Successfully crowdfunded in August 2015 and launched in July 2018, the Augur platform operates as a decentralized prediction market running on Ethereum blockchain. Its REP token is used as the source of reward and “gas” for making predictions.

Unlike many of its competitors in the cryptocurrency scene, the Augur platform was not designed to correct any specific issue with the associated technology, such as blockchain, block sizes, transfer speeds or centralization. Instead of that, the Augur developers sought to utilize cryptocurrency technology to improve what they identified as the problems with the prediction markets.

Put simply, these markets operate as groups of people who speculate on the outcomes of various events and receive rewards in case a specific forecast is proven to be correct. The size of the reward depends on the likeliness of the outcome one bets against.

The events one can try to “predict” can be election results, asset prices, sales results and other events of interest to the participants in these communities. What the Augur team sought to achieve with their blockchain-based platform was:

- To design a specific protocol aimed at prediction market which would be operated and owned with a greater degree of accessibility.

- To give credibility to their platform’s focus on the users by making the protocol fully decentralized.

- To make it possible to make predictions with as few related fees as possible.

- To go for better accuracy compared to non-crypto prediction markets.

All of these should be made possible with the help of the Augur’s reliance on the features of the Ethereum platform which allows it to create a huge database of answers to the questions about the events which have not actually happened.

Augur’s Wisdom of the Crowd Concept

Yet, creating a database which would operate in the manner similar to Google or any other web browser is not a technological feat only. The Ethereum platform underlying Augur was thus combined with the concept called “wisdom of the crowd”. This approach is based on the idea that larger groups of people are “smarter” than individuals, even those who hold specialist knowledge about a particular subject. This extends to making predictions about certain events.

By making predictions on the Augur platform, the users will create pools of data on any subject, which would serve as a source of answers in relation to a particular topic. The Augur team’s ambition is to make this process both more accurate and closer to real-time availability. The presence of the higher number of participants is supposed to deliver better accuracy. At the same time, higher number of users in the prediction-making process should protect the system’s drive towards fuller decentralization.

The wisdom of the crowd concept is further fortified by having the Augur platform allow users to both provide and trade their predictions in exchange for “real” monetary rewards. These take the form of the platform’s REP token. The reward-based system is expected to make the participants give predictions based on their real expectations, not their hopes. While the Wisdom concept still has to prove its worth (the Augur platform has only recently went live), it has so far drawn attention from the likes of Vitalik Buterin, an advisor to the Augur team, who called it “Uber for knowledge”.

How Does Augur Work?

The Augur prediction market protocol is marketed as the only protocol in which its developers do not meddle into its operation beyond providing the initial open source code. In practice, this means that its creators do not create markets, engage in trading or have the ability to control or oversee actions taking place on the Augur platform.

Based on this, Augur has to perform several roles as a decentralized system whose operation is automated with the use of smart contracts.

- Augur operates as software running a P2P protocol which is available for free use. Its users can access it via desktop client app in the manner they would do in case of Bitcoin or Ethereum nodes.

- Augur platform also operates as a blockchain oracle protocol in which users can ask questions related to events in the “external world” and get an answer. The data on specific events are gathered “off-chain” by the holders of the REP token and sent to the smart contracts.

- The Augur platform will also operate as a repository of smart contracts written in Solidity and made deployable on the Ethereum blockchain. These contracts distribute rewards based on the level of accuracy on the original prediction made by a user. This level of decentralization means that the users must still observe their local or national regulations which cover the prediction trading.

How Does One Create Prediction Markets with Augur?

The main actions the user can take on the Augur platform are related to the creation of markets and prediction trading. They are performed across the four stages:

- Creation of markets

- Trading

- Reporting

- Settlement

Any user on the platform can create a market for an event that takes place or is expected to take place in the real world. The first step is to check the list of available markets to avoid double coverage for the same event.

The choice of events used for prediction is virtually limitless, and the related questions can be formulated along the lines of “What will be the results of snap elections in XY country?” or “What will be the price of gold by the end of 2018?”. Whatever event is picked, the market creator on the Augur platform will have to part with some of his Ethereum tokens in form of a fee. In exchange, the creator will receive the validity bond which will be subsequently refunded to him/her, provided that the final outcome of the market is proven to be valid.

After this, the market creator needs to decide upon the creator fee, as the percentage of the value of rewards won by those who made the right prediction for a specific event. This fee has to be in the range between 0% and 50% of what is won by other participants bidding for the event. Once the market is created, this fee can be lowered, without the possibility of being raised.

As the market creator has to bear the initial cost in Ethereum, the recommended approach by the developers is moderation: setting too high a creator fee may turn the users off from making a bid for the created event. At the same time, the creator fee has to be substantial enough to cover for the creation of the bidding market in the first place.

