Bitcoin Price Prediction as BTC Dips 4% – More Sell-Off Ahead?

In the world of cryptocurrencies, Bitcoin’s unpredictable price movements are always under the microscope.

Today, with Bitcoin’s price hovering at $26,164 and a 24-hour trading volume reaching a staggering $18 billion, the cryptocurrency has seen a dip of nearly 4% in the last day.

Despite the recent setback, Bitcoin continues to reign supreme with its #1 spot on CoinMarketCap, boasting a live market cap of $509 billion.

With its current circulating supply nearing its max at 19,472,618 BTC coins out of a potential 21,000,000, it’s imperative to consider the broader financial landscape.

US Jobless Claims In Highlights

In related economic news, the US Department of Labor (DOL) released encouraging data on Thursday.

Initial Jobless Claims for the week ending August 26 stood at 228,000, marking the lowest in a month and undercutting last week’s figure of 232,000.

This positive development surpassed market expectations, which were pegged at 235,000.

⚠️BREAKING:

— Investing.com (@Investingcom) August 31, 2023

*U.S. JOBLESS CLAIMS RISE 228,000; EST. 235,000; PREV. 232,000

🇺🇲🇺🇸 pic.twitter.com/NSkP8DnQTp

The report further highlighted that the 4-week moving average escalated marginally, shifting from the revised 237,250 to 237,500.

As Bitcoin shows signs of revival, these economic indicators might significantly influence its trajectory.

