Nexo Review in 2024 - Pros & Cons

What if a crypto exchange could provide many of the financial services we’re accustomed to from banks? That’s Nexo, a European-based crypto exchange that offers trading as well as lending and borrowing and even an innovative Mastercard that works as a credit or debit card.

In our Nexo review, we’ll explore the pros and cons of Nexo as well as the exchange’s features that set it apart from other platforms.

Our Take on Nexo

By some measures, Nexo might be better described as a crypto lending platform than an exchange, but the addition of the Nexo Pro advanced trading platform makes Nexo competitive with well-known exchanges like Coinbase for crypto trading. Where the platform falls short is in its comparatively small selection of 65 cryptocurrencies. By contrast, Coinbase offers more than 250 tradable cryptos.

Nexo remains a popular choice for traders who want to earn a yield on their crypto holdings and fans of the Nexo card, which can act as a rewards credit card or as a crypto debit card.

- Nexo’s user-friendly interface allows newer users to navigate the platform with ease.

- Daily interest paid on crypto holdings offers a way to build your portfolio without trading.

- The Nexo card provides a first-ever switchable crypto card that can act as a credit or debit card.

- Free deposits and withdrawals keep trading costs lower.

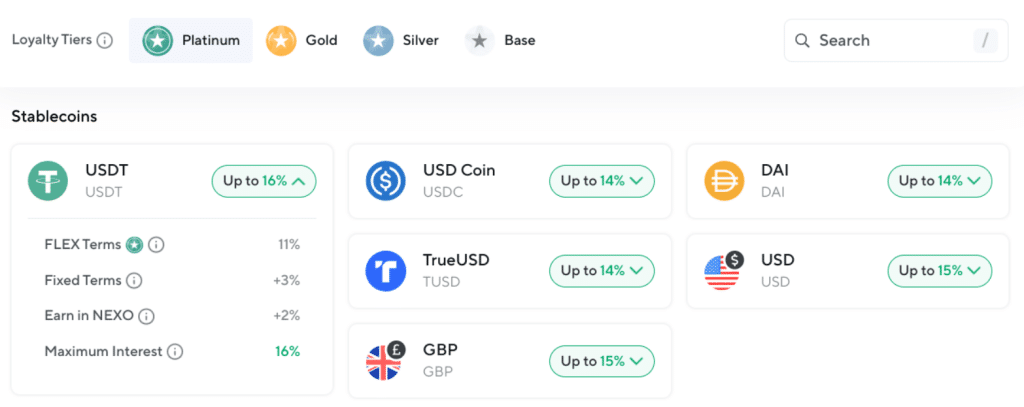

- Nexo offers outstanding interest rates (up to 16%) for stablecoin lending.

- Nexo’s rewards, loyalty levels, and interest rates can be difficult to follow.

- No No-fee trades can be expensive due to larger spreads on some assets.

- Many platform perks revolve around the NEXO token, the value of which can be volatile.

- Not available in the US or UK.

Nexo’s Strengths

Considering the popularity of cryptocurrencies in 2024 there are thousands of crypto exchanges fighting to become household names. In this section we’ll examine the features that set Nexo apart from the competition.

Easy-to-use platform:

New and experienced users should feel at home on Nexo. The platform is well-designed and intuitive to use. Nexo Pro offers a low-cost trading solution for advanced traders, which brings an uncluttered interface and clear charts with over 100 available indicators.

Nexo card: The Nexo card offers the best combination of benefits compared to other crypto cards from providers like Coinbase, Crypto.com, and Gemini. Other cards work as credit or debit cards, with no possibility of switching modes. Nexo provides a two-in-one solution that lets you easily switch between credit and debit modes. Credit mode uses your crypto as collateral to borrow while earning up to 2% cashback. Debit mode lets you spend BTC and other crypto assets like cash, automatically converting your crypto to cash as needed. In debit mode, you also earn up to 14% interest, paid in crypto.

Crypto lending: While the Nexo card offers an easy way to access the value of your crypto, Nexo also offers crypto loans funded with cryptocurrency you can deploy on other protocols or on Nexo itself. Borrowers can repay according to their own schedule with instant approval. Lenders can earn up to 16%, with interest paid daily.

