Best Crypto to Buy Now December 15 – Helium, Aave, Osmosis

As the cryptocurrency market fluctuates with volatility, investors seeking the best crypto to buy now are analyzing projects like Helium, as the HNT price continues to surge impressively.

Leading contenders for the best crypto to buy title also include AAVE, which is showing considerable price strength, Osmosis, setting new year-to-date highs, and standout Bitcoin alternatives like Bitcoin ETF Token and TG.Casino for early investment potential.

Best Crypto to Buy Now in the News

December has seen Helium’s HNT price dramatically escalate from $2.7 to around $8.3 as of writing, representing substantial gains of approximately 180%, pushing its market capitalization above $1.2 billion.

This sharp rise is supported by strong momentum indicators, signaling that this upward trajectory could continue.

With Helium’s data transmission offerings that could shake up traditional networks and grow its market share, the project’s future looks promising.

AAVE jumped 13.06% yesterday, suggesting the cryptocurrency could continue rising after declining for much of December.

Aave is currently trading well above key moving averages, with technical indicators hinting at a continued upward trajectory.

The protocol’s role in the DeFi sector, with substantial borrowing activity and interest from major investors, supports a positive outlook.

Osmosis has also captured investor interest, with its OSMO token price surging 85% over the past week and pushing past the $1.00 psychological level. OSMO is currently trading at $1.4113, displaying a further 13.22% increase so far today, as it reached a new annual high earlier today.

Technical indicators point to a promising future, especially with a strategic merger on the horizon that could elevate Osmosis’s status in the DeFi space.

With a market capitalization of around $650 million, Osmosis is positioning itself as a cryptocurrency to watch closely.

While Helium, Aave, and Osmosis showcase robust market activities, the anticipation around crypto presales like Bitcoin ETF Token and TG.Casino suggests a keen investor appetite for new ventures in the cryptocurrency market.

As projects like Helium, AAVE, Osmosis, Bitcoin ETF Token, and TG Casino continue to lead and drive momentum in the crypto market, the search for the best crypto to buy now continues.

