Bitcoin Price Prediction: November’s Peak After Uptober’s Rise?

Bitcoin price trajectory has once again captured the attention of the financial world. Bitcoin price closing at $34,296 on Tuesday with a marginal decrease of less than 0.10%, the cryptocurrency’s performance continues to intrigue both skeptics and proponents.

The recently-coined term “Uptober” encapsulates Bitcoin’s stellar October performance, yet many believe that November, traditionally Bitcoin’s strongest month, might offer even more surprises. Notable figures such as the legendary investor Druckenmiller have expressed regret over not owning Bitcoin, reflecting its growing influence.

Furthermore, as global markets remain volatile, adhering to investment strategies like those recommended by Robert Kiyosaki might be the key to weathering what some predict to be the “Greatest Crash in World History.”

November’s Promise: Following Bitcoin’s Uptober Triumph

The price of Bitcoin increased by 30% in October, from $26,900 at the beginning of the month to $34,296 by the end of the month. Based on past statistics, November has shown to be a robust month for Bitcoin, with an approximately 38% increase following April. This encouraging pattern points to possible growth in November.

In 2023, several themes, including as worries about banks failing, macroeconomic developments, and increasing institutional interest, all contributed to the volatility of the bitcoin market. In Q3 and Q4, exchange-traded funds (ETFs) became more popular, and investors were drawn in by the prospect of the next Bitcoin halving, which is expected to occur in around six months.

If history would repeat, #Bitcoin will hit new ATHs in November 2024.

Historically, Bitcoin has always hit new ATHs six months after the halving. pic.twitter.com/L3WNL7d8Tm

— Crypto Rover (@rovercrc) October 27, 2023

Analysts observe that investor optimism and profits have increased as a result of this jump. There is anticipation that November will do better than anticipated given its past performance history and the possibility of BTC ETFs being approved by the US Securities and Exchange Commission (SEC). This bullish trend might pick up steam on Wednesday, potentially culminating in a “Movember” triumph for HODLers.

With this news, the prognosis for the Bitcoin market is becoming more optimistic.

Druckenmiller’s Bitcoin Regret: A Missed Opportunity

In an interview with hedge fund manager Paul Tudor Jones, billionaire investor Stanley Druckenmiller lauded Bitcoin for forging a robust “brand” over the previous 17 years. Even though 70-year-old Druckenmiller now owns gold, he noted that Bitcoin is a popular alternative as a practical store of wealth, particularly with younger consumers.

He stated that even if he doesn’t now own Bitcoin, he should. Druckenmiller had previously owned Bitcoin, but he sold it in September 2022 as a result of tightening policies by central banks.

Stanley Druckenmiller is one of the most successful hedge fund managers on Wall Street and is worth $6,200,000,000.

He says, “Young people look at #bitcoin as a store of value. It’s a brand. I like it. I dont own any, but I should”pic.twitter.com/DXjrnvE1Qc

— Documenting ₿itcoin 📄 (@DocumentingBTC) October 30, 2023

The market forecast for Bitcoin is favorable due to the support of a reputable investor such as Dreyfus, as well as his optimistic comments on cryptocurrencies’ capacity to thrive in the face of waning faith in central banks. It’s an indication of how conventional financial statistics are beginning to accept digital assets.

Navigating the Predicted Crash: Kiyosaki’s Investment Wisdom

The well-known author of “Rich Dad Poor Dad,” Robert Kiyosaki, has offered financial guidance to investors to aid them through what he predicts will be the biggest financial collapse in history. Although conventional wisdom supports a 60/40 stock and bond strategy, Kiyosaki cautions that investors in this way would not fare well in 2024.

Rather, to weather the upcoming economic slump, he advises distributing investments as follows: 25% in real estate and energy equities, and 75% in gold, silver, and Bitcoin. This is the first time he has disclosed to his followers the precise distribution of assets.

SHIP of FOOLS. Forever and ever financial experts have promoted the idea “Smart Investors invest in 60/40 60% bonds 40% stocks. In 2024 60/40 investor will be biggest losers. Before going down with the ship consider a shift to 75% Gold, Silver, Bitcoin 25% real estate/oil…

— Robert Kiyosaki (@theRealKiyosaki) October 29, 2023

Famed for his forecasts on the values of gold, silver, and Bitcoin, Kiyosaki recently predicted that the price of silver would increase, gold would rise sharply, and the price of Bitcoin would reach $135,000. His support for cryptocurrencies has been constant, and he has emphasized their ability to withstand economic downturns.

As more people become aware of Bitcoin’s potential as a safe-haven asset in volatile times, the market outlook for the cryptocurrency is improving thanks in part to Kiyosaki’s guidance and support.