Who is Nexo Best For?

Is Nexo ideal for HODLers or short-term traders? Let’s explore who Nexo caters to:

- People who want to hold their crypto. Rather than needing to sell your crypto to raise capital, Nexo lets you borrow against your crypto. Use your funds for any purpose.

- People who want to earn a yield. Crypto yields for lending reach 14% or boost your yields by choosing interest paid in NEXO tokens. Stablecoins pegged to a fiat currency earn the highest yields, so you don’t have to risk volatility to earn a return.

- Traders outside the US and UK. Nexo is withdrawing from specific markets due to regulatory concerns.

Nexo at a Glance

Here’s a convenient table covering the key metrics users should keep in mind when researching Nexo in 2024.

| Category | Our Rating (out of 5) | Comment |

| Number of coins: 65 |

3.9/5 | Nexo offers top cryptocurrencies, including BTC, ETH, SOL, and XRP. However, competitors like Coinbase offer a wider selection. |

| Trading Fees: Basic trades – spread only Nexo Pro – 0.40% taker fee, 0.30% maker fee |

4.3/5 | Basic trades use a spread, which can sometimes add up to 2% to trading costs. Advanced trading fees, however, are lower than those of Coinbase. |

| User experience: | 4.5/5 | Nexo’s user-friendly interface makes navigation easy. |

| Staking: ETH only |

3.9/5 | Stake ETH with as little as $1 using Nexo’s NETH token. |

| Features: Lending & borrowing, rewards credit card/crypto debit card |

4.4/5 | Nexo excels in its crypto-as-money features, including lending and borrowing and a rewards card. |

| Trustworthiness: | 3.8/5 | We were unable to find current proof of reserves. |

| Customer service: | 4.0/5 | Support options include live chat and an email ticket system. |

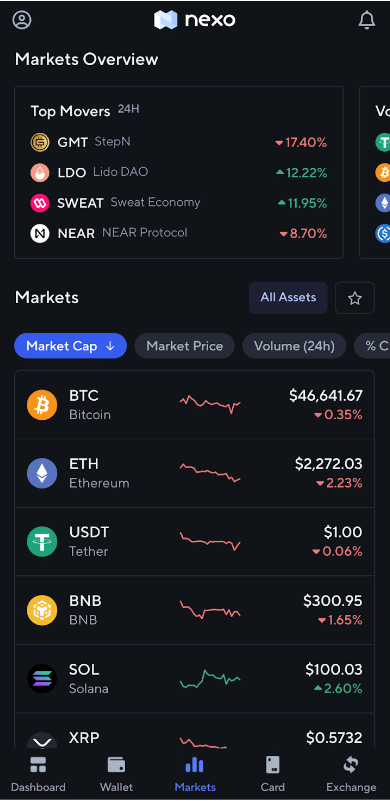

Cryptocurrencies Available for Trading on Nexo

Nexo’s selection of 65 cryptocurrencies lags behind competitors like Kraken, with about 240 cryptocurrencies, and Coinbase, with over 250 cryptocurrencies. However, the platform supports the most popular cryptocurrencies and a number of perhaps surprising altcoins.

Top Cryptocurrencies on Nexo by Trading Volume

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- BNB (BNB)

- Ripple (XRP)

- Avalanche (AVAX)

- Arbitrum (ARB)

- Cardano (ADA)

- Dogecoin (DOGE)

- Polygon (MATIC)

Although the selection on Nexo is smaller than other platforms, the exchange still offers several in-demand altcoins.

