DeFi Unlocked: How to Earn Crypto Investment Income on Compound

DeFi (decentralized finance) has emerged as the hottest crypto trend of the year, with the total amount of US dollars locked in decentralized finance protocols surpassing USD 9bn on September 1 before correcting lower.

In our new “DeFi Unlocked” series, we will introduce you to the different ways you can earn investment income in the booming decentralized finance market.

In part one of our DeFi series, you will discover how to earn interest on cryptoassets by placing them into the Compound (COMP) money market protocol.

What is Compound Finance?

Compound is an autonomous, open-source interest rate protocol that allows cryptoasset users to borrow and lend digital assets on the Ethereum (ETH) blockchain.

Compound supports BAT, DAI, ETH, USDC, USDT, WBTC, and ZRX, and currently pay interest rates from 0.19% to 8.06%. Prevailing interest rates vary from asset to asset and depend on market conditions.

The idea behind Compound is to enable anyone across the globe with an internet connection to borrow or lend funds in the form of cryptoasset. To date, however, the protocol – like effectively all DeFi apps – has mostly been used by experienced crypto users and investors hunting for yield.

How to earn interest on your cryptoassets on Compound

Earning interest on your crypto holding might be easy on Compound, provided you are comfortable with using MetaMask or similar Ethereum client that can interact with dapps (decentralized apps).

To start earning crypto interest on Compound, you will need to take the following steps:

- Access compound.finance

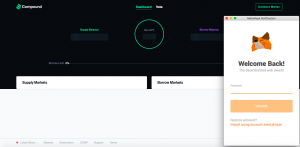

Next, you click on “App” on the top right of the website to access the protocol dashboard

Source: Compound Then, you connect to the protocol with your Ethereum wallet (MetaMask, Coinbase Wallet, or Ledger)

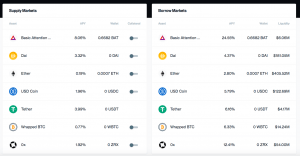

Source: Compound Once connected, you will be able to view all available assets, borrowing and lending rates.

Source: Compound The stablecoins – DAI, USDC, and USDT – are favorites among DeFi investors as they ensure that the principal of the loans retain its value while investors can cash in on the interest and – in the case of Compound – also on the COMP token.

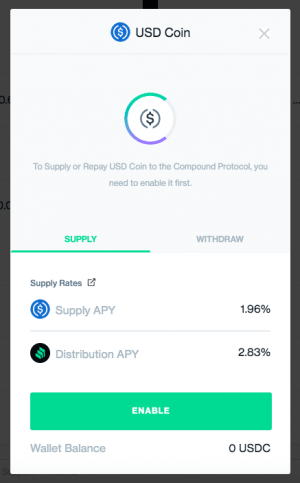

Click on the asset you want to deposit, enter the amount you wish to lend, and confirm the transaction. In the screenshot below, you can see that if you were to deposit USDC, you would earn 1.96% APY (annual percentage yield) on your deposit.

Source: Compound - If you are content with the rate you will receive on your deposit, click enable to confirm the lending transaction. And that’s it. You will then start earning interest on your USDC deposit.

In addition to the interest earned on USDC, you also receive COMP tokens as an incentive to provide liquidity to the protocol.

What is the COMP token & how can it boost your returns?

Compound users receive COMP tokens for interacting with the protocol. That means regardless of whether you are borrowing or lending, you will receive COMP tokens proportional to the amount you borrow or lend and dependent on the day’s COMP distributions.

As a result, some creative investors have started to lend one stablecoin and borrow in another – at a small loss in terms of interest rate differential – to earn enough COMP to generate a profit. This form of liquidity mining became popular following Compound’s introduction of the COMP governance token in May 2020.

While the returns of liquidity mining COMP compressed, the interest you can earn on US dollar-backed stablecoins, USDT and USDC, are still higher than what you would receive on a currency savings account at your local bank.

As a result, Compound provides an alternative to existing savings accounts and money market fund solutions in the legacy financial system.

Disadvantages & risks

The Compound protocol has been running since 2018. However, that does not mean that code vulnerabilities couldn’t be found and exploited. Of course, that is the case for all DeFi protocols and not specific to Compound. It offers bug bounties for anyone who can find a vulnerability in its open-source code to increase its security.

There is also the risk of a “bank run” on Compound. A bank run – in traditional finance – refers to depositors withdrawing their cash when they fear it may no longer be safe in their bank. In the context of the Compound, bank run risk exists because of the protocol’s utilization rate, which refers to how much depositors’ funds are going to borrowers. So if all depositors would withdraw their funds in one go, that would be an issue.

To address this concern, Compound adjusts its interest rates according to borrowing activity to entice more depositors to place funds into the protocol.

Finally, there is also some opportunity cost of holding assets in Compound that you can’t trade for a potentially better-performing asset in the secondary market. Having said that, you can withdraw your deposits from Compound and convert it into other cryptoassets.

The bottom line

Compound is one of the most established borrowing and lending protocols in today’s DeFi landscape. However, interest rates for most available lendable assets on Compound are not going to make you a crypto millionaire anytime soon. While the COMP governance token provides an additional financial incentive to deposit tokens into the protocol, Compound is arguably more of a protocol for investors then opportunistic traders.