A Guide to iGaming and High-risk Dapps

The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

This article has been brought to you by DappRadar, a dapp data aggregator and analysis firm.

_______________

Dapps are arguably the most dynamic innovation of the blockchain era. With tons of different use cases, innovators are churning out impressive blockchain apps all the time. For investors and everyone in this industry, the task of identifying viable Dapps from the bunch is all-important.

iGaming, or eGaming-better known as eSports, is one field that blockchain technology adds value to seamlessly. Online gaming, eSport, is a natural fit for crypto enthusiasts and for good reasons. With the US Supreme Court relaxing legislation on online gambling in 2018, this field is ripe for blockchain disruption thanks in part to the automation brought by the technology and the high level of transparency.

Gaming is an industry worth hundreds of billions of dollars, with its popularity rising every year. The emergence of the internet expanded the reach of online gambling far beyond human imagination. What was previously a niche sector, the preserve of a few, is now a global billion-dollar industry. iGaming is a significant part of the wider industry and a key driver of blockchain growth.

Whether Poker or betting on outcomes of real-world events like sports, iGaming has the potential to draw hundreds of millions of people. Online gaming is a convenience that this industry desperately needed. With the advent of blockchain technology, the gaming sector has the chance to take a massive leap.

Software Development Kits (SDKs) are a Dapp possibility that developers can immensely benefit from. Moreover, the interoperable gaming profiles possible on blockchain add to the gaming experience of users. The crown of it all is the ability to own your gaming content on the blockchain. Game developers can competitively monetize what they create.

Given, Bitcoin and gambling have a rich history already. Since 2013, Bitcoin has had tremendous use in the gambling sector. On account of its privacy and decentralization, it is an efficient way to store value for an activity that has heavy restrictions in some countries. Based on this, eGaming is a natural fit for Bitcoin users. Augur is an example of a Dapp that aims to replicate the success of iGaming on the Ethereum blockchain.

In general, online gaming benefits immensely from blockchain. Let’s look at the specific traits of blockchain that make online gaming better:

Blockchain Solutions to iGaming

The efficiency of blockchain technology is making an impact in industries far and wide. For iGaming, blockchain can create a new digital gaming environment. Possibilities are courtesy of a few changes like:

1. Improved Transparency

Transparency is certainly the trademark of blockchain technology. Online gambling operators can improve transparency due to the immutability of this innovation. For instance, the full disclosure of gambling odds, and results of bets on their platform becomes easier. On the flipside, game developers can be sure that the operator does not manipulate the RNG (Random Number Generator) that helps in generating game outcomes.

2. Smart Contract Agreements

Smart contracts are an Ethereum innovation that facilitates digital agreements between the respective parties. Accordingly, one party commits to execute payment when a preprogrammed condition gets triggered by the outcome of an event.

In effect, a smart contract is “trustless” because it automatically comes to fruition upon successful completion of the condition. In iGaming, smart contracts facilitate secure agreements between players and the operator.

This security is because the smart contracts are verifiable and immutable agreements. In the gambling industry, especially, such elevated trust is an asset. Smart contracts can facilitate collaboration between game developers and content creators. In the future, this can be the standard model for game development.

3. Data Security and Storage

Typical centralized platforms have a centralized point of weakness. With decentralization, hackers face more significant challenges when attempting to compromise the system.

Blockchain technology solutions can provide participants in iGaming a greater deal of privacy. The concern of centralized data storage is real in this mass surveillance era. Blockchain data security and management solutions add useful utility to this space.

In an ideal world, these benefits would be a perfect addition to the different sectors that the blockchain can disrupt. However, the benefits come in the form of vessels, namely Dapps. Were all Dapps safe and viable, the success of blockchain would be far more resounding than it is today. Unfortunately, investors and users in the market have to contend with the problem of high-risk Dapps.

The Problem of High-Risk Dapps

Amidst the historic ICO boom of late 2017, it quickly became evident that not every shining project had the Midas touch. About 40% of ICOs at the time failed for among other reasons, outright fraud. Many developers rushed to cash in on the boom without necessarily ensuring the viability of their projects.

Investors, understandably, fell for such tokens out of the sheer promise of excellent return that Bitcoin had shown. Needless to say, the industry now has an embarrassingly long list of “dead coins.”

Dapps are a favorite for such speculative developers. With iGaming a hot trend, there is no shortage of platforms proclaiming themselves the best thing since sliced bread in this sector. Investors are often unlucky to find themselves at the receiving end of such ‘high-risk’ dapps.

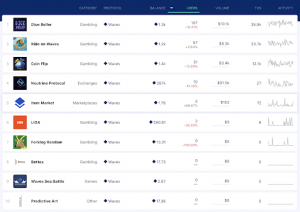

High-risk dapps are those which have the bearings of a scam and Ponzi-schemes. Notable warning signs include fabricated volumes, fast-risers beyond logic, and even the classic too good to be true story. For any rising industry, credibility and legitimacy are invaluable. Therefore, it is fair to claim that such high-risk dapps have slowed the progress and adoption of decentralized applications in general.

Ethereum Dapps users have fallen victim to a number of such gimmicks. With Tron and other platforms providing stiff competition in this space, the number of high-risk Dapps is now probably as big as ever.

The Case of FOMO3D and PoWH3D

To prove how Ponzi Scheme Dapps could become huge, these two Ethereum Dapps raked in $43M worth of ether by July 2018. FOMO3D had the design of an exit scam. Its lead designer, Justo calls it a social experiment in greed. Similarly, PoWH3D (“Proof of Weak Hands 3D”) is a pyramid scheme that has made its way into the Ethereum protocol.

Even though these two are not necessarily traditional Dapps with utility value, their success left a few lessons. The underlying greed that fueled their success, with such obvious flaws, has been an Achilles heel to crypto.

Unfortunately, the problem of fraudulent projects will always be around. Given the potential lucrativeness of crypto investments, this industry is a magnet for nefarious entities looking for their next score. This exploitation is possible because of the relative infancy of this industry. Most of the people who fall for such schemes don’t understand the risk factors involved before making the decision to invest in a questionable dapp.

So, even though legitimate dapps are transforming the world, others make it worse for those who have faith in them. With every high-risk dapp that goes bust, more people lose faith in this industry. However, the fact that blockchain technology has gained significant institutional adoption is a silver lining.

A high-risk dapp can run for long and become tremendously successful without showing cracks. Unfortunately, some tout such success for marketing ends, drawing in even more people.

The Big Picture

Taking a look at DappRadar high-risk dapp rankings, it paints a reassuring picture that most of the high-risk projects have a low transaction volume. A few like Ethereum dapps more so in the DeFi and Exchange sectors have significant transaction volumes and user numbers.

Crypto has a learning curve to go through to become a transcendent innovation. It is encouraging that blockchain technology has taken a life of its own. However, investors and users need to keep away from high-risk dapps for viable projects to stand out. Decentralized applications can be the enduring legacy of cryptocurrency. Securing this legacy requires a concerted effort from everyone in cryptocurrency.