Bitcoin Price Breaks $27,000 After Spiking 3% – 3 Reasons We Might Have a Bullish October

Bitcoin (BTC) has bounced-back +3.96% following reclamation of 20DMA support, and with price action turning bullish – here are 3 reasons why Bitcoin will see a strong performance in October.

This comes amid increased anticipation in Bitcoin markets, as the Securities and Exchange Commission (SEC) are facing mounting pressure to approve a BTC spot ETF – a move which many believe could catalyze the next bull run pre-halving.

Yet, the SEC seem intent on kicking the decision off into the long grass – with the regulator announcing in separate September 28 filings further delays for the spot Bitcoin ETF applications of Invesco, Bitwise and Valkyrie.

Prominent figures in the crypto community such as Daan de Rover have highlighted that fundamental headwinds are pushing towards approval for a BTC spot ETF before January 10.

Bitcoin Price Prediction and 3 Reasons October Will Be Bullish for BTC

As price action battles to consolidate here – fighting for $27,000, Bitcoin is currently low in its channel, with BTC trading at a market price of $27,020 (representing a 24-hour change pf -0.01%).

This comes following yesterday’s spike in price, which saw BTC bounce off freshly-won support from the 20DMA at $26,406 to rise +3.69% to current levels.

And this morning has seen a well-defended open by Bitcoin bulls, with significant buy pressure underpinning the move to consolidate – preventing any localized retracement.

Reason 1: Bitcoin is Seeing Technical Structure Strengthen Alongside MACD

Bitcoin is consequently seeing technical structure strengthen on the short-time frame (STF) with price action now poised for a test of resistance from the 200DMA – which has converged with the $28,000 price level.

A push above the 200DMA is critical here – the ascendant moving average has acted to suppress upside moves for 43-days since August 17.

Meanwhile, Bitcoin’s indicators provide some cause for concern, with the RSI signalling bearish divergence at 56.84 (over-bought) – following the sudden spike.

Yet, the MACD embodies bulls on parade – with a jaw-dropping 73.39 reading – signifying serious momentum behind price action.

Reason 2: On-Chain Inflows Could Signal Upcoming Dip on STF; Key Marker Before Next Bullrun

