Will Bitcoin Volatility Decline as it Continues to Appreciate?

Disclaimer: The text below is a press release that was not written by Cryptonews.com.

Bitcoin is consolidating at 58,000 USD. It failed to break the resistance of 60,000 USD for multiple times but investors’ confidence remains strong. According to Oanda’s analyst Edward Moya, the market is in “wait-and-see mode … Consensus is a break above 60,000 USD is not a matter of if, but when. Next barrier is at 75,000 USD.”

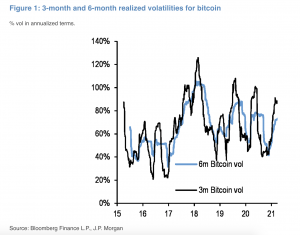

Over the past few months, institutional investors have been the major driving force for Bitcoin’s rallies. In a report, JPMorgan Chase & Co. suggests that the decline of Bitcoin volatility could lead to more institutional investors warming up to the cryptocurrency.

CME Group, one of the largest derivatives exchanges in the world, announced that its Micro Bitcoin Futures contracts will go live on May 3. The Micro futures contract will be worth 0.1 BTC, enabling more retail investors to hedge risks and gain exposure to Bitcoin.

Crypto Exchange Bexplus‘s marketing director Knash Nikolssom comments that “CME’s move shows that the crypto derivatives market is gaining broader acceptance. More participants in the market will surely help to tone down market volatility. This, combined with a new bout of institutional support, will drive Bitcoin towards the mainstream.”

MicroStrategy, one of the biggest Bitcoin advocates, snatched another 253 bitcoins at an average price of 59,339 USD. Now the company owns 91579 bitcoins and its stock price once reached an ATH of 1,315 USD on February 9, 2021, increased more than 826% since August 2020.

Bitcoin gaining broader acceptance will help to reduce its volatility, a key concern of big investors when considering whether to adopt Bitcoin. Many believe that Bitcoin is unlikely to drop below 40,000 USD, a level where a number of institutional investors purchase Bitcoin.

How To Earn BTC As Volatility Declines?

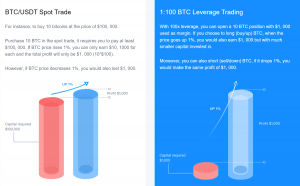

Futures trading is one of the most popular tools to earn money with Bitcoin’s volatility, but it can also be used in a calm market. Futures trading enables traders to bet on the price directions of Bitcoin and earn profits with the price differences. With leverage, traders can gain greater exposure and enhance profitability.

Registered in Saint Vincent and the Grenadines, Bexplus is a leading crypto derivatives trading platform offering 100x leverage futures trading on a variety of trading pairs – BTC, ETH, LTC, EOS, XRP and etc. No spread, no KYC requirements, no deposit fee, Bexplus is trusted by clients worldwide, including the USA, Japan, Iran, and Sudan.

Why Choose Bexplus

- 100x leverage on BTC, ETH, LTC, XRP, EOS contracts

- Demo account with 10 free BTC

- Easy registration with No KYC

- 100% deposit bonus

- Up to 21% annualized interest rate on BTC savings

Follow Bexplus on:

Website: https://www.bexplus.com/

Telegram: https://t.me/bexplusexchange

Apple App Store: https://itunes.apple.com/app/id1442189260?mt=8

Google Play: https://play.google.com/store/apps/details?id=com.lingxi.bexplus

{no_ads}

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.