Altcoin Selection on Nexo

- Chainlink (LINK)

- Uniswap (UNI)

- THORChain (RUNE)

- Maker (MKR)

- Aave (AAVE)

- Hedera (HBAR)

- Synthetic (SNX)

- Osmosis (OSMO)

- Bonk (BONK)

Trading Fees on Nexo

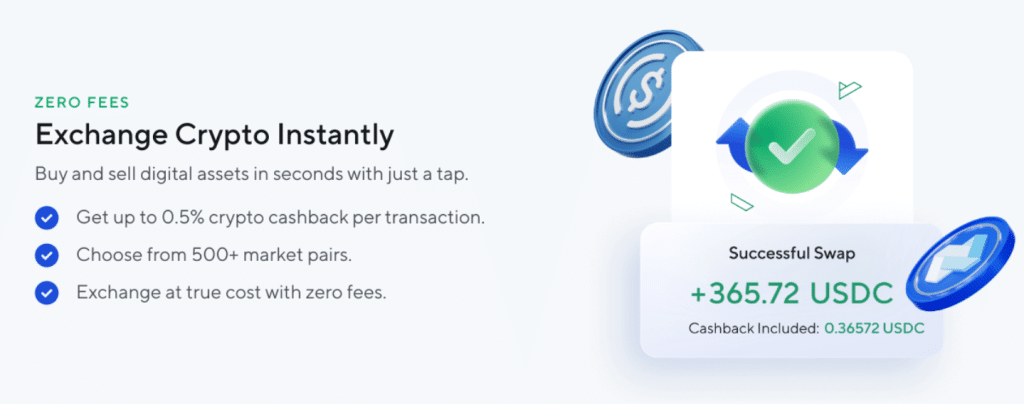

Nexo offers two trading platforms, each with its own fee structure. Basic “swaps” come with no fees and include a cashback bonus of up to 0.5%. However, Nexo also uses a variable spread, which adds to the cost of swaps.

Swaps support trigger prices, so you can continue earning while waiting for a price you choose. You can also stack multiple swap orders to average out of a position or dollar-cost average when buying.

What Is Dollar-Cost Averaging in Crypto?

Identifying market lows for buying and highs for selling can be tricky business. Dollar-cost averaging offers an easy way to optimize your trades without needing to be a trading guru.

- Buying: When buying, dollar cost averaging works by buying a fixed dollar amount at a fixed interval, such as buying $100 worth of bitcoin on the first of every month.

- Selling: Some investors also use reverse dollar-cost averaging to exit a position, selling a fixed amount at a fixed interval to avoid the perils of timing the market incorrectly.

Nexo Pro, Nexo’s advanced trading platform, does not add a spread to trades. Nexo’s fee structure positions the exchange lower than Coinbase but higher than Kraken and Binance at base tiers. For example, Coinbase Advanced charges 0.6% maker fees and 0.8% taker fees at the base volume tier. By comparison, Nexo Pro charges just 0.3% and 0.4% maker and taker fees, respectively.

Maker Fees vs. Taker Fees

Many advanced trading platforms like Nexo Pro base trading fees on a maker/taker model.

- Maker orders “make” a market by providing liquidity in the form of fixed-price (limit) orders. Without limit orders, we’d have nothing to trade against. Imagine a training world with no prices.

- Taker orders “take” liquidity off the market by buying or selling against existing orders. These are often called market orders because you’re trading at market prices.

Trading fees on the Pro platform vary by 30-day trading volume.

Nexo Pro Trading Fees

| Volume Tier | Taker Fee | Maker Fee |

| Up to $10,000 | 0.40% | 0.30% |

| $10,000 to $50,000 | 0.34% | 0.20% |

| $50,000 to $100,000 | 0.30% | 0.15% |

| $100,000 to $1 million | 0.20% | 0.10% |

| $1 million to $10 million | 0.18% | 0.08% |

| $10 million to $100 million | 0.15% | 0.05% |

| $100 million to $200 million | 0.10% | 0.02% |

| $200 million to $500 million | 0.08% | 0.00% |

| $500 million+ | 0.06% | 0.00% |

Nexo Futures Trading Fees

Trading fees for perpetual trades are fixed at 0.06% for opening or closing a position.

Similar to other perpetual futures platforms, Nexo uses a variable funding fee, which helps the contract price track market prices. Funding fees can add to the cost of trades or may reduce overall trading costs.

Nexo Review: The Nexo Trading Experience

Few crypto platforms offer an interface as clean as you’ll find on Nexo. It’s as beginner-friendly as it gets.

