Best Crypto to Buy Now December 14 – BONK, Injective, Helium

After consolidating for the past few days, BONK is making a renewed push following its Coinbase debut, sparking speculation on whether the meme coin could be one of the best cryptos to buy now.

Injective (INJ) and Helium (HNT) have also notched new highs, reflecting a mix of bullish on-chain metrics and bearish technical indicators.

Amidst these developments, crypto presales like Bitcoin ETF Token and Launchpad XYZ are attracting attention for their potential impact on the cryptocurrency market.

Best Crypto to Buy Now in the News

BONK has now been officially listed on Coinbase, further emphasizing its expanding importance within the Solana ecosystem.

$BONK is now live on @coinbase!

Read their announcement for details on how to deposit BONK and get started. 🤝🐕 https://t.co/dt795PgStB pic.twitter.com/8mZe30dBF0

— Bonk! (@bonk_inu) December 14, 2023

The BONK price witnessed a swift surge of more than 50% following the announcement, reaching a new all-time high of $0.0000196199.

However, the BONK price has slightly retraced and is currently trading at $0.0000170009, albeit still up by 32.13% so far today.

Market analysts speculate that BONK could climb to the $0.0000200000 psychological mark, with its market capitalization crossing $1 billion after an 800% rally over the past 30 days.

Injective also experienced a continuous surge in trading activity, surpassing previous all-time highs and soaring above $30.

The token’s impressive growth, marked by a 1,800% rise over the past year, is further punctuated by an increase of 6.17% so far today.

Factors such as an upcoming network upgrade, weekly token burns, and activity on the Helix DEX have fueled INJ’s growth.

However, the mix of bullish on-chain metrics and bearish technical indicators has led to mixed market sentiments, with the potential for its rally to be counterbalanced by possible price corrections.

Helium’s market price has also climbed, reaching a new YTD high of $6.9 earlier today.

The token’s 211% rise over the past month is bolstered by the launch of a monthly phone plan by Helium Mobile and its transition to the Solana blockchain.

Helium’s on-chain metrics exhibit bullish trends, but technical indicators like the RSI suggest a possible price correction.

The increase in staking activity and stable whale activity indicates a balanced market dynamic for HNT.

Meanwhile, investors looking for early-stage opportunities are eyeing Bitcoin alternatives through new crypto presales.

Bitcoin ETF Token and Launchpad XYZ, while less established, present potential new entries in the cryptocurrency space.

The search for the best crypto to buy now continues amid fluctuating prices and market dynamics.

With each token presenting its unique set of catalysts for growth and challenges, investors are watching the market closely for its next decisive move.

Coinbase Listing Sends BONK Price Soaring to New Heights

As traders and investors closely monitor the pulse of the cryptocurrency market, the BONK price has emerged from a period of consolidation, embarking on a notable uptrend.

This rally was catalyzed by a convincing bounce from the Fib 0.382 level, which sat at a delicate $0.0000097148, leading to an impressive 12.09% surge yesterday.

The momentum for BONK was further accelerated today by the announcement of its Coinbase listing, triggering a 50% intraday spike and etching a new all-time high into the charts at $0.0000196199.

The BONK price is currently trading at $0.0000170009, marking a 32.13% rise so far today.

The technical indicators paint a vivid picture of BONK’s market posture.

The 20-day EMA is currently at $0.0000091355, towering above both the 50-day EMA of $0.0000056723 and the 100-day EMA of $0.0000035438.

This alignment typically signifies a bullish trend, with the shorter-term EMA acting as dynamic support for the BONK price trajectory.

The RSI currently reads a robust 81.02, up from the previous day’s 74.21. An RSI above 70 is commonly interpreted as overbought territory.

However, in the context of a strong uptrend, such as with BONK, an overbought RSI can persist, indicating a powerful momentum that may not reverse immediately.

The MACD histogram currently stands at 0.0000007235, up from yesterday’s 0.0000005230.

This positive histogram suggests that the bullish momentum behind the BONK price is intensifying, providing a tailwind for further appreciation.

As for resistance, BONK’s immediate challenge is the recent swing high zone ranging from $0.0000130001 to $0.0000134277.

Today’s bullish price action has the potential to convert this resistance into support, essentially flipping a critical ceiling into a floor that could prop up future BONK price movements.

Additionally, the BONK price has touched the extended Fib -0.618 level at $0.0000192483, and the proximity to the extended Fib -0.786 level of $0.0000208499 raises the possibility that these levels may soon be tested as the next upward targets.

