Governments Paralyzed by Pandemic and Politics Are Bullish for Crypto

Juan Villaverde is an econometrician and mathematician devoted to the analysis of cryptocurrencies since 2012. He leads the Weiss Ratings team of analysts and computer programmers who created Weiss cryptocurrency ratings.

Dr. Bruce Ng is an educator in the field of Distributed Ledger Technology (DLT) and has been a lead crypto-tech analyst for Weiss Cryptocurrency Ratings since shortly after their launch.

____

Forced lockdowns around the world are exposing fatal flaws in the monetary and financial regimes that have reigned since 1971 — when President Nixon cut the US dollar loose from gold.

Freedom from any restraint from the yellow metal is basically what gave central banks de-facto license to print money up the wazoo.

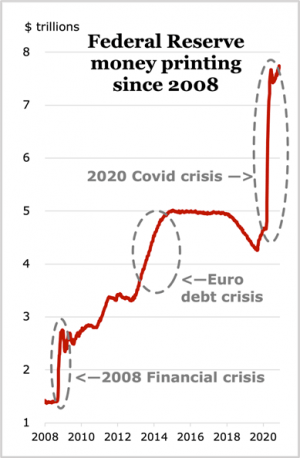

And that’s exactly what they did over the decades that followed — and especially since 2008. Since then …

Central Banks Have Become Primary Shapers of Economic Policy Across the Western World

Central bankers are broadly insulated from the politicking that customarily takes place in parliaments, congresses or even the courts.

They are also largely unconstrained by the comings and goings of elected officials.

That basically leaves them free to pursue almost any policy they deem appropriate. And here, their policy response to the 2008 global financial crisis looms large:

Massive monetary interventions in the form of near-zero interest rates and wholesale money-printing.

Of course, it could be argued that, without these monetary excesses, the global financial system would have collapsed in 2008.

It could also be argued that the mid-2010s European debt crisis would have destroyed the Eurozone and the euro. Or that the world economy would have been by crushed by COVID lockdowns in 2020.

Be that as it may, these excesses also caused tremendous collateral damage. Unprecedented asset price inflation. And a society-crippling surge in inequality.

Folks wealthy enough to hold assets saw their net worth explode post-2008. While people living paycheck-to-paycheck watched the real value of their income shrink to a tiny fraction of what it once was.

We take no pleasure in saying this, but these trends are going to continue, no matter what finally emerges from the revolving door of Presidential elections.

A gridlocked, dysfunctional government practically guarantees central banks will once again step in to fill in the void. This is the world we live in.

Permanent asset price inflation is now the official policy of those holding the levers of monetary power. And these high priests of money and finance are going to keep their collective foot on the gas to prop up a hopelessly hyper-indebted system.

And, thus, kick the can down the road just a little further. Because of this, investors’ demand for safe-haven assets like bitcoin (BTC) and gold has nowhere to go but up in the months ahead. However …

Bitcoin Has A Little-Recognized, But Key Advantage Over Gold

With gold, higher prices soon lead to expanding supply. For example, higher gold prices mean miners can profitably mine lower-grade ore that was previously uneconomic to produce. And such supply increases naturally work against sharply rising gold prices.

Bitcoin, however, doesn’t work that way. There’s a hard ceiling on supply, defined and fixed by the blockchain. No more than 21 million BTC can (or ever will) be created — no matter what prices or market conditions may be.

So, what happens when surging investment demand collides with fixed supply? Prices go ballistic. That’s Economics 101.

This also explains why crypto markets are prone to go into exponential parabolic uptrends … only to crash back down, recover, then shoot for the stars again.

On top of that, every time a crypto bubble pops, valuations never actually come all the way back down to where they were before. That’s because each successive bubble brings new people into the crypto universe — many of whom never leave.

This is how the crypto industry grows. By sucking people in during bull runs. Then, by consolidating and expanding infrastructure during the bear markets that inevitably ensue.

Which, of course, lays the groundwork for the next parabolic upsurge … when even more folks jump into the bandwagon.

How long will these dynamics play out? As long as global central banks remain hell-bent on their present policies.

___

Learn more:

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Undetected Inflation: Your Fiat Money Devalues Faster Than You Think

Not Every Country Can Shake The Magical Money Tree Amid Coronavirus Pandemic

Bitcoin vs. Modern Monetary Theory