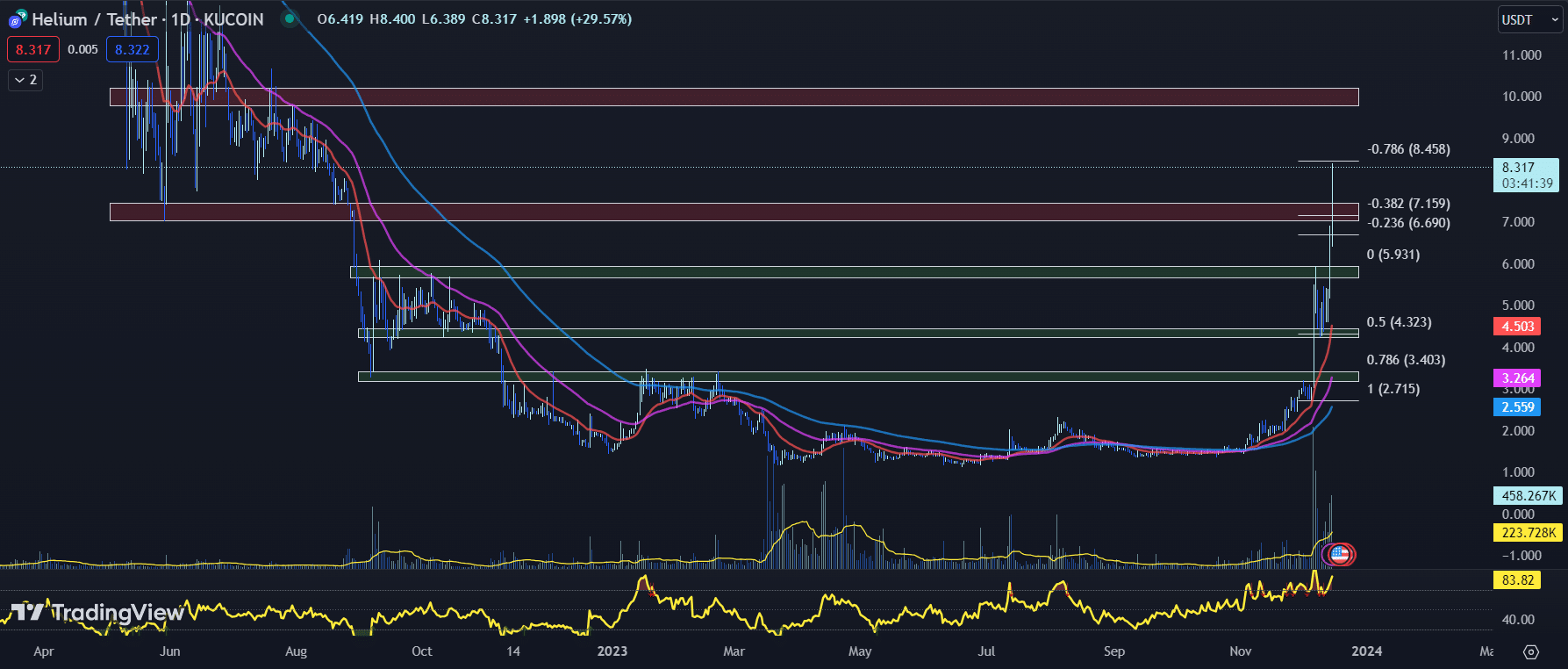

MACD Histogram Gains Momentum: HNT Price Bolsters Bullish Trend

The HNT price surge continues unabated, with the cryptocurrency not just breaking past previous resistance levels but setting a new year-to-date high of $8.40, before slightly retracting to $8.317.

This notable ascent registers a 29.57% increase so far today, highlighting the potent bullish sentiment that has gripped the HNT price for the past few weeks.

From a technical standpoint, the HNT price exhibits a robust uptrend, with its 20-day EMA at $4.503, the 50-day EMA at $3.264, and the 100-day EMA at $2.559.

These figures show a bullish EMA alignment, with each short-term EMA well above the longer-term EMAs, typically a harbinger of continued upward momentum.

HNT’s RSI is currently elevated at 83.82, an increase from yesterday’s already-high 77.5. This indicates extreme buyer enthusiasm.

However, in strong bullish trends, the RSI can remain overbought for extended periods as prices continue to climb.

Further fueling the optimistic outlook is the MACD histogram, currently at 0.341, up from yesterday’s 0.197.

The increasing histogram value indicates that the bullish trend is gaining momentum, with the MACD line diverging further from its signal line, reinforcing the strength of the current price movement.

Investors have witnessed the HNT price effortlessly breach the immediate resistance zone, ranging from $7.034 to $7.448—a zone that aligns with the Fib 0.382 level at $7.159.

his area is set to morph into a support zone if the HNT price manages to close above it, which could provide a springboard for further gains.

Looking ahead, the next potential resistance lies at the extended Fib -0.786 level of $8.458. Should the HNT price clear this hurdle, the path could be paved toward the previous swing high zone between $9.790 and $10.203, which coincides with the psychologically significant $10 level.

Conversely, should a retracement occur, the new support zone, formerly resistance—$7.034 to $7.448—will be the first test of HNT’s strength. A break below this level could see the HNT price seek further support at the extended Fib -0.236 level of $6.690.

Traders and investors alike should consider the potential for a retracement given the overextended RSI but also recognize the strength of the current trend.

The HNT price action suggests that there is still room for growth, and those trading HNT should watch closely for either a consolidation above the new support level or a continued push towards double-digit figures.

Caution is advised as the market digests the recent gains, and participants should look for confirmation of either a continuation or reversal before making any trading decisions.

