Bitcoin Price Prediction: BTC Surge Over $37,000 Amid Record Transactions

In a remarkable turn of events, Bitcoin’s price surged to $37,444, marking nearly 1% increase on Tuesday, signaling robust investor confidence and market dynamics. This notable ascent coincides with significant developments in the cryptocurrency sphere, including Tether’s unprecedented freeze of $225 million in USDT, a response to a DOJ investigation and termed as the “largest-ever freeze of USDT.”

Additionally, Bitcoin shattered its own records with over 710,000 daily transactions confirmed on Sunday, underlining its growing acceptance and utility. In the financial corridors of Wall Street, analysts are now eyeing a staggering $100 billion potential for a Bitcoin Spot ETF, a move that could further solidify Bitcoin’s position in mainstream investment portfolios.

This confluence of events paints a bullish picture for Bitcoin’s future, as it continues to navigate the complex tapestry of digital finance and regulatory landscapes.

Tether Implements Record $225M Freeze Post-DOJ Investigation

The cryptocurrency market, particularly Bitcoin (BTC), is showing signs of resurgence following a significant announcement by Tether and Okx. In a groundbreaking move, Tether voluntarily froze $225 million in USDT tied to a human trafficking ring in Southeast Asia.

This action was taken in collaboration with the US Department of Justice (DOJ) and utilized analytical tools from blockchain analysis firm Chainalysis. This freeze represents the largest in Tether’s history and demonstrates the platform’s commitment to combating illegal activities within the cryptocurrency market.

Tether freezes $225 million worth of stolen USDT after DOJ investigation https://t.co/nIAHXeFj5Y

— The Block (@TheBlock__) November 20, 2023

This proactive stance is pivotal for market integrity, contributing to a safer, more regulated environment and bolstering investor confidence. Consequently, Bitcoin’s price has been positively impacted, underscoring the importance of regulatory measures in strengthening the cryptocurrency ecosystem.

Bitcoin Sets New Record with Over 710,000 Transactions in a Day

During the weekend (On November 19, 2023), Bitcoin achieved a remarkable feat by breaking its previous record for the highest number of daily transactions within a 24-hour period. The network’s robust hash rate of 480 exahash per second (EH/s) facilitated the confirmation of an extraordinary 710,579 transactions, surpassing the earlier record set on September 15, 2023. A noteworthy aspect of this achievement is that a significant majority of these transactions, totaling 475,249, were inscription-based, representing a considerable portion of the day’s total.

This surge in inscription-based transactions has led to a notable increase in miners’ fees, particularly evident on November 19 and also on November 12, which witnessed the third-highest transaction volume in Bitcoin’s history. The resulting transaction backlog, exceeding 200,000, has subsequently raised the cost of block space. Alongside these developments, the network’s hashrate, according to a seven-day moving average, has reached an all-time high of 480 EH/s.

Bitcoin Achieves Lifetime Record With Over 710,000 Daily Transactions Confirmed on Sunday https://t.co/DjQhwPfSi9 via @BTCTN

— John Williams M.Ed. (@islandmotivates) November 21, 2023

While these factors have contributed to an increase in the cost of transactions, they have also positively influenced Bitcoin’s market value. The heightened transaction volume and the network’s strong performance are key indicators of robust investor confidence and an overall positive sentiment in the Bitcoin market.

Wall Street Forecasts $100 Billion Future for Bitcoin Spot ETF

The emergence of Bitcoin exchange-traded funds (ETFs) is capturing the attention of both institutional and individual investors, with Wall Street predicting a transformative impact on the cryptocurrency market. Bloomberg Intelligence projects that major financial players such as BlackRock, Fidelity, and Invesco could propel the market into a $100 billion domain.

📈 #Bloomberg Intelligence reports suggest a bright future for #Bitcoin spot #ETFs, as heavyweights like BlackRock, Fidelity, and Invesco join the fray. Could we see a $100B market emerge? Time will tell. #BitcoinETF #CryptoGrowth 🚀💰👀 $SAI pic.twitter.com/xcXVT17bvh

— SAI.TECH (@SAI2TECH) November 21, 2023

The US Securities and Exchange Commission (SEC) is expected to approve Bitcoin ETFs by mid-January, a significant shift after a decade of rejections. This anticipation has fueled a 30% surge in Bitcoin’s price over the past month, reaching yearly highs and igniting a new wave of excitement. The latest CoinShares report indicates a sustained interest in digital assets, with inflows of $176 million last week and a total of $1.32 billion this year.

Currently, with Bitcoin priced at $37,444, the rising institutional demand and positive market sentiment appear to be bolstering the asset’s value.