What is Prediction Share Trading?

In addition to earning from creating prediction markets on the Augur platform, the users can also try their luck and knowledge by engaging in trading and purchasing prediction shares as soon as a market is created. These shares are related to the outcomes of events which are the subjects of predictions. Those who buy shares for the “correct” outcome can make a profit from it.

The amount of the reward is based on the likelihood of the correct outcome taking place. The Augur users are invited to focus on the markets they consider their field of expertise or interest. In case the created market comes with a binary (yes or no) question, such as predicting the correct value of Bitcoin by certain date in January 2019, the value of shares that can be bought on Augur will actually reflect the odds that Bitcoin will actually hit the predicted price.

Value of a single share can range anywhere from 0 to 1 ETH. The prices of shares are also subject to changes, depending on the following factors:

- The prices are likely to rise as the number of users who buy shares increases

- The prices will drop if the users prefer to sell their shares.

- The general sentiment towards a predicted event may change.

- Other real-life events can make a specific event less likely to happen.

Price fluctuations allow the traders to try to engage in speculations, such as buying shares at low prices followed by selling them at higher prices as the number of people making bids increases. This can be done before the final outcome becomes known. It also possible to make a profit by holding onto shares for a correctly predicted event once the market is closed. The amount earned will be calculated as the number of shares multiplied by price and divided by the number of potential minimum and maximum price points for a specific prediction market.

Reporting Event Outcomes on Augur

Funds one uses to buy the shares are locked by the Augur’s smart contract system and released only after the predicted event takes place. An important role in relation to this is played by the users who report on the outcome of events, as they also stand to profit in the Augur ecosystem. Their main tool is the REP token (short for “Reputation”) which is staked on the outcomes if one desires to become a reporter. In addition to reporting on the events, reporters also send the results to the smart contract system.

The core feature here is the Augur’s decentralized oracle system which determines the event outcomes based on the submitted reports. Before the reporters can collect their rewards, it is necessary to check if any of their claims are disputed by other users.

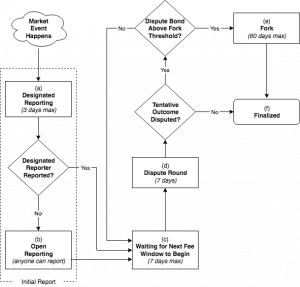

The reporting process itself takes place across several steps:

- A market creator needs to select a designated reporter once the prediction market is created. While the reporter will be “officially” in charge of reporting the outcome of the event, he/she does not have the power to decide the outcome unilaterally. The Augur community can use every opportunity to challenge and change the official report submitted by the designated reporter.

- The market creator needs to post a no-show bond. If the designated reporter submits a required report on time, the no-show bond, which is paid in REP, is returned to the market creator. The designated reporter has to provide a stake related to the event outcome they report about.

- Once the event takes place, the deadline for submitting a report on its outcome is three days. If the report is not submitted within the set timeframe, the market creator stands to lose the no-show bond and the process enters the open reporting phase.

- At the open reporting stage, any user can provide a report on the outcome of a particular event. Whoever gets to do it first will get the no-show bond which has to be used as that person’s stake.

- Whatever the outcome, the Augur market will enter the next phase in which the next “fee window” is waited upon. These windows run in 7-day consecutive intervals, during which the Augur system collects fees which are added to the respective reporting fee pools. Once this interval is over, the REP holders who participate in the reporting process get paid from these pools.

- After this, the market receives a tentative outcome which can be disputed by any REP holder which does not agree with it. The users who dispute the outcome can set aside some funding which is to be used as their stake.

- The outcome is finalized and the specific prediction market gets resolved.

REP Token Availability

As of December 2018, the REP token’s market cap stood at USD 87 million, down from more than 1 billion it had in January 2018. After the ICO for the Augur involved distribution of more than 8 million tokens, their maximum number was capped at 11 million units.

The REP token is available for trading on cryptocurrency exchanges such as Bittrex, Binance and Poloniex. Once acquired, these tokens can be stored in ERC20-supporting wallets, at least until the Augur decides to launch dedicated wallets for their currency.

While prediction markets paired with blockchain may seem like a niche, the Augur still faces some competition in Gnosis, Stox and Hivemind which, despite technological similarities, feature varying economic designs.

Augur History

The Augur project started in late 2014 as one of the early solutions build around the Ethereum’s technology. The beta version of the protocol was launched in 2016, with the main net going live in July 2018. Two masterminds behind the project were Joey Krug and Jack Peterson, both with much experience under their belt when it comes to blockchain tech and Bitcoin.