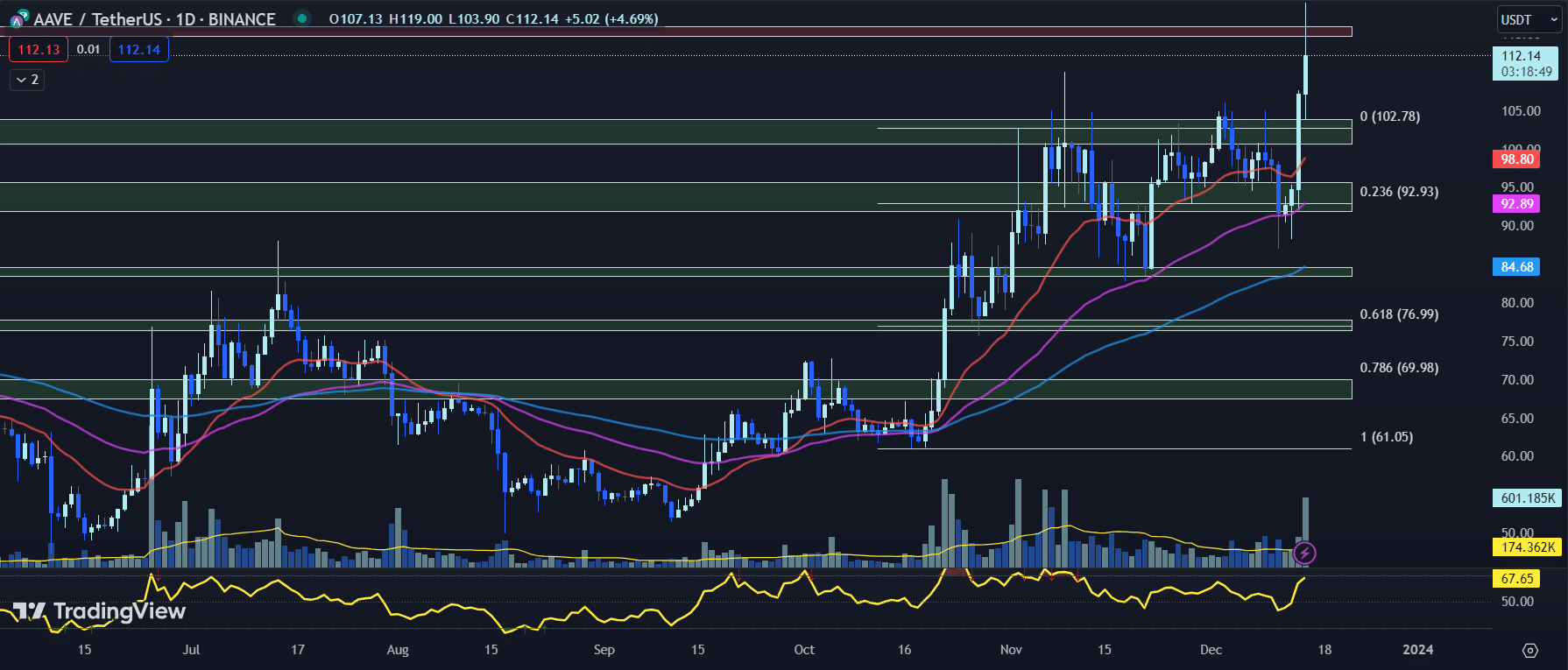

7-Week Consolidation Shattered: AAVE’s Price Surges to New Heights

The AAVE price has recently shown a commendable breakout from a seven-week consolidation zone, highlighted by yesterday’s substantial uptick of 13.06%, which propelled the cryptocurrency to set a new year-to-date (YTD) high earlier today.

This bullish momentum has continued, with the AAVE price currently trading at $112.14, marking a 4.69% increase so far today.

Technical indicators for AAVE paint a promising picture for traders and investors alike. The 20-day EMA for AAVE stands firmly at $98.80, well above the 50-day and 100-day EMAs, which are plotted at $92.89 and $84.68, respectively.