Simple swaps, in which you exchange one crypto for another, work as smooth as butter. In a few clicks, you’ve rebalanced your portfolio. And swaps support triggers, a way to buy or sell at a price you set – and you can set multiple triggers, easing in or out of a position. That convenience comes with a cost, however: spreads.

Generally, a spread refers to the difference between the highest-priced selling order and the lowest-priced buying order in an order book. But it can also refer to a markup that allows an exchange to lock in a price on volatile assets. The latter is what Nexo uses for its no-fee swaps, and it can be costly in some cases. Some users report spreads of up to 2% or higher. Spreads vary based on market conditions, so check the numbers before confirming a trade to be sure the swap makes sense for you.

Boosters

Swaps also support “boosters,” which refers to borrowing against your crypto to trade larger amounts. This process can be completed manually using Nexo’s Instant Crypto Credit Lines, followed by a swap. But the booster option on the convert tab simplifies the process and lets you use up to 3x leverage with just a few clicks.

We’ll cover Instant Credit Lines in just a bit. Loan balances accrue interest but don’t have a fixed payment schedule.

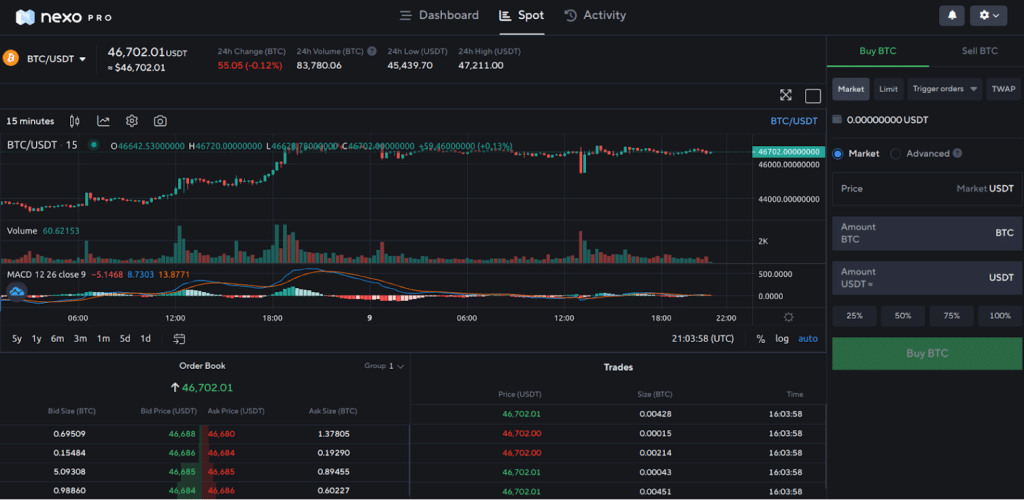

Nexo Pro

To avoid the spread fees discussed earlier, you can instead use Nexo Pro, an advanced trading platform that’s easier to use than many competing platforms.

Nexo Pro starts out simple but offers more functionality with a few clicks. Notably, the advanced trading platform provides charts with over 100 indicators. Add MACD (moving average convergence/divergence), shown above, or any of 100+ other indicators instantly.

Advanced trading platforms can be notoriously tricky to use. Nexo bucks the trend, making Nexo Pro simple enough that newer traders can trade successfully. As a caveat, Nexo Pro doesn’t offer many of the features available on other platforms, such as automated trading bots or options trading. Less clutter translates to fewer trading tools.

Nexo Futures (Nexo Pro)

Perpetual futures let you bet on the future price of BTC and other cryptocurrencies without buying the crypto asset. Instead, you buy a contract that bases your profit or loss on the difference between the price when you open the contract and the price when you close your position.

Choose to go long (a bet the price will increase) or short (a bet the price will decrease) and amplify your earnings with leverage of up to 50x on 70+ crypto assets. Leverage trades use your crypto as collateral, with the highest leverage available for USDT collateral, which has the least volatility.

Due to the higher risk associated with leveraged perpetual futures, Nexo requires users to pass a quiz before they become eligible to trade futures. Availability also varies by region, with US and UK users restricted.

