Over $268 Million Shorts Liquidated as Bitcoin Price Briefly Tops $57,000

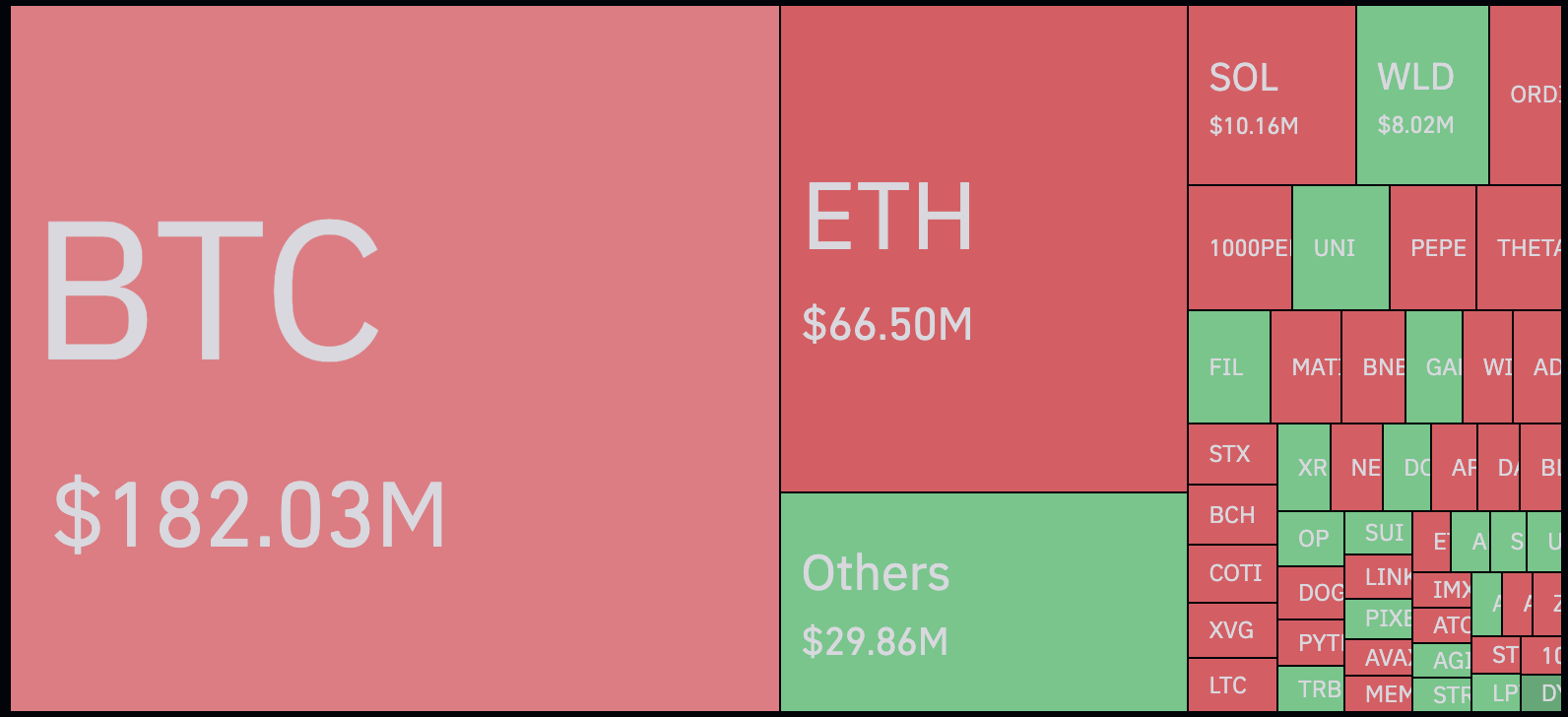

The price of the leading cryptocurrency Bitcoin rallied over 10% to soar above $57,000 for the first time since November 2021. The price rally caused total shorts positions to bleed over $268 million in the last 24hrs, including $158 million in bitcoin shorts, as per Coinglass data.

Bitcoin price rally during early Asian hours on Tuesday spilled into altcoins as well with ETH trading above $3,241, nearly 5% up in the last 24hrs. Solana (SOL), the fifth largest crypto by market cap, also recorded a nearly 7% rise in the last 24 hrs, trading above $109.

The entire market cap of crypto currently sits at $2.24 trillion, with a jump of 6.8% in the last 24hrs, as per Coingecko data.

Spot Bitcoin ETFs Record $2.4 Billion in Daily Volume

The recent Bitcoin price rally came on the heels of US spot Bitcoin ETFs registering another all-time high in daily volume. As reported earlier, total spot Bitcoin ETFs recorded $2.4 billion in daily volume on Monday, led by BlackRock’s ETF trading under the ticker “IBIT” which accounted for $1.3 billion of the total volume.

Analyst Eric Balchunas from Bloomberg posted on X, “Not totally sure reason besides price rally generating interest but it does seem like these things really see heightened action on the first day after weekend.”

MicroStrategy Continues to Stack Bitcoins

Another catalyst that preceded that Bitcoin price rally was Microstrategy buying another 300k BTC at an average price of $51,813 for $155.4 million on late Monday. The latest purchase brings MicroStrategy’s total crypto holdings up to 193,000 BTC, worth $10.8 billion at the current price. That’s nearly 1% of Bitcoin’s entire circulating supply.