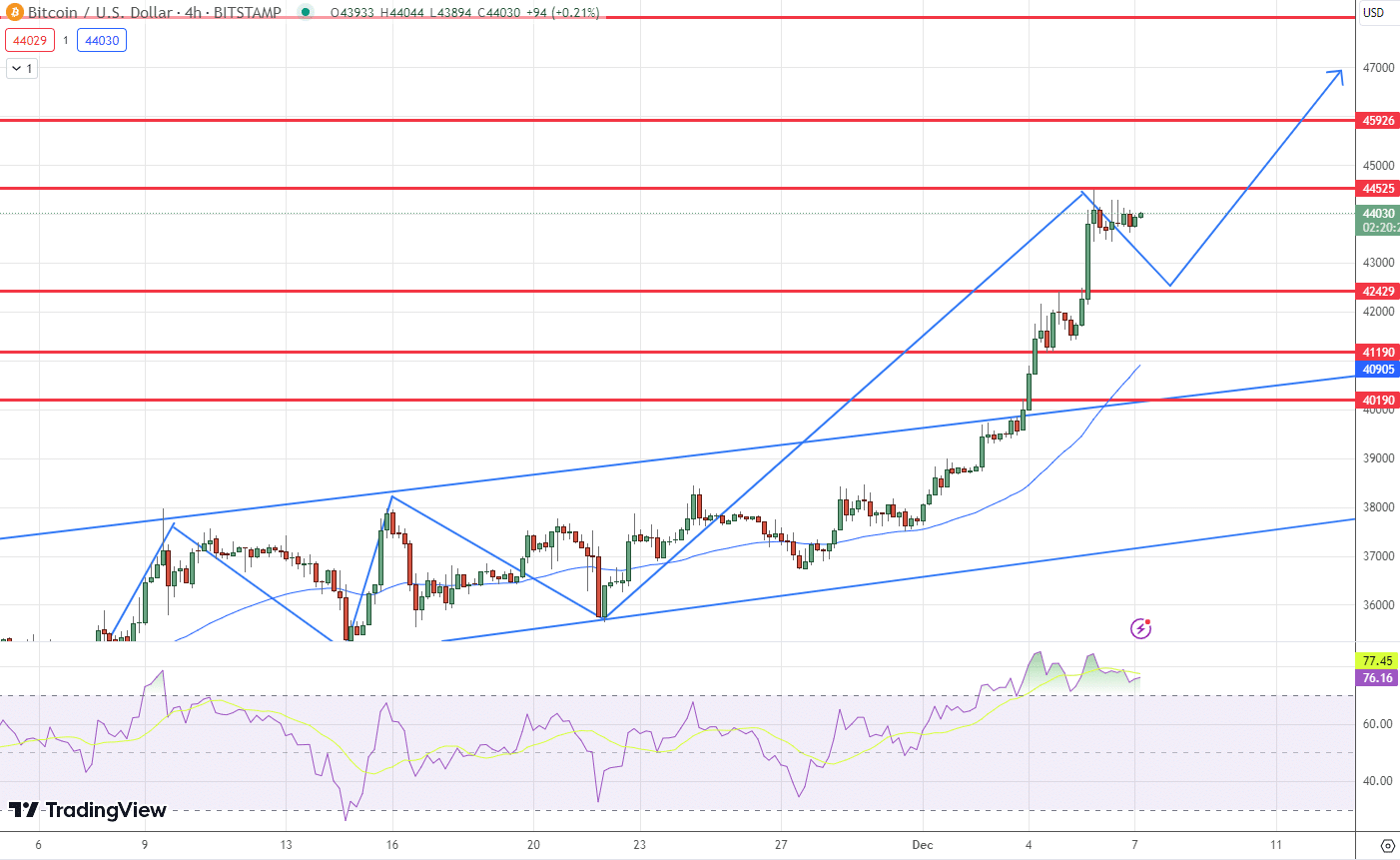

In the ever-evolving landscape of cryptocurrency, Bitcoin continues to capture the attention of investors and market analysts alike. Currently trading at $44,002, marking a modest increase of 0.15% on Thursday, Bitcoin stands at the forefront of significant developments in the digital currency domain.

The anticipation surrounding a new core release for Bitcoin (BTC) further fuels investor interest. Additionally, the fervor around Bitcoin price halving and the potential approval of Bitcoin ETFs, as discussed at NBX Berlin, suggests a bullish trajectory for the cryptocurrency through 2024.

Adding to this intrigue is Blackrock’s recent update on its Spot Bitcoin ETF filing, which delves into the possible SEC classification of Bitcoin as a security. These developments collectively paint a dynamic picture of Bitcoin’s future, encapsulating both technological advancements and regulatory landscapes.

Exploring Bitcoin’s New Core Release: Impact and Expectations

The most popular cryptocurrency, Bitcoin, has recently released its latest core version, v26.0, now available on the official Bitcoin Core website. This represents a significant milestone for the digital currency. The release notes highlight various enhancements, including bug fixes, performance improvements, and the introduction of new features.

Key modifications include nodes actively seeking outgoing connections to bolster defense against eclipse and partition attacks, and the experimental support for the v2 transport protocol (BIP324). Additionally, users can now submit raw hex transactions directly to the mempool using the new RPC “submitpackage.” The option to create legacy wallets, however, has been removed.

In a move reflecting broader acceptance, the Swiss city of Lugano, aligning with other Swiss government agencies, has begun accepting Bitcoin and Tether for payments related to taxes, fines, and municipal invoices. This development in Lugano, demonstrating an increased adoption of Bitcoin, might be contributing to the cryptocurrency’s current upward price trend.

NBX Berlin: Bitcoin Halving and ETFs Driving Price Surge

The Next Block Expo conference, held in Berlin, provided insights into the factors driving the growing interest in Bitcoin and their effects on wider markets. Industry leaders discussed crucial topics such as potential spot Bitcoin exchange-traded fund (ETF) licenses, the upcoming Bitcoin mining incentive halving, and key regulatory moves as Bitcoin broke $42,000 for the first time in over a year.

Market behavior is psychologically influenced by the four-year Bitcoin halving cycle, which Miko Matsumura of gumi Cryptos Capital likened to a medieval battering ram. One of the main drivers behind Bitcoin’s recent surge is the potential approval of Bitcoin ETFs in the United States, expected to attract $10–$12 billion in investments.

Jonas Jünger, regional manager at Binance, emphasized the importance of such events for exchange operations. However, João Leite of Polkastarter advised caution amidst market frenzy. The sector overall views the recent $4.3 billion deal with Binance positively. These developments have significantly impacted Bitcoin’s current price rise, indicative of both dynamic market conditions and increasing investor confidence.

BlackRock, the world’s largest asset manager, has expressed concerns in its recent registration update for a spot Bitcoin exchange-traded fund (ETF). The update addresses the potential risk of the U.S. Securities and Exchange Commission (SEC) or other regulatory bodies classifying Bitcoin as a security. BlackRock warns that such a designation could negatively impact Bitcoin’s trading value and complicate its trading, clearing, and maintenance in the United States.

The asset manager cites the SEC’s lawsuit against Ripple and the resulting decline in XRP’s market capitalization as a precedent. Joe Carlasare, a commercial litigator, noted the unexpected inclusion in BlackRock’s filing and suggested that the SEC might have requested this information. Amidst the market’s ongoing volatility and regulatory uncertainties, this development could significantly influence Bitcoin’s current pricing.