This alignment typically signifies a strong bullish trend, as the shorter-term EMA acts as a dynamic support level for the price.

The RSI adds further optimism to the AAVE price narrative, registering at 67.65, a climb from the previous day’s 65.53. While this indicates a heating market, the RSI is still short of the overbought threshold of 70, suggesting that the AAVE price may have room for additional upside before any significant pullback.

A notable shift in momentum is observed through the MACD histogram, which currently stands at 0.62, a stark contrast to the previous day’s -0.26. This positive swing in the MACD histogram is a bullish signal that often precedes continued upward price movements.

Despite the current bullish trend, traders should remain vigilant when approaching resistance zones. The AAVE price briefly surpassed the significant horizontal resistance band stretching from $114.65 to $115.94 earlier in the day, reaching a YTD high of $119.

These levels, which haven’t been tested since August of 2022, will be a critical area to watch, as a sustained break above could confirm the AAVE price’s strength and set the stage for further gains.

Conversely, the immediate support zone for AAVE, lying between $100.66 and $103.83, has previously acted as a resistance for over a month. If this zone converts into reliable support, it may provide a safety net for the AAVE price during any potential retracement.

For traders and investors responding to these technical signals, the outlook for AAVE suggests a bullish bias. However, given the proximity to the overbought territory and the looming resistance barrier, a cautious approach with close observation of the $114.65 to $115.94 resistance zone would be prudent.

A definitive close above this zone could offer a clear signal for potential entry points, while a failure to maintain above the support zone may necessitate a reevaluation of bullish positions.

In either scenario, setting stop-loss orders around key support and resistance levels could help mitigate risk in this volatile market.

