4 Reasons Why A Smart Bitcoin Investment Makes Sense for Your Child’s Future

Cryptocurrencies are no longer on the fringe of finance, and some parents are exploring them as an investment to build their children’s future nest egg.

A recent survey found that nearly half (45%) of US parents who own cryptocurrency are already investing it in their children’s future, with 40.6% more planning to join soon.

CouponBirds surveyed 1,046 parents in the US between January and March this year, exploring their views on investing in crypto for their children.

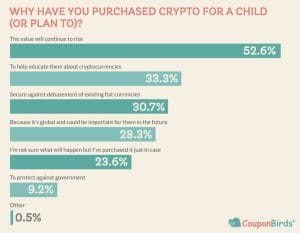

The top reason for these parents to buy crypto for their kids was the potential for future growth. However, education and currency debasement were also found to be significant motivations.

A majority said they approach these investments on a “set it and forget it” basis, intending to leave it untouched until their children are ready to take control.

Danny Baer, a wealth director at Bitcoin life insurer Meanwhile, suggested that instead of viewing Bitcoin as a quick way to make money, it’s wiser to consider it a long-term investment.

He explained that from a historical perspective, each Bitcoin price dip has been higher than the previous cycle’s peak. This suggests the asset has been on a 15-year bull run.

Long-Term Investment Opportunities

The long-term potential of cryptocurrencies like Bitcoin is a topic of debate. While some believe they could become mainstream, there’s no guarantee. However, due to the market’s volatility, experts generally recommend crypto as a long-term investment, ideally held for at least a decade.

Identity.com executive director Phillip Shoemaker said the key to investing in Bitcoin is to make frequent, smaller purchases. You buy it, store it safely in a hardware wallet, and then hold onto it for the long term.

“You do this with assets like Bitcoin, however, not the more speculative coins,” he told Cryptonews. “But this is one of those things that people should be doing. Gold is a good investment, but Bitcoin is dwarfing all this stuff. So, yes, I would recommend this.”

Portfolio Diversification

Cryptocurrency’s rollercoaster price swings, potential security breaches, unclear regulations, and its relatively new existence create a challenging investment landscape.

Kelly Ferraro, CEO at River North Communications, said that parents should carefully consider their own risk tolerance before investing. They should also ponder the investment’s long-term time horizon and how it would contribute to diversifying their child’s overall portfolio.

For a smart approach, consider talking to a financial advisor and investing a manageable amount as part of a diversified portfolio.

“Understanding the legal and tax implications of crypto investments in their region is vital,” she said.

“Ultimately, the decision should align with the family’s financial goals, risk appetite, and commitment to ongoing education about the evolving cryptocurrency landscape.”

Role of Scarcity in Bitcoin’s Value

Investors should consider Bitcoin’s finite supply, a key differentiator in today’s environment of seemingly limitless central bank money printing, as contributing to its value.

Frank Corva, senior digital asset analyst at Finder, advocated for investing in Bitcoin on behalf of children, calling it an “excellent move.” He also predicted a massive price surge for Bitcoin, predicting it could hit $1m by 2030, thanks to its “perfect scarcity.”

“Assets like ETH and SOL do not have a hard cap, which makes them a bit more questionable as long-term investments,” he said.

Corva added that parents should consider their comfort level with self-custody. Unlike traditional investments, they will need to manage digital assets using a hardware wallet like Trezor. This requires technical knowledge and strong security practices.

Negligible Consequences of Small Percentages

The future of cryptocurrency, like any investment, is difficult to predict with certainty. Years or decades from now, it’s unclear how the market will have evolved.

Yet, diversifying your money across different assets can potentially improve returns. Limiting risk is equally important, according to Stephen Kates, principal financial analyst at RetireGuide.com.

“There is little harm in small, low-single digit percentages within a given investment strategy,” he said. “Any parent who wants to gift or purchase Bitcoin for their children should consider that it should not make up the majority of any investment strategy.”

Kates added that seasoned traders swear by position sizing and risk management. Mastering these skills is the ultimate weapon in your trading arsenal.