Nexo Web3 Wallet

Recently, Nexo added a Web3 wallet as a way to interact with decentralized applications to swap cryptocurrencies and earn yields. The wallet supports external wallets, like MetaMask or Coinbase Wallet, but can be used as a standalone app as well. Thus far, Nexo’s wallet is not supported on its mobile app, however.

What Is Web3?

Web3 refers to the crypto ecosystems that use your wallet address as your identity. In web 2.0, we use usernames and passwords. Web3 aims to return ownership of your identity to users, allowing you to transact or interact with relative privacy compared to web 2.0.

Currently, the Nexo Wallet supports five networks.

- Ethereum

- Polygon

- Avalanche

- BNB Smart Chain

- Fantom

Notably, Abitrum, which is the largest Ethereum Layer 2 network, is not yet supported.

Nexo Wallet offers several features that simplify web3 usage, operating much like a portal to the decentralized crypto world – but with guard rails to help users avoid deep ravines.

Nexo also adds some features not found with many other wallets.

- Batching: Execute multiple transactions at once to save on fees.

- Flexible gas payments: Crypto networks use cryptocurrencies to pay for transactions and computing power on the network. Nexo Wallet lets you use stablecoins or other supported tokens to pay for transactions.

- Optimized transactions: Nexo uses “smart transactions” to optimize and save money on transactions.

- Aggregated liquidity: Make swaps on decentralized apps without leaving your wallet. Nexo searches for the best value when making swaps, spreading your swap across multiple decentralized exchanges if needed.

- Aggregated wallets: See all your wallet balances and NFTs in one place (supported networks only).

Although a decentralized wallet, users from specific regions, including the US, cannot use the Nexo Wallet app.

Nexo labels its wallet as “beta,” suggesting that more features are on the way, including a “DeFi card,” about which no details have yet been provided. Our curiosity is piqued.

Nexo’s Mobile App

Like its desktop counterpart, the Nexo mobile app is well-designed, smooth-running, and easy to use.

Expect a scaled-down experience, however. Nexo Pro (including futures trading) was conspicuously absent from the mobile app, as was the Nexo Web3 Wallet.

Supported features center on swaps through Nexo Exchange, lending and borrowing, and the Nexo Card, which we’ll cover in more detail shortly. Swaps were not available in certain regions.

Nexo’s mobile app serves as a simple way to manage lending and borrowing on the go, with the ability to perform simple swaps from anywhere.

Nexo Loyalty Levels

Many of Nexo’s perks vary depending on your “loyalty level,” ranging from Base to Platinum. Loyalty tiers are determined by the amount of NEXO tokens held relative to the total account balance.

- Base: No NEXO tokens are needed. This level includes accounts with less than 1% of the portfolio value in NEXO tokens.

- Silver: At least 1% (up to 5%) of your total portfolio value in NEXO tokens qualifies for Silver Level.

- Gold: If your account has 5% up to 10% of its portfolio value in NEXO tokens, your account qualifies for Gold Level benefits.

- Platinum: Accounts with 10% or more of the portfolio value in NEXO tokens qualify for Platinum Level benefits, including the highest interest rates for lending and the lowest rates for borrowing.

Loyalty levels drive interest rates on Nexo, with higher tiers earning higher interest rates.

Nexo Lending Interest Rates by Loyalty Level

| Loyalty Level | USDT | BTC |

| Base | Up to 12% | Up to 4% |

| Silver | Up to 12.5% | Up to 4.5% |

| Gold | Up to 14% | Up to 5.5% |

| Platinum | Up to 16% | Up to 7% |

Minimum amounts apply, however. For example, you’ll need at least 0.001 BTC to earn interest on your BTC deposits.

- BTC minimum: 0.001 BTC

- ETH minimum: 0.01 ETH

- NETH minimum: 0.005 NETH

- NEXO minimum: 1 NEXO

- USDT minimum: 1 USDT

- USDC minimum: 1 BTC

Stablecoins like USDT have the lowest minimum deposit requirements and pay the highest interest rates in lending.

