Launched in January 2018, Ravencoin has since established itself as a peer-to-peer platform focused on the creation and transfer of assets, instant payments and token issuance.

What is Ravencoin?

Ravencoin is a digital network and P2P blockchain built around the open source project of the same name. It revolves around enabling easier creation and distribution of assets and tokens between users in its ecosystem. Its development started out in 2017 when the future core of the Ravencoin team started building technology on the foundation of the Bitcoin code fork. The final result was the creation of the blockchain optimized for asset transfers, with Ravencoin and its RVN token being actually specialized for the asset exchange over blockchain, unlike what is found with the likes of Ethereum and Bitcoin.

What is Ravencoin Attempting to Achieve?

While creating a highly specialized blockchain poses the risk of designing a solution which is too focused on a niche, the Ravencoin team aims to counter this by trying to play its strengths in an attempt to resolve several issues:

- While the asset exchange with non-specialized blockchains can be an option, dedicated solutions such as Ravencoin are built to minimize potential issues. Ravencoin allows the users to tokenize and trade with any asset relevant to the global economy. Since Ethereum and Bitcoin were not designed to allow for the easy assignment of assets to individual users, there came the need for the creators of tokenized assets to validate their ownership over them. This should be easier to do on the network which was purposefully built for that task. Supported assets include both real-world assets such as legal deeds, gold bars and silver coins, and “virtual” ones, such as licenses for various activities, access tokens for particular services, in-game items and currencies, software licenses etc. Ravencoin also makes it possible to tokenize credit, gift cards and reward points.

- Tokenization of assets allows for easier management of their ownership and Ravencoin aims to streamline this process. Tokens launched as part of several different projects can be easily confused or even taken for belonging to an unrelated project unless one has enough time to study the contracts backing them. Ravencoin aims to make each tokenized asset unique and easily traceable to its original project with its system of tamper-resistant registration. At the same time, this should not interfere with its attempt to offer an advanced decentralization model paired with a commitment to keeping the project ASIC resistant for as long as possible.

- Ravencoin sees tokenized assets as potentially disruptive to the existing securities and shares markets. The reason for this is the fact that the asset creators on the Ravencoin blockchain will be able to provide rewards to the users who hold their tokens. The ensuing model would operate as a decentralized dividend distribution system. Securities or partnership interests would come with the option to pay dividends in RVN tokens. At the same time, the securities tokens would be created from stocks or shares of a company, with the shares being represented by tokens instead of physical stock certificates. At the same time, Ravencoin wants to become a pioneer in promoting the regular use of securities on the blockchain. Early adopters such as investors should be rewarded by being given access to a young market which is expected to draw much capital in the future.

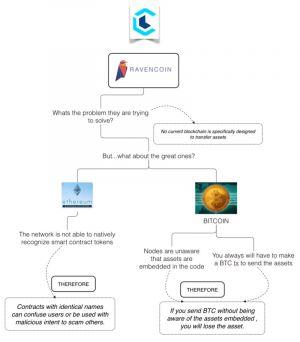

Potential Issues with Asset Management on Non-Specialized Platforms

Bypassing the existing limitations of the asset management on the blockchain required Ravencoin to move away from the parent Bitcoin’s technology. At least since 2014, platforms such as Counterparty used the Bitcoin’s blockchain technology to allow users to link their assets to parent blockchain. A similar thing can be said of Ethereum, with a whole range of tokens built under the umbrella of its tech, such as ERC20, ERC721 and others.

While the option of linking assets with native blockchain is supposed to improve security, the price tag often comes in form of related fees. With Counterparty, for example, the assets are attached to transactions made with Bitcoin. Bitcoin already comes with the set of rules which must be adhered to in order for the system to register assets as being tokenized in the first place. The exchange of assets requires one to spend bitcoins in the sufficient amount to have a transaction processed. At the same time, the use of network can include transaction fees, making this type of interaction somewhat costly.

Similarly, linking assets with tokens carries a risk of destruction of the underlying asset in case the user sends tokens to “wrong” wallets or exchanges. This is made even riskier with Ethereum which has trouble identifying smart contract tokens. This can cause confusion in the cases when ERC20 tokens have similar or identical names, with only the contract hash being a distinguishing factor between them.

Ravencoin’s Three-Pronged Solution

The proposed solution to these issues is to have the system which will keep track of assets and clearly recognize each instance in which the tokens are designated as such. The Ravencoin team wanted to take what actually worked well with Bitcoin while embellishing its features to create a more asset-aware system:

- Since Ravencoin’s protocol is made fully “aware” of the assets, they should be prevented from the accidental destruction. The protocol will ensure close monitoring of the assets whose transfers across the blockchain are kept safe and auditable.

- Ravencoin’s system features a communication system which allows the users to exchange messages and make it easier to create, track and distribute assets among themselves. The platform features a layer which is specifically designed for this purpose and does not piggyback communication on the backs of other systems.

- Underlying assets managed with Ravencoin will be protected on the platform based on their distribution and the reliance on developing a robust mining community.

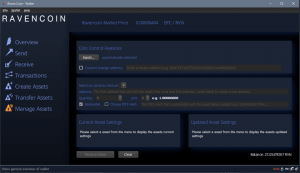

Asset Creation with Ravencoin

Creating asset token on the Ravencoin platform is a process consisting of several stages:

- A user initially needs to spend some RVN tokens

- Newly created tokens need to be given a unique name

- The number of tokens to be used is set

- The number of decimal places is defined

- The user determines if more asset-attached tokens of this type can be issued in the future

- Asset transfer from one address to another comes with the standard transaction fees paid in RVN tokens

This process represents the basic procedure involving the creation of each token on the Ravencoin platform. It is followed by equally important consideration regarding the type of token the user wants to create.