Support levels also deserve attention. The immediate support zone is mapped between $0.0000092589 and $0.0000111065, aligning closely with the Fib 0.236 and 0.382 levels.

The strength of today’s rally suggests that the immediate resistance zone could morph into a robust support base, underpinning the BONK price in the event of a retracement.

In light of these technical indicators, the near-term forecast for BONK is one of cautious optimism.

Traders might consider capitalizing on potential pullbacks to these newfound support levels, while also being prepared for the possibility of profit-taking after such a swift ascent.

The key for those navigating the BONK price waters will be to watch for confirmation signals, such as a consolidation above new support levels or a breakout above the next Fibonacci extensions.

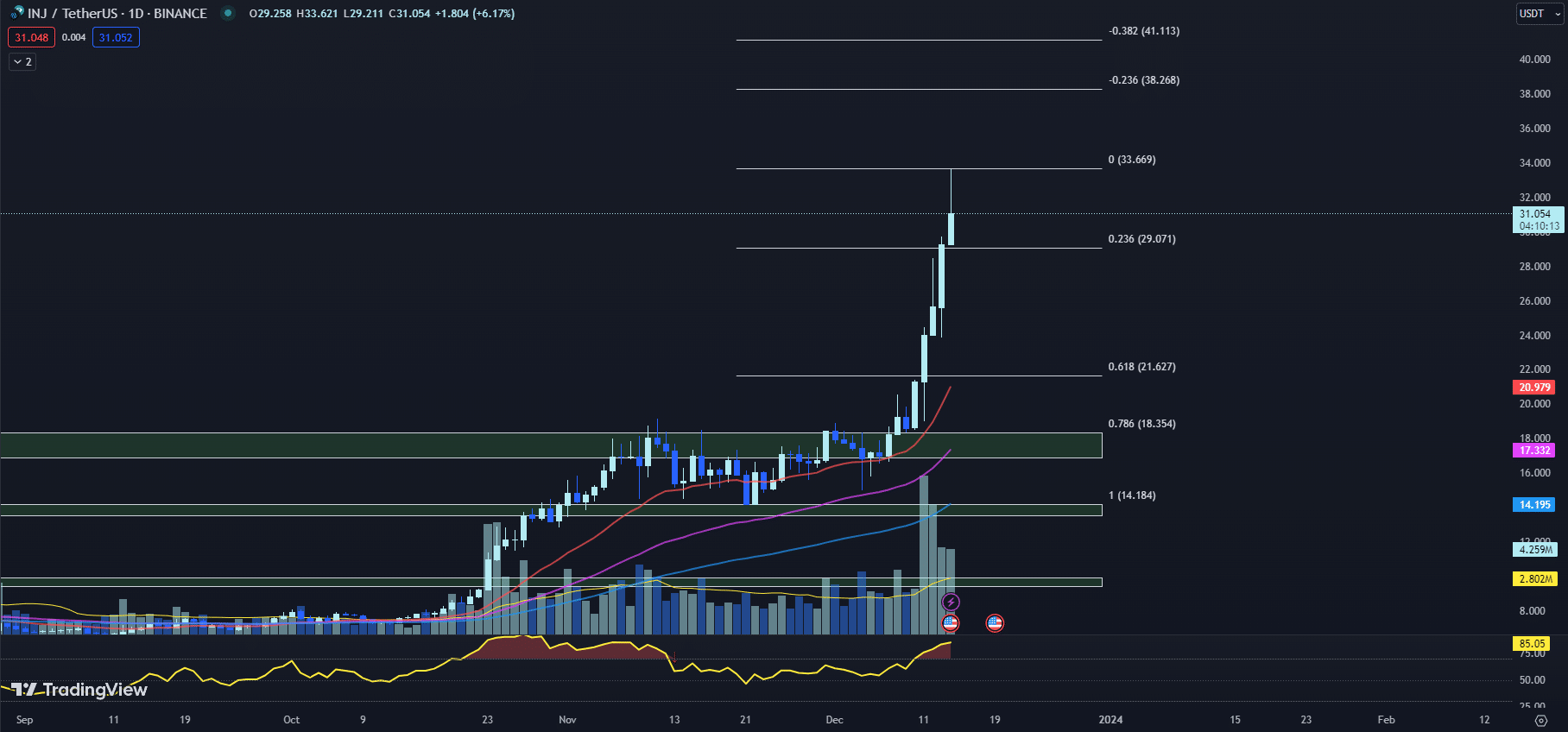

INJ Price Prediction: Balancing Bullish Indicators with Warning Signs

The INJ price is scripting a narrative of bullish persistence in the cryptocurrency markets, as it extends its winning streak to a potential fifth day of gains.