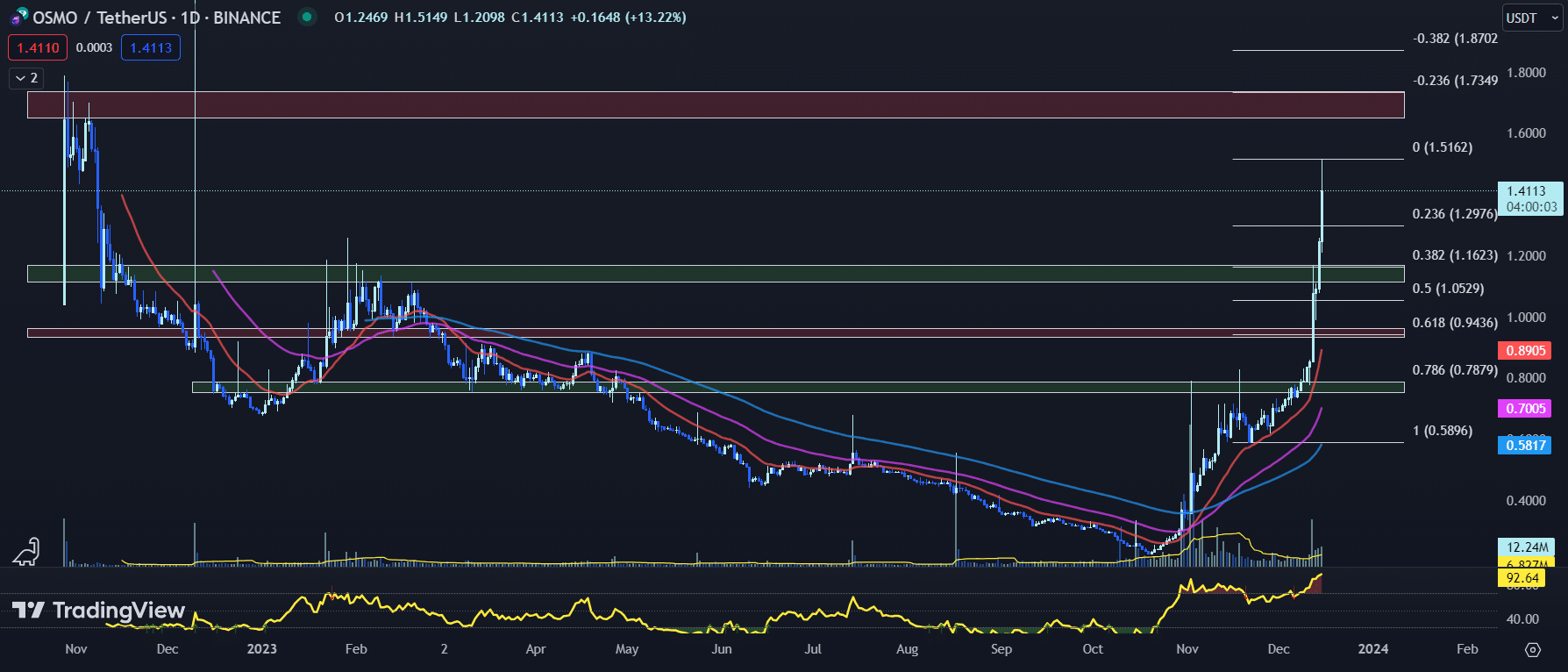

OSMO Price Skyrockets: Bullish Technical Indicators Drive Surge

The OSMO price has been on a sharp upward trajectory, setting a new year-to-date (YTD) high earlier in the day at $1.5149, before slightly retreating to $1.4113, albeit still marking a respectable 13.22% increase so far today. This surge has been underscored by the convergence of several bullish technical indicators.

Analyzing the moving averages, the OSMO price is well above the 20-day EMA of $0.8905, the 50-day EMA of $0.7005, and the 100-day EMA of $0.5817.

This bullish alignment, with each short-term moving average above the longer-term averages, typically indicates strong upward momentum.

However, traders should be vigilant as such steep inclines can sometimes precede corrections if the price detaches too far from these support levels.

OSMO’s RSI provides a stark illustration of OSMO’s uptrend, soaring to 92.64, a notable increase from the already elevated 90.52 yesterday.

An RSI above 70 typically suggests overbought conditions, which can foreshadow a potential pullback as traders consolidate gains.

The MACD histogram, currently at 0.0580 up from 0.0423, affirms the bullish sentiment as the histogram’s positive value indicates upward price momentum.

A widening histogram suggests the trend has strength and may persist, but as with RSI, traders should be wary of overextension.

Regarding key price levels, the OSMO price encounters immediate resistance at the day’s high of $1.5149.

Should momentum continue, the next resistance zone lies between $1.6516 and $1.7381, which aligns with the extended Fib -0.236 level of $1.7349, a price level not reached since early November of 2022.

On the flip side, OSMO’s price support is the Fib 0.236 level of $1.2976. A retracement could find firmer footing in the established support zone ranging from $1.1139 to $1.1679, which coincides neatly with the Fib 0.382 level of $1.1623.

These levels could serve as critical junctures where the OSMO price may stabilize in the event of a downturn.

While the OSMO price exhibits strong bullish signals, its overbought status warrants caution among traders.

The immediate future could see the price testing resistance at the YTD high, with a breakthrough potentially inviting further gains. Conversely, a reversal may find support at the aforementioned Fib levels.

Investors would be wise to closely monitor these developments and consider the current technical indicators as part of a comprehensive trading strategy.

While the market favors established cryptos like HNT, AAVE, and OSMO, under-the-radar presales like Bitcoin ETF Token and TG.Casino offers largely untapped growth potential.

These fresh blockchain concepts provide inexpensive early exposure to new niches like crypto-based ETFs and crypto gambling.

The Next Big Breakthroughs: Overlooked Bitcoin Alternatives Primed for Growth

While Bitcoin has dominated the crypto space, investors are beginning to explore lesser-known Bitcoin alternatives that could be set for potential growth.

Getting in early on carefully selected new crypto projects provides exposure at a fraction of future valuations.

Two such overlooked crypto gems offering upside potential are Bitcoin ETF Token and TG.Casino.