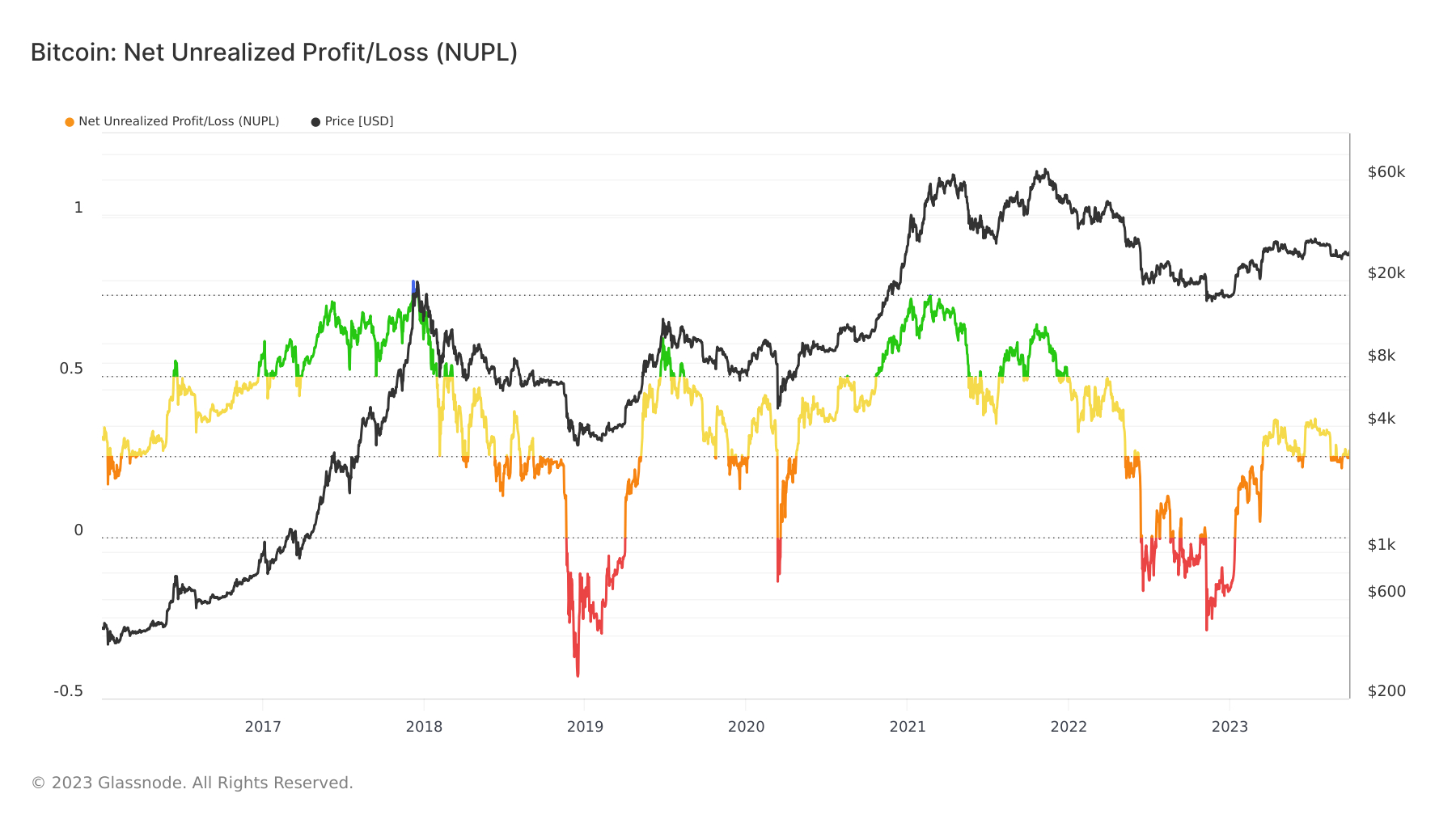

Looking On-Chain, Net Unrealized Profit Loss (NUPL) showcases the importance of the $27,000 level – which currently acts to demarcate the boundary between market optimism (above $27,000) and fear (below $27,000).

Historic data on the NUPL suggests Bitcoin is likely to hold this range until the next halving event, with the potential for a -30% move down to $18,000-20,000 representing the worse case scenario (similar to March 2020).