The fervor around Injective (INJ) is palpable, with the cryptocurrency notching a new all-time high of $33.621 in today’s session.

The enthusiasm, however, is tempered by the emergence of a potentially bearish candle on the charts, characterized by a long upper wick—an indicator that could signal a forthcoming retracement after the recent price surge.

Injective’s technical indicators illuminate a scenario where bulls have had a strong grip on the market.

The 20-day EMA of INJ price lies well above both the 50-day and 100-day EMAs, at $20.979, $17.332, and $14.195 respectively.

This significant gap between the short and long-term EMAs typically indicates a robust bullish trend, suggesting that any dips in INJ price may be considered buying opportunities by the market participants eyeing longer-term growth.

The RSI is another component adding to the narrative, with a reading of 85.05, a slight uptick from the previous day’s 83.30.

Such a high RSI typically points to overbought conditions, yet for INJ, this might simply underscore the strength of the current trend rather than an immediate reversal.

Investors should, nonetheless, proceed with caution, as an RSI at these levels often precedes a period of consolidation or pullback.

Further bolstering the bullish sentiment is the MACD histogram which has climbed from 1.044 to 1.292.

This incremental rise is indicative of growing bullish momentum in the INJ price, potentially setting the stage for further upside.

However, despite the bullish tone set by these indicators, the INJ price has witnessed a slight descent from its peak today, trading at $31.054, up 6.17% for the day.

This momentary pullback could be the market’s way of catching its breath after a spirited run.

Looking ahead, resistance levels loom large on the horizon.

The extended Fibonacci -0.236 level at $38.268, followed by the -0.382 level at $41.113, are the forthcoming hurdles that the INJ price needs to clear.

These levels could act as beacons for traders, guiding the next leg of INJ’s journey.

On the flip side, the immediate support levels are not to be overlooked.

The $30 psychological level and the Fib 0.236 level at $29.071 provide a safety net for the INJ price if the current retracement deepens.

Should the INJ price dip, these levels will be critical for maintaining the bullish structure that has been established over the past several days.

The technical indicators for Injective (INJ) suggest that the momentum is with the bulls, but caution is warranted given the overextended RSI.

A break above the aforementioned Fibonacci levels could fortify the bullish case, while a fall below the immediate support levels might call for a reassessment of the prevailing market sentiment.

Market participants should keep a close watch on these key technical levels as INJ’s price action continues to unfold.

