’s largest economy.

This will boost BTC’s legitimacy, easing skepticism that has long kept many investors away from the crypto market.

Spot Bitcoin ETFs will also be easy for traditional investors to invest in.

Rather than needing to open an account at a crypto exchange, and understand web3 nuances such as how to use wallets, investors will be able to buy the ETF directly with their existing brokers.

All said, spot Bitcoin ETFs in the US are expected to attract significant demand, bringing a wave of fresh capital into the crypto space.

The assumption is that this will provide significant support to the Bitcoin (BTC) price in the years ahead.

As per widely followed crypto investor Mike Alfred via a tweet on X, Standard Chartered just projected $50-100 billion of spot Bitcoin ETF inflows this year.

They also project that the BTC price could hit $200,000 by the end of 2025.

Standard Chartered just put out a note saying that we could see $50-100B of spot Bitcoin ETF inflows in 2024 and a BTC price of $200,000 by the end of 2025. This is a big traditional bank, folks. The whole world is about to wake up on this.

— Mike Alfred (@mikealfred) January 8, 2024

That’s why traders have been aggressively buying BTC on Monday; to front-run this anticipated wave of new demand.

Where Next for the Bitcoin (BTC) Price?

Bitcoin’s latest leg higher has seen the price pop to the north of a short-term upward trend channel.

This opens the door for an acceleration of near-term gains towards the 2022 highs around $48,500.

Assuming spot Bitcoin ETFs do get the green light, the likelihood of testing the 2022 high is strong.

A surge towards the key psychological $50,000 level is also on the cards, though profit-taking is likely to keep trading conditions highly choppy.

Many analysts have been warning that the Bitcoin (BTC) market might see a sell-the-fact reaction to spot ETF approvals.

This is where investors decide to sell in order to book profits following the confirmation of a positive market catalyst.

Traders shouldn’t be surprised to see BTC swing anywhere between $40,000-$50,000 in the days and weeks ahead.

But in the longer term, Bitcoin (BTC) price risks are heavily tilted towards further upside.

That’s because the price is likely to also benefit from tailwinds like a Fed cutting cycle and the historically bullish Bitcoin issuance rate halving in 2024, at a time when institutional adoption in the US is also about to leap forward thanks to the new ETFs.

we’re really going to have Bitcoin spot ETF’s and a Bitcoin halving within a few months of each other

the 2024 script be crazy

— RookieXBT 🧲 (@RookieXBT) January 8, 2024

On a side note, if the slim possibility that the SEC decides to reject spot Bitcoin ETF applications this week – a move many have equated to the agency going to war against the crypto industry – BTC could quickly flush back into the $30,000s.