Staking Opportunities on Nexo (Smart Staking)

Nexo scaled down its staking support recently, now focusing on NETH, an Ethereum staking token that lets you earn staking rewards with as little as $1. Nexo calls it Smart Staking.

When staking ETH on Nexo, your staked ETH is converted to NETH, which earns rewards and can be used as collateral for loans.

Nexo Staked Ethereum (NETH) earns from staking rewards in addition to MEV (Maximum Extractible Value). MEV is a process in which transactions can be front-run, changing the order of transactions to earn extra yields. Nexo runs its own validators, making this possible.

The combination of mechanisms used by Nexo Smart Staking often results in higher overall yields for stakers.

Ethereum staking earns 4% to 8% annually, depending on loyalty tier.

Nexo Smart Staking earns 3.5% to 12% annually based on loyalty tier.

Nexo’s Web3 Wallet also supports several decentralized staking and yield protocols.

Nexo Lending and Borrowing

The Nexo platform remains better known as a lending and borrowing platform than as an exchange.

Lending on Nexo

Users can earn strong yields by buying or transferring assets to the platform. Increase your earnings by locking your funds for three months.

Nexo pays interest automatically. For example, if you buy or deposit USDT, you’ll earn 9% at current rates on the Base tier. Lock your funds for three months to earn an additional 3%. Higher tiers earn higher rates, boosted by a bonus yield paid in NEXO tokens.

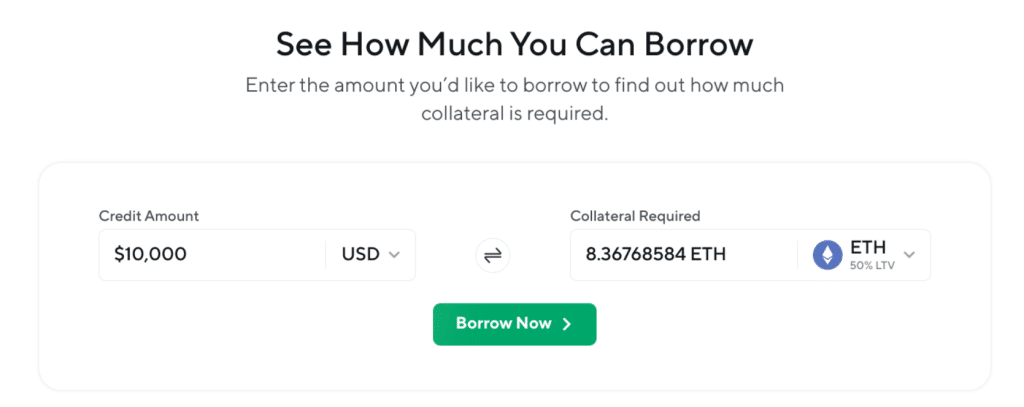

Borrowing on Nexo

Nexo also lets you borrow against your crypto. No credit checks, no paperwork, and no required monthly payments.

Because borrowing on Nexo uses your crypto as collateral, loan-to-value (LTV) drives the transaction. With a low LTV of under 20% and Platinum level, you can borrow with 0% interest. As LTV increases, interest rates increase as well.

LTVs under 20% earn the best interest rates for borrowing when combined with Platinum and Gold levels.

| Loyalty Level | LTV below 20% | LTV above 20% |

| Platinum | 0.00% interest | 7.90% interest |

| Gold | 2.90% interest | 10.90% interest |

Borrow as little as $50 using stablecoins like USDT or $500 in fiat, with a maximum of $2 million daily.

Generally, loans are instant but can take up to 1 day if Nexo needs additional information for Know Your Customer (KYC) or Anti-money laundering (AML) requirements.

Nexo Card

The innovative Nexo Card (Mastercard) is one of Nexo’s top features.

- Spend your crypto like cash in debit mode.

- Borrow against your crypto in credit mode.

Switch between the modes easily and on the go using the Nexo mobile app.

In credit card mode, your Nexo card taps into your instant lines of credit, borrowing against your crypto. Interest rates vary based on your loyalty tier, but unlike a traditional credit card, there are no fixed monthly payments.