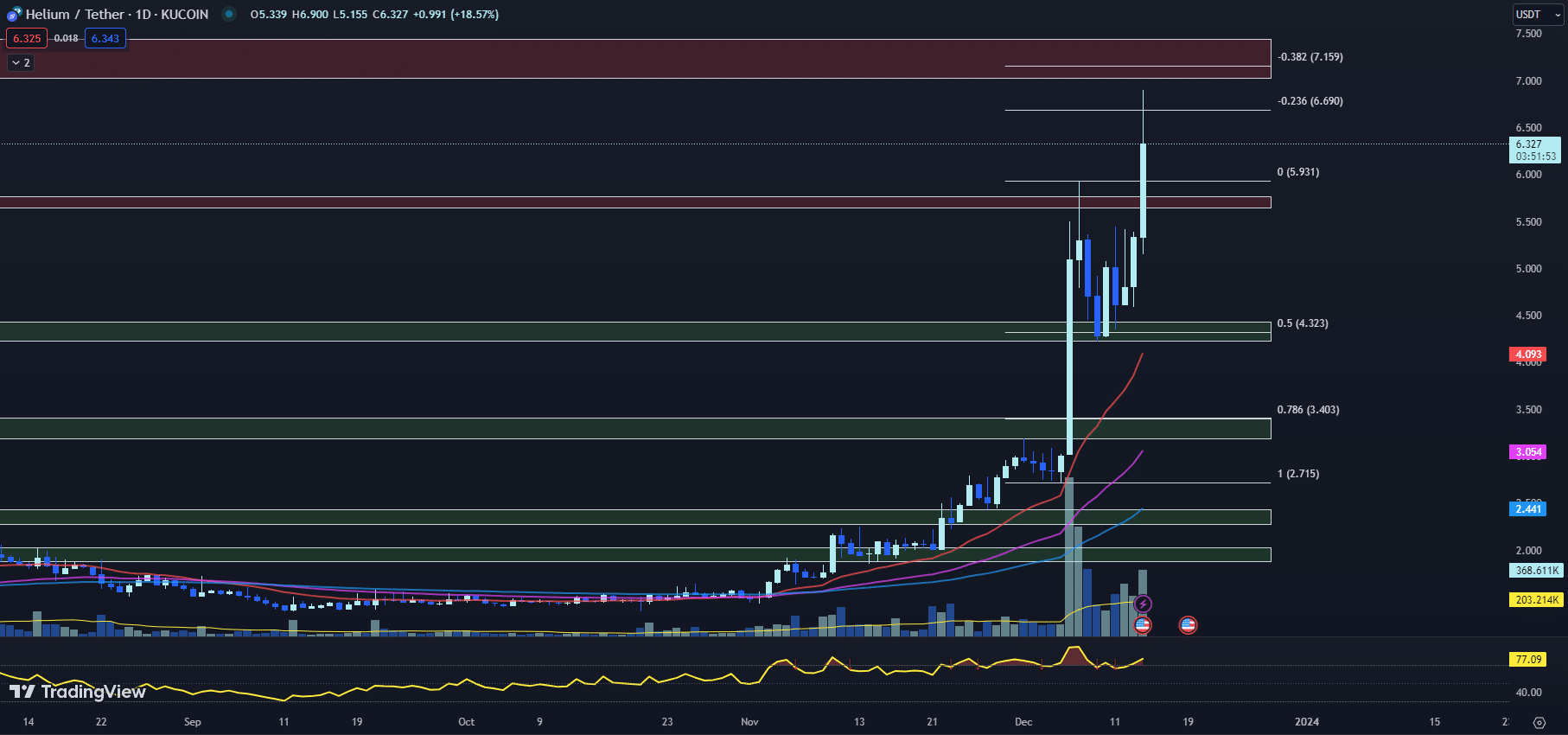

HNT Price Prediction: Breaking Consolidation with Strong Uptrend

The HNT price has recently broken free from its consolidation, embarking on an upward trajectory that culminated in a new YTD high of $6.90 earlier today.

The HNT price currently trades at $6.327, boasting an 18.57% increase so far today, which may leave investors to wonder about the cryptocurrency’s next move in the market.

Helium’s technical indicators are painting a picture of robust momentum.

The 20-day EMA of the HNT price is well above its longer-term counterparts, at $4.093, against the 50-day EMA of $3.054 and the 100-day EMA of $2.441.

This bullish alignment suggests that the HNT price has been on a strong uptrend and may continue to find aggressive buying on dips.

The RSI is currently at 77.09, a climb from yesterday’s 71.61. An RSI above 70 indicates that the cryptocurrency is becoming overbought.

However, in the context of the HNT price, the elevated RSI may also reflect the intense buying pressure that has driven the recent price spike, though it could also signal a potential for a price pullback as traders look to capitalize on the gains.

A glance at the MACD histogram reveals a value of 0.192, up from yesterday’s 0.137.

This increase further underscores the burgeoning bullish sentiment around HNT.

An ascending MACD histogram typically signifies that an upward price trend is gaining strength and that the bullish momentum may persist.

Despite these indicators signaling strength, traders should be mindful of the HNT price resistance.

The immediate resistance zone between $5.653 and $5.769 has been tested, and with the HNT price surmounting this hurdle, it now eyes the extended Fib -0.236 level of $6.690, which was briefly touched upon when HNT reached its new annual high.

On the other end of the spectrum, the previous resistance zone of $5.653 to $5.769 could transition into a support area in the coming days, particularly if the HNT price retraces from its current highs.

This potential support is further reinforced by the next support level of $4.234 to $4.435, which aligns with the Fib 0.5 level of $4.323.

These levels might serve as a cushion for the HNT price, should it face short-term profit-taking following its significant rally.

Given these dynamics, while the upward momentum for the HNT price is evident, traders would do well to keep a close eye on the emerging support and resistance levels.

A sustained hold above the newfound support could validate further upside, whereas a breach below could signal a short-term reversal of fortune.

Investors should consider the possibility of increased volatility near these critical levels and plan their trades accordingly, keeping in mind the potential overbought conditions reflected in the RSI.

Uncovering the Next Big Thing: Intriguing Bitcoin Alternatives Worth Watching

Bitcoin may be dominating the cryptocurrency headlines, but investors searching for the best crypto to buy now should look beyond established cryptocurrencies.

The next major disruptor could be an overlooked Bitcoin alternative still in its early stages.

While chasing overvalued cryptocurrencies with inflated market caps might seem tempting, the real upside potential lies in finding the right projects before they gain widespread recognition.

Getting in early with the most promising Bitcoin alternatives could lead to potential returns down the road.

Two intriguing crypto ventures to keep on your radar are Bitcoin ETF Token and Launchpad XYZ.