Bitcoin Price Prediction

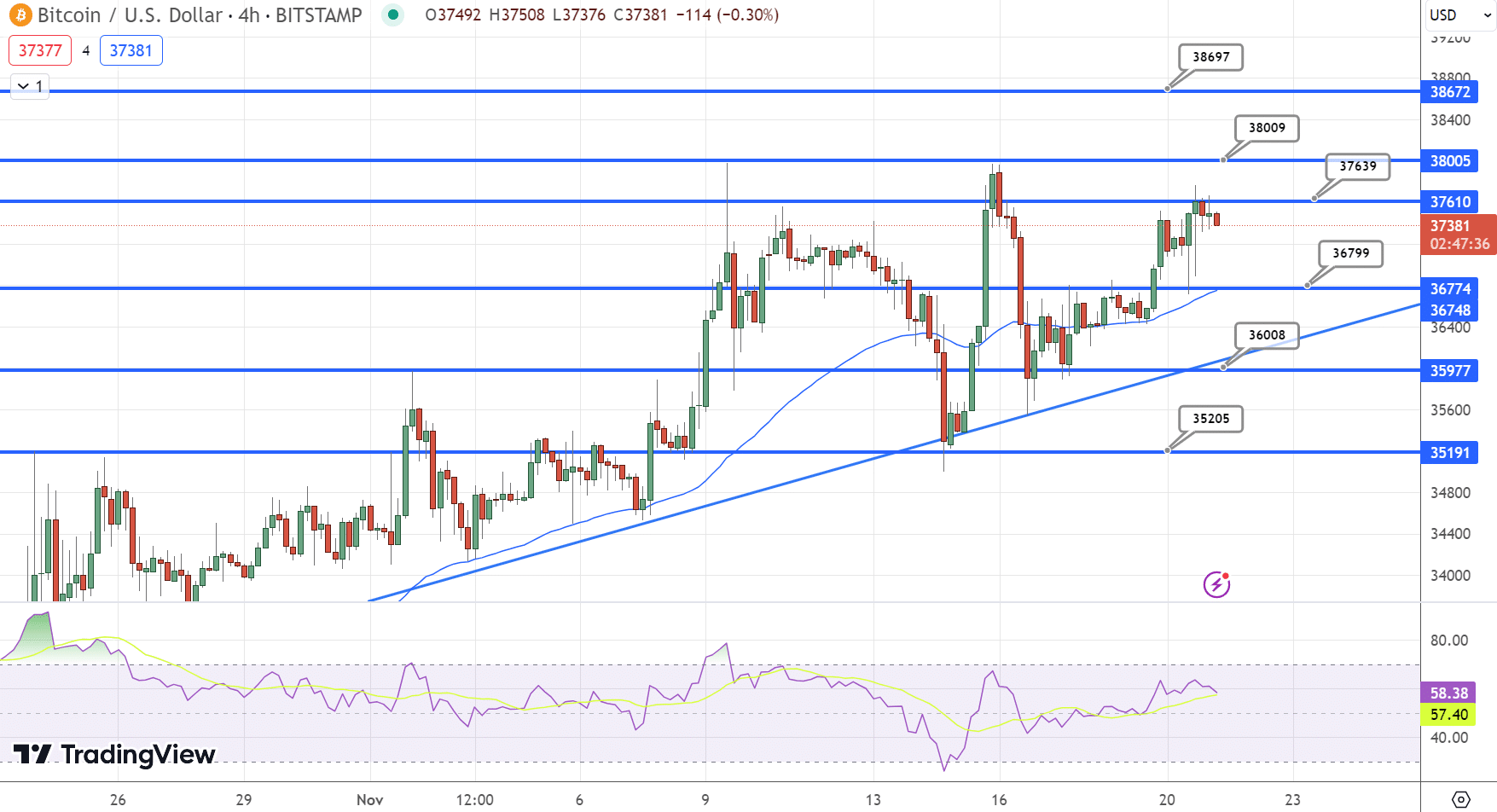

Chart patterns denote an upward channel formation, with Bitcoin recently breaking out of this pattern. This breakout could suggest the beginning of a new bullish phase, provided Bitcoin can leverage this momentum to challenge and surpass the immediate resistance levels ahead.

The overarching trend is cautiously optimistic, as Bitcoin appears to gear up for a potential retest of the $38,000 territory. Investors and traders alike are eyeing the $38,697 level, a breach of which would undoubtedly signal a strong bullish drive. Nonetheless, the market is known for its volatility, and as Bitcoin navigates through the confluence of these technical indicators, a discerning eye on upcoming market developments remains critical.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.