Bitcoin Price Prediction

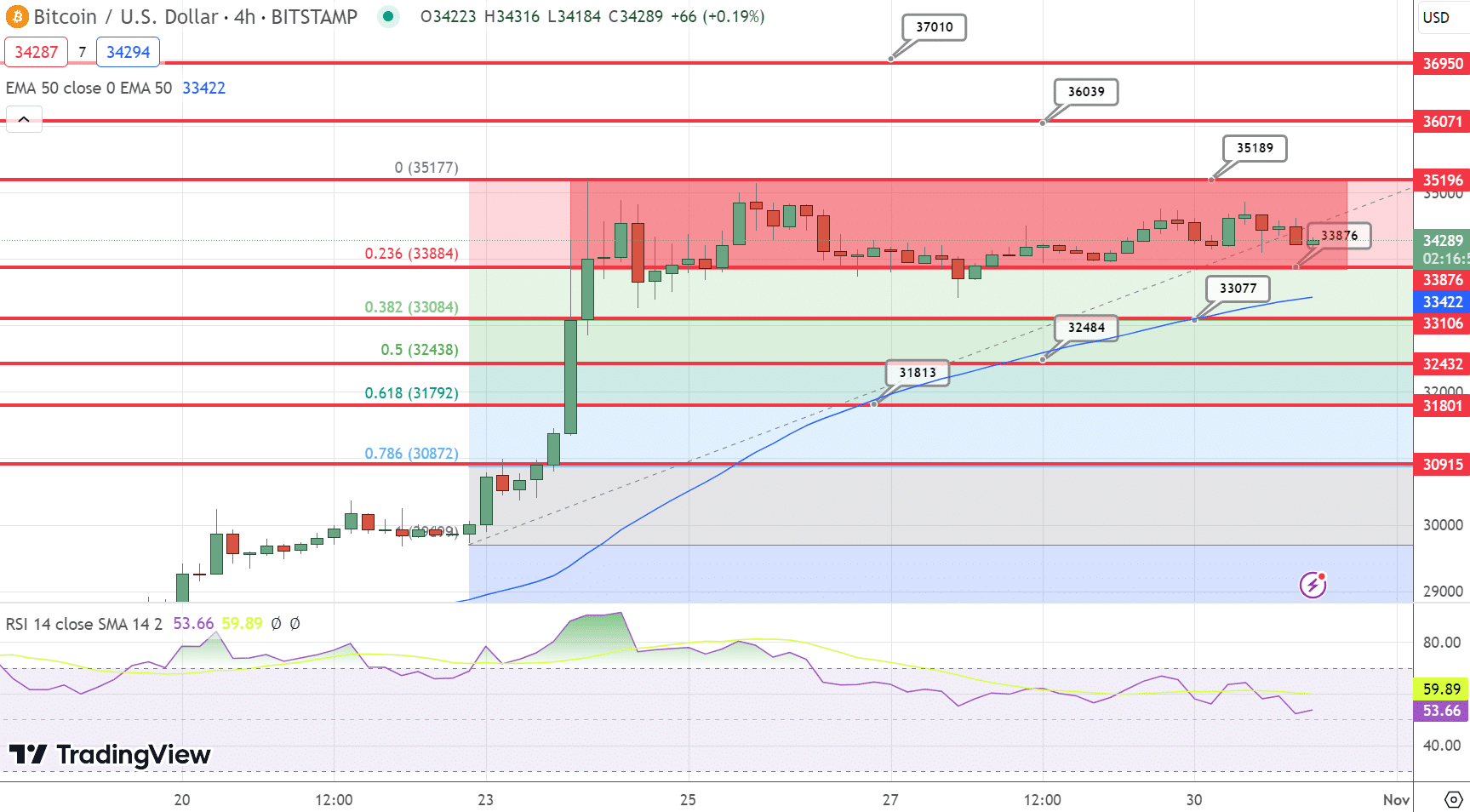

Analyzing the recent daily chart, Bitcoin’s pivotal point is highlighted at $33,920, aligning intriguingly with the 23.6% Fibonacci retracement level. In terms of resistance, the first barrier is positioned at $34,500, succeeded by $35,250, and then at $36,150.

Conversely, we anticipate immediate support around the $33,000 mark, corresponding with the 38.2% Fibonacci retracement level. Subsequent support zones are found at $32,450 and $31,800, representing the 50% and 61.8% Fibonacci retracements, respectively.

From a technical lens, the Relative Strength Index (RSI) reads at 57. Positioned slightly over the neutral zone, this indicates a dominant bullish sentiment, hinting at an ongoing buying drive.

Furthermore, Bitcoin’s 50-Day Exponential Moving Average (EMA) is noted at $32,800. With Bitcoin trading above this EMA, it’s indicative of a near-term upward trend.

Surveying the daily chart configurations, Bitcoin appears firmly poised, maintaining a steady stance above a double bottom support at $33,450. Additionally, the 23.6% Fibonacci level seems to be providing a robust defense against major downtrends.

A distinct red rectangle on the graph suggests a consolidation period, hinting that market participants might be awaiting a compelling cue for a notable breakout.

In Summary

To wrap up, Bitcoin’s general trajectory appears bullish, particularly if it sustains above the $33,900 marker. On the other hand, a dip below this could signal a potential bearish shift.

Given the present signals and market sentiment, Bitcoin might aim for the $34,500 resistance in the upcoming sessions.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.