Bitcoin ETF Token seeks to benefit from the anticipation surrounding the potential approval of Bitcoin ETFs by the SEC, while Launchpad XYZ is positioned as a comprehensive AI solution for crypto trading, utilizing machine learning algorithms to analyze market data.

Participating in presales allows investors to maximize their exposure to a project’s growth trajectory as it scales up.

Though riskier, investing in the right presale can generate substantial gains when the project takes off.

For forward-thinking investors seeking overlooked opportunities, exploring developing Bitcoin alternatives could pave the way to finding the next big disruptor before it hits the mainstream.

The key is identifying the projects with the most disruptive potential while they are still under the radar.

$BTCETF Token Tops the List as the Best Crypto to Buy Now with SEC’s Bitcoin ETF Verdict Imminent

BlackRock has recently met with the U.S. Securities and Exchange Commission (SEC) to discuss a proposed bitcoin exchange-traded fund (ETF).

This marks the third such meeting in three weeks between the SEC and major financial institutions, including Grayscale, Fidelity, and Franklin Templeton.

Analysts speculate that the SEC may approve over a dozen spot bitcoin ETFs in early January, coinciding with a decision deadline on Ark Invest’s proposal.

The launch of these ETFs would represent a major milestone for Bitcoin’s mainstream adoption.

The Final Stage of #BitcoinETF has commenced! 🚀 pic.twitter.com/VvRpsaRKA8

— BTCETF_Token (@BTCETF_Token) December 14, 2023

One project set to benefit from the decision is Bitcoin ETF Token ($BTCETF), a cryptocurrency that incentivizes holding through token burns triggered by Bitcoin ETF milestones.

There are five milestones, each burning 5% of the total supply: $BTCETF reaching $100 million volume, the first spot bitcoin ETF approval, the first ETF’s launch, over $1 billion invested in bitcoin ETFs, and bitcoin price hitting $100,000.

Presale buyers will also receive staking rewards of up to 69% APY in additional $BTCETF tokens.

With built-in token burns, $BTCETF offers more than just ETF speculation, making it one of the best crypto to buy now.

BlackRock’s unique ETF proposal allows banks to invest with cash rather than actual bitcoin.

This could dramatically accelerate $BTCETF’s milestones of over $1 billion invested in Bitcoin ETFs and the Bitcoin price hitting $100,000, as banks investing billions into a Bitcoin ETF could catalyze increased price appreciation.

The $BTCETF token presale has entered the final stretch of its presale and has raised close to $4 million.

The token is currently being sold for $0.0068 before its launch on major crypto exchanges.

With the first bitcoin ETF likely weeks away, $BTCETF presents a speculative opportunity to benefit from both the ETF hype and built-in tokenomics.

Investing with an Edge: Why Launchpad XYZ is the Best Crypto to Buy Now

A little-known cryptocurrency startup called Launchpad XYZ has raised over $2.17 million so far in its ongoing $LPX token presale, defying the bear market conditions plaguing most cryptocurrencies.

The project revolves around its fundamental proposition, which is centered on exclusive AI algorithms that will generate automated signals for cryptocurrency trading.

With the crypto market dominated by large-cap cryptocurrencies, new entrants face an uphill battle to gain traction.

However, Launchpad XYZ’s presale success demonstrates investors’ appetite for fresh concepts in the crowded crypto space.

Stay ahead with real-time market data from #LaunchpadXYZ. 🔥

Make decisions based on the latest market movements. 💪#LaunchpadXYZ #CryptoMarkets pic.twitter.com/M8UBtSNkt1

— Launchpad.xyz (@launchpadlpx) December 13, 2023

According to Launchpad XYZ’s published roadmap, the startup plans to transition beyond AI trading into a multifaceted crypto ecosystem.

The roadmap outlines building a decentralized exchange, gaming services, and the ability to seamlessly integrate Web2 and Web3 functionalities on their platform.

This long-term vision offers upside potential as the platform’s capabilities will expand over time.

The current focal point remains the project’s algorithmic trading tools, Apollo and LPQ.

The AI analyzes market data and trading patterns to identify opportunities and optimize trade entry and sizing.

Providing easy access to institutional-grade quant trading gives regular cryptocurrency investors an advantage, and the positive returns from Launchpad XYZ’s alpha Telegram trading group have further fueled momentum for the ongoing presale.

As crypto emerges from the bear market, interest in data-driven trading tools has the potential to surge.

For crypto investors seeking the best crypto to buy now, Launchpad XYZ presents a compelling option that ticks several boxes of promise.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.