Monetha hopes to “fix” the existing ecommerce ecosystem with its decentralized trust and reputation system while also challenging transaction speeds and pricing models of the dominant payment processing systems such as Paypal or Stripe.

Monetha payment platform runs on Ethereum blockchain and was created with the belief that trust, reputation, and transparency in transactions are unseen but essential elements of ecommerce. Monetha team sees the current ecommerce ecosystem as functional, yet ultimately flawed system brought down by the ball and chain put around the legs of both merchants and customers. Monetha wants to help them by presenting itself as the solution to four main problems its team have identified in the whitepaper.

Monetha is focused on improving the existing state of ecommerce in four key fields.

- Lack of Trust-Based Verification System in Commercial Transactions

- Long and Expensive Payment Procedures

- Poor Knowledge and Accessibility of Ethereum-Based Economy

- Prevalence of Scams in Ecommerce

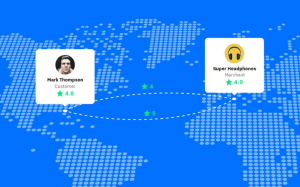

Monetha’s solution makes it possible to record each commercial transaction and allow both the merchants and customers to “verify” each other prior to doing business. Monetha wants to make a seller’s history easily checkable by the user to build trust. The traders’ prior record serves as a seal of quality, and there is no need for each merchant to be tested for reliance each time a new customer approaches him. Monetha team believes that trust is a rarity today and it can be destroyed too easily. Reputation is another intangible good which the seller can “transfer” across the platforms with the help of Monetha.

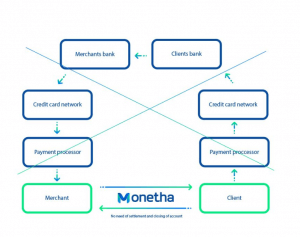

Monetha wants to reduce the number of steps both the sellers and buyers go through to make a single transaction. In its bid to become a preferred payment gateway, Monetha offers to bring down the settlement steps in each transaction from the current 15 – 16 on average down to a single one.

It goes hand in hand with slashing many transaction fees to only one, while getting rid of expensive cross-border payment chargeback fees, such as those charged by Paypal and alternative services.

Finally, Monetha wants to apply similar cuts to the long waiting times the sellers have to contend with (as long as several weeks) before receiving their money.

Monetha wants to establish itself as a merchant’s shortcut to the burgeoning blockchain-based economy created on the Ethereum platform. This primarily refers to dealing with insufficient knowledge on accepting and using Ether at the time when the merchants risk losing much for ignoring blockchain and cryptos.

Ethereum, specifically, is seen by Monetha developers as a versatile platform for the development of digital products and assets. They believe it will ultimately supersede Bitcoin as the payment platform. Knowing that at least ten percent of the global GDP is expected to be stored on blockchain platforms by 2025, Monetha offers retailers an opportunity to tap into this technology in a user-friendly and accessible manner.

The key issue Monetha team deals with is bridging the gap between the blockchain technology for payments and the inexplicable lack of the trust-based systems to support it. At the same time, they noticed the rise of another industry which grew in parallel with blockchain, namely ecommerce, whose retail sales amounted to 2.3 trillion US dollars in 2017 alone.

Yet, Monetha team have identified a hidden enemy eating away the profits of the ecommerce world: scams perpetrated by both sellers and buyers. According to the data of the Australian Competition and Consumer Commission, no less than $90 928 622 were lost in 161 528 cases involving ecommerce scams in 2017.

Recognizing that many of these scams stem from the breach of trust between sellers and buyers, Monetha wants to counter this trend with its decentralized trust and reputation system – DTRS. The system aims to cover several most important pain points in ecommerce.

DTRS leverages blockchain and Ethereum’s smart contracts to come up with a reasonably effective shield against scams. It is ensured by making it possible for both the buyers and sellers to give ratings. These ratings are stored on the immutable Ethereum blockchain and, as such, form what Monetha creators describe as the “trust rate” for each seller. If rates alone were not enough, the customers could use Monetha’s DTRS to get access to reviews made by individual users and posted on the visible place on the merchant’s website.

That is the point at which the DTRS’ smart contract system kicks in to prevent any manipulation with trust rate values. The system is designed to manage the rates only after an actual transaction takes place as a prerequisite for storing the information on the immutable blockchain. Before creating a rating, the DTRS uses an algorithm to assess the quality of the transaction in question and evaluate it on the actions taken by both the seller and the buyer.

The process is over once these two participants in the DTRS system are given a rating. With it, the customers can check if a particular seller is a newcomer in the industry or is in the habit of shipping damaged products. Since the e-retailers are not allowed to change and manipulate the rates, the prospective buyers can make an informed decision on purchases based on the unalterable and objective data.

While buyers are the more vulnerable party, frauds go both ways, and the DTRS system aims to protect the merchant as well. The world of ecommerce had to contend with nearly $7 billion in chargebacks in 2016. A portion of these had to do with chargeback frauds in which consumers made purchases online, followed by requesting chargebacks from the issuing bank after they have actually received their purchases. With the DTRS system, sellers face much lower risks of chargebacks and scammers, as they have insight into buyers online commerce history and appropriate rating.