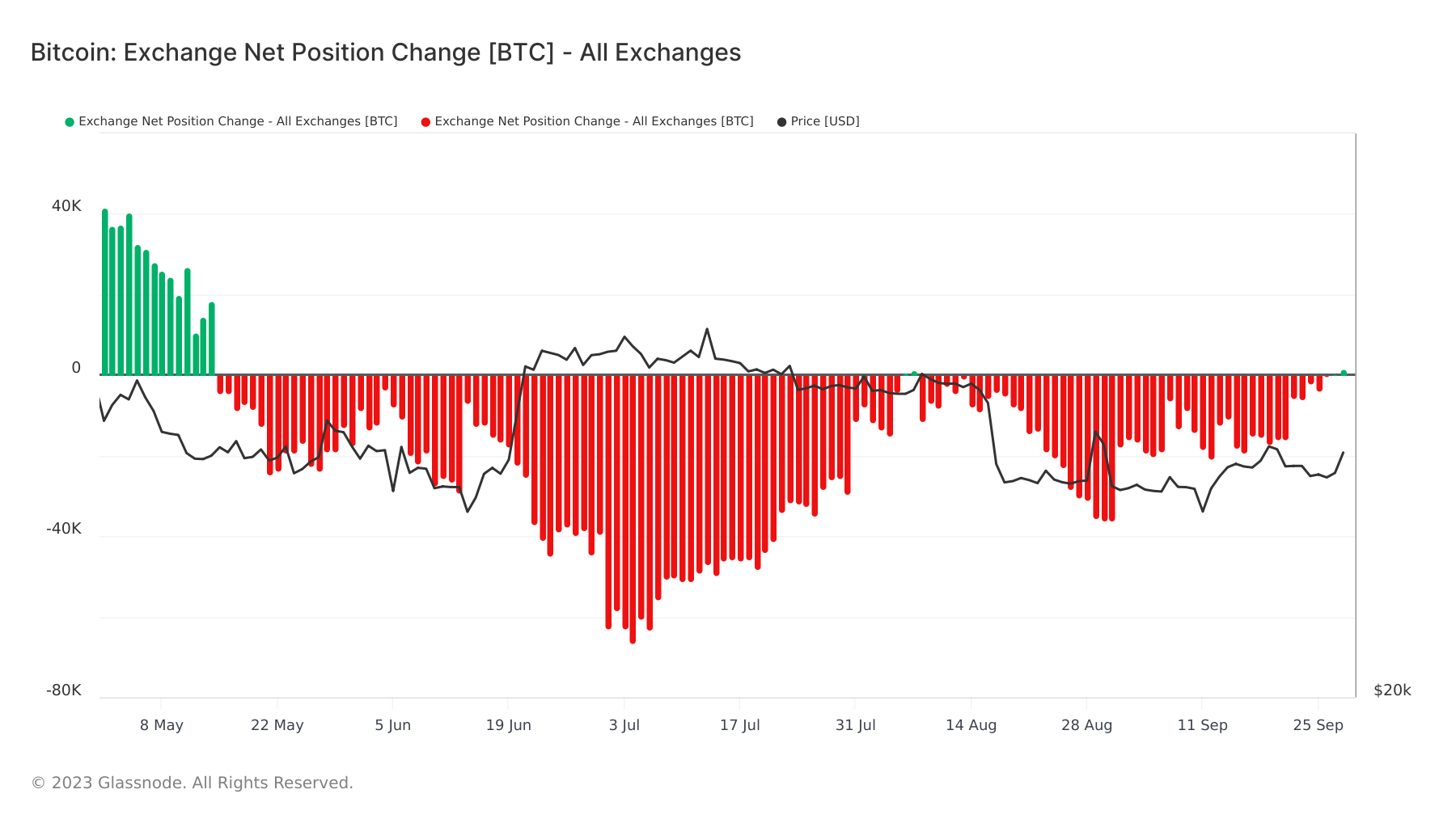

While in a significant move, Exchange Net Position Change has seen a reversal to net inflow in the past 24-hours – this comes amid a multi-month accumulation trend that has failed to crack $30,000 properly.

This reversal could be important on the short-time frame, last time this happened on August 7, price saw a -14.4% fall just a week later – amid weak outflows (accumulation).

With many short-term holders seemingly underwater, on-chain data paints a somewhat worrying view on the STF – however, a dip here could prove healthy for Bitcoin in months to come – setting the stage for attractive institutional entries into theorized BTC spot ETF before January 10.

Reason 3: Growth In Bitcoin Derivative Tokens Suggests Huge Consumer Appetite for Bitcoin

Finally, a new force is acting to induce high levels of interest in the leading cryptocurrency: Bitcoin Derivatives.

The past two-months have seen on-chain frenzy around Bitcoin-linked tokens such as BITCOIN, BITCOIN 2,and BTC20.

For example, in the instance of the BITCOIN2 token (ERC-20), multi-million trading volume saw price action surge an unimaginable +25,000%.

While the BTC20 presale gained sensational traction, which saw the unlikely project skyrocket to a whopping +$5m raised.

Bitcoin Price Prediction: What Will BTC Do on the Short-Time Frame?

Overall, with improved technical structure trading against poor on-chain sentiment – everything is to play for – yet, with rising interest in Bitcoin derivatives and significant buy-pressure underpinning a well-defended consolidation at $27,000 on the short-time frame BTC seems set to push up.

To the upside, Bitcoin is targeting a re-test of the 200DMA at $28,000 (a possible +3.55% move).

While, downside risk could see Bitcoin return to the 20DMA at $26,486 (a possible -2.04% tumble).

Overall, risk: reward is 1.74 – a good entry, characterised by more upside reward than risk.

Yet, while Bitcoiners are fighting for small percentile gains, traders seeking big profits are continuing to rotate capital into Bitcoin derivatives tokens – which offer superior short-term returns (but higher risks).

Reaping the Rewards of a Mining: Bitcoin Minetrix’s Presale Hits $197k Raised

Bitcoin mining, long seen as a domain dominated by colossal corporations with their deep pockets and access to state-of-the-art equipment, is undergoing a transformation.

Bitcoin Minetrix aims to ensure this lucrative venture is not just confined to the elites but is accessible to everyone.

How? By rewriting the rules of mining through its innovative Stake-to-Mine model.