Creating Rewards with Ravencoin

With Ravencoin, the users can create reward tokens which exist on its blockchain. After being created, these tokens can be distributed as rewards for the performance of various services or as parts of a fund-raising effort. Tokens raised in this manner can be used to send various digital currencies to other parties.

The use cases for the rewards created in this manner may vary, ranging from the payment of dividends and distribution of payments to providing customers with loyalty points as part of a group reward effort. The same goes for distributing the project shares which can be turned into assets, i.e. tradable tokens. In case the company in charge of a project makes profits, it can use Ravencoin and its RVN as the vehicles for distributing these profits to all holders of the tokens in question.

Ravencoin Supports Creation of Unique Tokens

Another option with Ravencoin are unique tokens. They primarily serve as potential proofs of authenticity, which is particularly important since they are resistant to attempts of replication. Unique tokens are also suitable for instances in which the user needs to manage proofs of ownership. Typical assets which are suitable for the use of the unique tokens in this manner include software licenses or registration documents.

Unique assets are created by having the user pay a certain amount of RVN tokens. The costs of making these assets are sent to a burn address. One of the main criteria for the creation is that targeted assets should not be divisible, as only they can be made unique with Ravencoin. At the same time, only the issuers of original assets have the right to make them unique. After their creation, these assets can be moved to the UTXO and linked with a unique identifier. Once this is done, unique assets become available for being transferred between addresses, with an option to keep track of their point of origin.

Examples of unique assets may include:

- Software and game developers can create unique assets in form of software to which specific tokens with the unique ID and license keys are assigned. In the case of games, the tokens can be used to transfer licenses.

- The same goes for in-game assets which can be treated as limited edition items such as weapons and other pieces of equipment.

- Unique assets can find their use with art dealers who can create assets with specific names and serial numbers attached to them. Since they would now come with the proof of their authenticity, these unique assets can be easily distributed to new owners, with the tokens involved being treated as non-fungible.

- Finally, unique assets can be linked with real-world assets. Be it a gold bar or a coin, each individual item can be issued a serial number and made auditable. With the help of Ravencoin, specific assets kept in a physical location can be created and linked as unique assets.

Ravencoin’s Approach to Scalability and Mining

Being a Bitcoin code fork, Ravencoin had to tweak its architecture to deal with Bitcoin’s issues such as those related to scalability or mining decentralization:

- Ravencoin had to introduce faster block times of 1 minute versus Bitcoin’s 10 minutes.

- Ravencoin has a larger total coin supply of 21 billion compared to Bitcoin’s 21 million.

- It features higher block rewards i.e. 5,000 RVN compared to 50 BTC.

Ravencoin is mined in the manner similar to that found with Bitcoin or Ethereum. RVN tokens function as Proof of Work tokens running on the Bitcoin UTXO model paired with BIP9 consensus rules. Tokens are distributed to persons which are supposed to make the network stronger by mining Ravencoin.

In addition to keeping some of Bitcoin’s essential features, Ravencoin also added a new mining algorithm called X16R which is supposed to bring the platform closer to its decentralization goals. X16R is an upgrade of X11 and its first task is to clip the wings of the users of ASIC hardware by making these rigs more difficult to build. Ravencoin does this by constantly randomizing the ordering sequence of 16 different hashing algorithms, making ASICs almost too expensive to be developed for this purpose. Ultimately, this allows more users armed with regular hardware to try their hand at mining these tokens. To make their X16R solution more viable in the long run, the Ravencoin team promised to modify the existing hashing algorithms if a dedicated ASIC miner ever gets developed.

How Does Ravencoin Handle Voting and Communication?

The Ravencoin platform also supports the creation of special tokens whose functionality is unrelated to assets. These are

- Communication tokens

- Voting tokens

Communication tokens foster the exchange of messages on a particular channel. Ravencoin hopes to bypass potential issues in which a token issuer is prevented from communicating with the token holders. To avoid this, Ravencoin introduced a layer which facilitates communication with the help of specialized tokens existing on top of the assets an owner may have. These tokens are linked to these assets, allowing only the holders to get the messages sent to them.

In this manner, Ravencoin can ensure that the token owners are protected from being inadvertently identified as participants in the communication process. This should be particularly helpful for the corporations, organizations, developers and newsletter senders that want to exchange messages with the users of their services or products in a more anonymous manner. Instead of relying on potentially vulnerable systems such as email, their messages will reach only the intended token holders whose tokens are also made transferable.

A similar principle also drives the voting system implemented by Ravencoin. The voting process is initiated by making use of the messaging system in which the messages are sent together with the VOTE tokens. In turn, the holders of these tokens can redeem them to participate in the voting process.

RVN Token Availability

As of February 2019, the circulating supply of Ravencoin has reached about 2.9 billion units. The historic high in terms of its market cap was reached in October 2018, when it was valued at more than USD 120 million.

The project was launched on January 3 2018, in order for it to coincide with the Bitcoin’s ninth anniversary. The Ravencoin mainnet was launched in October 2018. There was no pre-mining nor ICO, and the developers decided against giving themselves or the project founders any sort of reward upon the launch. This was supposed to promote the image of the Ravencoin as an open-source and community-driven project whose ecosystem is built for an easier involvement of as many participants as possible.

Ravencoin is available for trading on a range of cryptocurrency exchanges, including Binance, Bittrex and others. The trading pairs usually include BTC, with DOGE, USDT and LTC being available options on some exchanges.

Acquired tokens can be stored with the help of official Ravencoin wallets available for iOS and Android, with an additional support provided for a paper wallet.