The system makes life easier for merchants who have to deal with non-scam chargebacks and damaged good returns. These are often protracted and expensive procedures. Since all transactions are recorded on the blockchain, their data can be used as the basis to file a complaint or claim if a customer is unhappy with the received product. In case the seller fails to respond to a claim, the smart contract system will immediately lower his trust rating as a warning to any future buyer. The same goes for buyers who abuse the system and request unjustified chargebacks.

Another feature of the DTRS is the ability to automate the circulation of information essential to specific transactions between a buyer and a seller. It refers to the information like times of transaction, product warranties, wallet addresses, shipping and delivery information, and technical data. All information is hashed and made available only to parties in the transaction via a simplified interface.

How Do I Transfer My Reputation?

Finally, the DTRS system recognizes that trust building is hard and merchants often look for an option to “transfer” their reputation between various trading platforms. These platforms often manage one’s individual ratings in a highly centralized manner. With DTRS, sellers who do not want to be a part of centralized marketplaces like Alibaba or eBay can still sell their products and enjoy the benefits of having their trust ratings shown to the buyers.

At the same time, there are sellers who, for instance, want to do business on eBay without having to build their reputation from scratch after receiving excellent ratings on Amazon. There are no such worries with DTRS, as the system allows the sellers to carry their ratings over no matter which e-commerce platform they want to use.

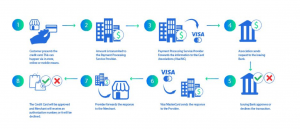

Merchants receive payments either from retail trading or e-commerce. All transactions with Monetha gateway run in line with the established workflow:

1. The customer adds items to the cart and selects the Monetha platform for payment instead of credit cards or PayPal.

2. Once the buyer places a purchase order, servers create QR code containing all the data needed to establish the legitimacy of a particular transaction. The information includes the addresses used, warranties, shipping details, and other compulsory data.

3. The amount involved in the transaction is immediately converted from fiat to the selected Ethereum-based currency.

4. The customer scans the QR code with the crypto wallet on his mobile app and hits “send” button to forward the funds to the merchant’s wallet.

5. Payment is received by the merchant directly and with no waiting time. Since Monetha processes transactions on the Ethereum blockchain, the average transaction time should take no more than two minutes.

With this system, Monetha enables direct transactions from customers to sellers. In order to live up to its promise to reduce steps involved in transactions (compared to Paypal or Stripe), the average transaction consists of a single step only, meaning it is settled and closed for both parties simultaneously.

The received amount of Ethereum-based currency can be exchanged for the seller’s preferred fiat currency. Also, sellers are given the option to choose the frequency of conversions of tokens to fiat currency, as well as pick the local currency they want to be exchanged. Concurrently, customers can check their Monetha apps to get an overview of the full purchase history with Monetha tied to a specific wallet address they used.

One more of many Monetha’s goals is to reduce the number of regular and “hidden” fees which are popular in the traditional ecommerce systems. Hence, Montha takes only 1.5% of a total transaction value per month. Also, Monetha wants to get rid of high chargeback fees, allowing the merchants to simply send the money back after paying a standard transaction fee.

In addition, Monetha’s payment processing system offers the following benefits to the customers and sellers.

For sellers:

- There is no minimum charge

- No holding periods set by third-party payment processors.

- Foreign exchange fees are not charged

For customers:

- Every purchase on the Monetha platform rewards the buyer with 0.2% of the transaction value in Monetha tokens (MTH) which are part of its loyalty pool.

- Monetha tokens can be used for purchases made with the Monetha wallet within a 6-month period, in the manner similar to credit card point rewards.

MTH holders will receive 0.5% of the transaction value on the Monetha platform in vouchers (“voucher smart contract”) that can be applied as a discount when buying from Monetha’s merchants. The value of the voucher or discount is proportionate to the amount of token a user holds. As these can be used only with the sellers within the Monetha’s ecosystem, the developers hope to increase the value of the MTH token by driving the adoption of their payment system.

In addition to gaining MTH by engaging in transactions on the Monetha platform, the tokens are also traded on the major crypto exchanges like HitBTC and Binance.

Monetha’s ICO was completed on 31 August 2017 and raised $37,000,000 in the sold token value. As of November, Monetha’s market cap stood at around USD 7 billion. 218,271,923 tokens are currently in circulation out of the total supply of 402,400,000 MTH.

The core of the Monetha team consists of Justas Pikelis, Laurynas Jokūbaitis and Andrej Ruckij as the platform’s founders. The project started in early 2017 when the trio came up with the idea of designing a payment and trust platform based on the blockchain. The platform was named “Monetha,” as a combination of the Latin word for “money” and the word “Ethereum.

In August 2017, the team entered the strategic partnership with the major online retailer from the Baltic States region Pigu.lt which integrated Monetha with its payment system. Similar partnerships followed, including those with the Finnish financial enterprise HODL Finance and the food delivery company Foodout Group.