These fresh blockchain-based concepts are seeking to shake up the finance and crypto-gambling industries.

Investing in these under-the-radar presales presents the opportunity to get in on the ground floor before wider recognition kicks in.

With bitcoin alternatives like these well-positioned for growth, now is the time to invest in the next generation of cryptocurrencies.

Finding the best crypto to buy now while they are still undiscovered presales could lead to a potential upside.

BTCETF Presale: Capitalize on the Bitcoin ETF Hype with the Best Crypto to Buy Now

The Bitcoin ETF Token (BTCETF) presale has reached its final stage, pushing toward the project’s fundraising target of $5,059,485.

The presale has already raised over $4.1 million from contributors looking to capitalize on the potential approval of a spot bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission.

Mapping the #BitcoinETF journey 🌐

The $BTCETF #Token path mirrors actual #Bitcoin occurrences.

With each Bitcoin #ETF milestone, #BTCETF tokens are burned, boosting staking rewards. 📊🔥 pic.twitter.com/I2hd5lYp53

— BTCETF_Token (@BTCETF_Token) December 15, 2023

BTCETF is designed to benefit holders through built-in burn mechanisms triggered by major milestones related to the approval and launch of spot bitcoin ETFs.

For example, the total supply of tokens will decrease by up to 25% at each milestone, increasing scarcity.

The transaction tax will also decrease from 5% to 4% after the first milestone is reached.

These milestones are expected to come in rapid succession as the likelihood of a spot Bitcoin ETF in the U.S. continues to climb.

Major asset managers like BlackRock have recently changed their tune on crypto, sensing the potential of being first to market.

The global ETF industry is valued at over $7 trillion, presenting an opportunity for first movers in the Bitcoin space.

With anticipation building around SEC approval of spot bitcoin ETFs, investors are wise to gain exposure to the trend sooner rather than later.

The presale is in its final stage, providing the public with a final opportunity to acquire the token known as the best crypto to buy now before its full launch.

TG.Casino’s TGC Token Presale: The Best Crypto to Buy Now for Dominating the Crypto Gambling Market

TG.Casino, a new Telegram-based cryptocurrency gaming platform, has raised over $4 million so far in its ongoing token presale as revenues and user growth accelerate rapidly.

The presale, which offers 40% of the total 100 million $TGC token supply, is now over 80% sold out as it heads swiftly toward its $5 million hard cap.

TG.Casino has already attracted over 11,000 Telegram channel members along with nearly 3,000 registered players.

$4 million raised and 80% of the way done🤩

Thank you everyone! Let's get this last one🎰 pic.twitter.com/LF5Sfcftdn

— TG Casino (@TGCasino_) December 15, 2023

Total deposits have topped $4.5 million on the platform’s casino, live dealer games, and sportsbook.

Players have wagered more than $45 million to date, generating surging revenues for the project.

The presale token price increases by $0.005 every five days until the hard cap is reached.

Heavy presale participation from crypto whales indicates towering confidence in the project’s upside potential.

TG.Casino inteds to provide a seamless, Telegram-based user experience.

Players can effortlessly create accounts, deposit crypto at no cost, wager with BTC and ETH, and earn rewards when betting with the native token $TGC, all through TG.Casino’s user-friendly platform.

The project has taken steps to assure users of its legitimacy, including obtaining a gaming license in Curaçao, passing an audit, and completing KYC verification.

As an operational platform with growing adoption, TG.Casino represents a standout opportunity compared to many speculative presale projects.

With staking rewards, NFTs for buyers, and token buybacks, TG.Casino is well-positioned as a leading crypto gambling ecosystem.

The presale’s rapid pace suggests that the hard cap may be reached sooner than expected.

With excitement rapidly escalating around this pioneering crypto gambling project, the window to secure what may be the best crypto to buy now at discounted prices could soon be closing.

Experts at cryptonews.com strongly recommend responsible gambling habits for those interested in the growing crypto gaming sector.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.