Credit mode also earns cashback rewards paid in NEXO tokens or BTC.

| Loyalty Level | USDT | BTC |

| Base | Up to 12% | Up to 4% |

| Silver | Up to 12.5% | Up to 4.5% |

| Gold | Up to 14% | Up to 5.5% |

| Platinum | Up to 16% | Up to 7% |

In debit card mode, you can spend your crypto like cash. Conversion rates apply using Nexo’s spread, discussed earlier. Debit mode does not support cashback, but you can earn interest on the crypto you hold on the platform.

Nexo Review: Supported Payment Methods

Choose from several ways to fund your account. Available options vary by market.

- Credit cards

- Debit cards

- Apple Pay

- Google Pay

- SEPA – EUR

- Faster Payment Service (FPS) – GBP

- Wire transfer – USD

- Crypto deposits

Minimum Deposit

Expect to deposit at least $10, £10, or €10 when making a fiat deposit.

In general, Nexo does not have a minimum deposit for cryptocurrencies, with some exceptions.

- Tron (TRX): 0.09 TRX

- Bitcoin Cash (BCH): 0.0005 BCH

- Litecoin (LTC): 0.0005 LTC

- Polkadot (DOT): 1 DOT

Minimum Withdrawals

Moving your crypto to a self-custody wallet may require a minimum withdrawal on Nexo.

- Bitcoin: 0.001 BTC

- Ethereum: 0.01 ETH

- NEXO token: 1 NEXO

- Tether: 10 USDT

- US Dollar Coin: 10 USDC

- Ripple: 25 XRP

- Avalanche: 1 AVAX

- Polkadot: 1 DOT

Check Nexo’s help pages for additional minimum crypto withdrawal amounts.

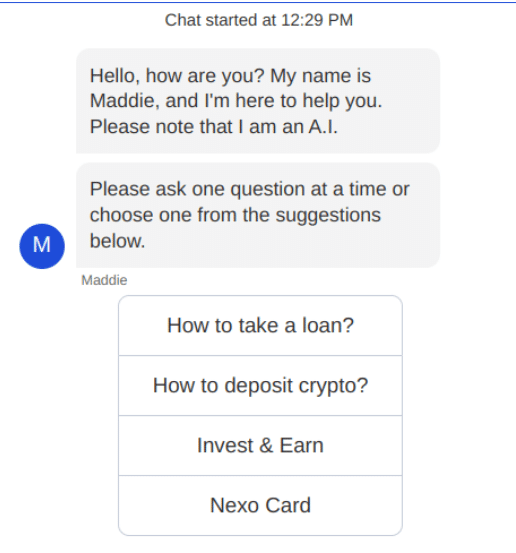

Nexo’s Customer Support

Like many crypto platforms, help comes in the form of chatbots and a ticket system. Nexo’s chat is open 24/7 and serves up AI-powered questions and answers. Just ask for an agent to get live assistance.

Nexo reviews on Trustpilot earn the platform one of the highest TrustScore rating we’ve seen for crypto trading platforms. Nexo scores a 4.7 out of 5, which is higher than eToro (4.3 out of 5) and miles ahead of exchanges like Coinbase (1.5 out of 5) and Kraken (2.0 out of 5).

Rare negative reviews of Nexo on Trustpilot receive a response from Nexo within 24 hours on Trustpilot.

Nexo’s Security and Licensing

Nexo holds several licenses and registrations with major regulators, although tightening regulations have led the exchange to pull out of markets such as the US and UK.

Nexo Registration and Licenses

- US registrations and licenses: In the US, Nexo is registered with the Financial Crimes Enforcement Network (FinCEN) and has also obtained a BitLicense through the New York Department of Financial Services. Nexo is also licensed with the California Department of Financial Protection and Innovation. However, the company is phasing out operations in the US and already blocks access to many features, depending on location.

- Outside the US: Nexo is also registered with the Australian Securities and Investment Commission (ASIC), FINTRAC in Canada, Organismo Agenti e Mediatori (OAM) in Italy, and licensed with the Financial Services Authority (Seychelles).