Bitcoin Price Prediction

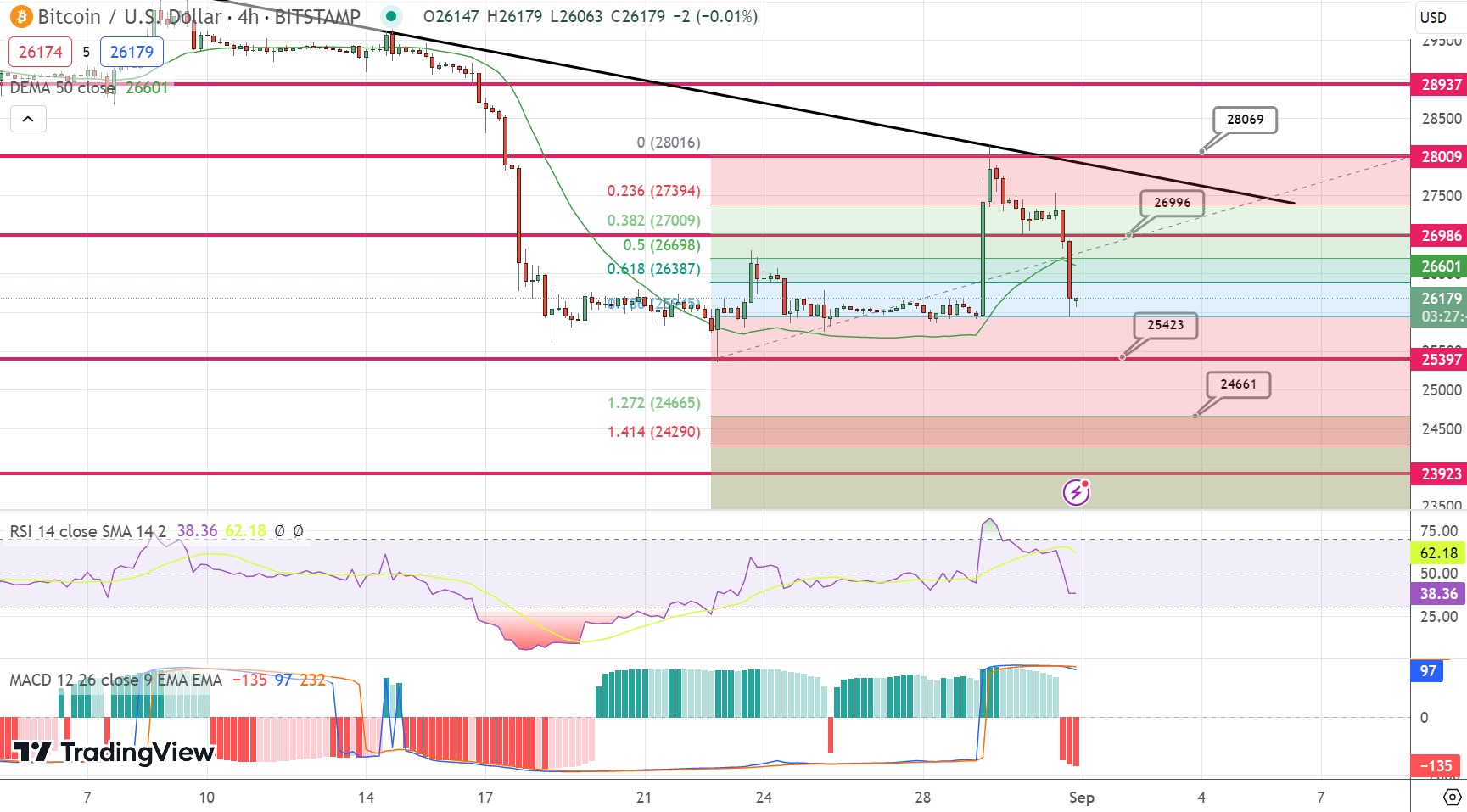

Examining the technicals of Bitcoin, there has been a pronounced bearish movement recently. Bitcoin sharply declined, dropping from the 27,300 level to a low of 25,900.

Observing the four-hour timeframe, Bitcoin has already achieved a 61.8% Fibonacci retracement at the 26,335 mark. Nonetheless, the downward momentum does not show signs of halting.

It has breached the 61.8% retracement and appears to be navigating towards the next significant support level at 25,900, which aligns with the 78.6% retracement.

Evaluating oscillatory indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), both signal bearish sentiment as they linger within the sell zone.

This suggests a continuation of the prevailing bearish trend. It is crucial to monitor the 25,900 level closely.

Any inability to break below this threshold may catalyze a bullish reversal, potentially driving Bitcoin’s price towards resistance levels at 26,700 and, beyond that, 27,400.

Above this range, the 28,000 mark could serve as a formidable resistance.

Conversely, if Bitcoin succeeds in breaching the 25,900 level, subsequent support is anticipated around 25,400, with a deeper descent possibly reaching 24,800.

In conclusion, the 25,900 level is a critical pivot for Bitcoin’s trajectory today.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

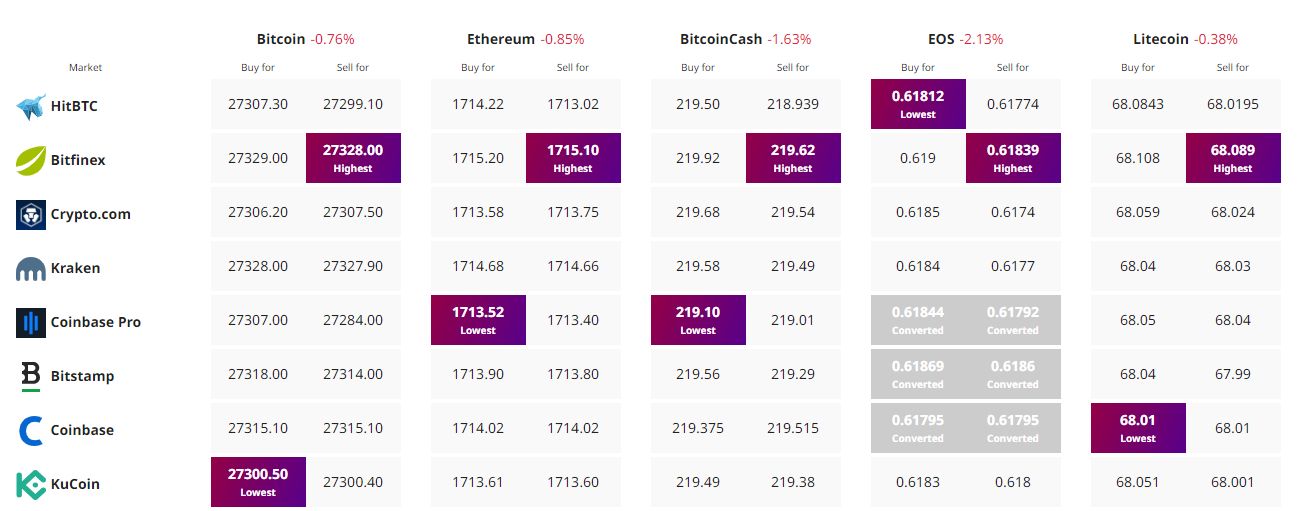

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.