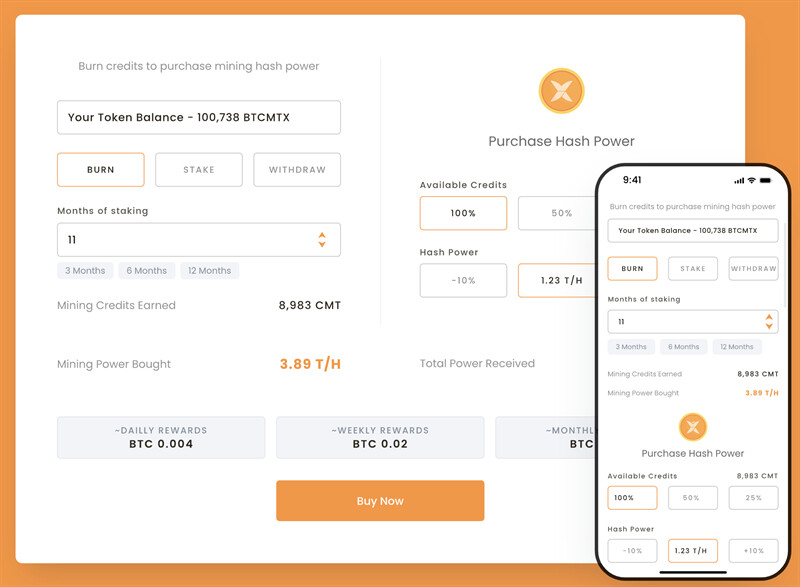

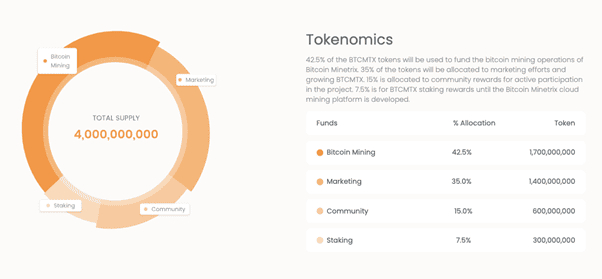

In a move aimed at side-lining energy-guzzling equipment, Bitcoin Minetrix provides an avenue where BTCMTX token holders can stake their tokens to receive mining credits.

These credits unlock the door to efficient Bitcoin cloud mining, making the process sustainable, secure, and, importantly, within everyone’s reach.

Here’s Why BTCMTX is Set to Explode Upon Launch

Initiating their ICO with a starting price tag of just $0.011 for the BTCMTX token, Bitcoin Minetrix isn’t asking for a fortune but an opportunity.

An opportunity for investors to be a part of a transformation that could very well redefine the Bitcoin mining landscape.

And if the initial figures are anything to go by—with the project raising $115,000 within a day of the ICO announcement—investors are eager to hop on board this mining juggernaut.

What’s even more compelling is that this is not just an investment in a token but in a future-proof concept; a concept that merges the best of both worlds: staking and mining.

The results? Large APYs and rewards in the form of BTC, all without the traditional barriers of hefty investments and technical know-how.

How Does BTCMTX Ensure Security and Transparency?

The crypto world, unfortunately, has had its fair share of scams, especially in the cloud mining sector and this is where Bitcoin Minetrix departs from the norm.

Not only does it provide a transparent mechanism of mining but it also empowers its investors. How? By ensuring they have constant control over their staked tokens and the flexibility to un-stake whenever they deem fit.

No hidden clauses, no fine print, just straightforward staking and mining.

Furthermore, for those concerned about the safety of their investment, the BTCMTX smart contract underwent meticulous auditing by Coinsult, a respected blockchain security entity.

The verdict? Clean as a whistle.

Bitcoin Minetrix stands tall, not merely because of its unique proposition but its commitment to making Bitcoin mining a universal venture.

With just a minimum investment of $10, it’s demolishing the barriers to entry, proving that you don’t need millions to be part of the mining elite.

For those seeking to ride the next wave of crypto innovation, the Bitcoin Minetrix presale is an avenue worth exploring.

In a world where Bitcoin’s derivatives are gaining traction, this is a project that not only promises returns but also champions the democratization of Bitcoin mining – a true game-changer in every sense of the word.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.