Proof of Reserves and Security Ratings

As a lending platform, it’s essential to demonstrate that the platform has enough assets to cover its liabilities. The 2022 collapse of several crypto platforms, including Celsius, which shared a similar lending/borrowing business model, makes transparency essential.

As far back as 2021, Nexo provided proof of reserves to show assets exceed liabilities in real-time rather than using a snapshot. However, since then, fewer auditing firms have focused on crypto. Nexo replaced its auditing firm with TrustReserve, which briefly offered a proof-of-reserves attestation for Nexo but which is now gone.

CER, a leading cybersecurity certification platform, notes Nexo as having proof of reserves. However, we were unable to find an active link. Overall, CER currently gives Nexo a “D” rating and lists Nexo as “uncertified,” which could suggest incomplete data.

CER’s methodology considers the following:

- Server security

- User security

- Penetration test

- Bug Bounty

- ISO 27001 certification

- Funds insurance

In a Reddit post from 2023, NexoJosh indicated that Nexo had discontinued the arrangement they had with their auditing partner and is pursuing alternative ways to assure the community regarding reserves.

Reserves aside, Nexo implements several security measures to harden accounts, including two-factor authentication and biometric authentication with its mobile application. The platform also supports whitelisting, a method of restricting withdrawals only to addresses you approve.

Insurance

Crypto custody partners Bakkt and Ledger Vault provide secure storage while also offering limited insurance for crypto assets.

What Could Nexo Do Better?

- Document proof of reserves. Following the collapse of well-known crypto exchanges like FTX and crypto lending platforms like Celcius, it’s imperative to show users that the exchange has the assets it says it has and that it can cover its liabilities. Nexo offered proof of reserves in the past, but we were unable to find current proof of reserves.

- Offer a less complicated tier system. Nexo’s tier system uses loyalty levels to drive interest rates, staking rewards, and more on the platform. All these moving parts center on holding a token of little real-world value elsewhere, which has fallen in price dramatically from its highs. As the price of NEXO tokens falls relative to the broad market, users are forced to buy or earn more to qualify for the top loyalty levels.

- Provide limited services in regulated markets. Nexo recently pulled out of the US and is reducing services in other key markets like the UK. Many other platforms have found ways to offer some services based on location rather than blocking users from accessing the site. Nexo swaps, its web3 wallet, and Nexo Pro parallel services offered by competing platforms without significant restriction. However, these services are unavailable in the US and may be restricted in other markets.

Our Review Methodology

Cryptonews.com is committed to unbiased reviews of products and services to help readers make better-informed buying and investing decisions. We evaluate exchanges based on a wide range of factors, performing real-world transactions where possible and comparing advertising claims against real-world results.

We review exchanges using a point system that considers usability, fees, available trading types, tradable cryptocurrencies, and additional weighting factors. In addition, we examine regulatory oversight and licenses, where applicable, as well as security measures taken by the exchange to protect users.

Conclusion

Nexo’s strengths come from its lending and borrowing platform rather than from its exchange offerings. With only 65 tradable cryptos, investment options center on top assets.

However, as a lending and borrowing platform, Nexo excels. With the ability to earn up to 16% yields in just a few clicks, Nexo becomes an attractive option for investors who want to put their crypto to work. Borrowing rates as low as 0% make Nexo a viable alternative for crypto-backed loans. As a caveat, we’d like to see better transparency regarding reserves, assuring depositors that their crypto is safe on the platform.

FAQs

Is Nexo a trusted platform?

Nexo’s users on Trustpilot generally trust the platform, awarding Nexo with a 4.7 out of 5 TrustScore, which is among the highest scores for any crypto-related platform.

Is Nexo safe to use?

We’re not aware of any hacks or breaches with Nexo. The platform also offers two-factor authentication as well as biometric authentication for its mobile app.

Is Nexo better than Coinbase?

Nexo offers better borrowing terms compared to Coinbase, which only offers borrowing with BTC as collateral. By contrast, Nexo supports borrowing in dozens of cryptocurrencies as well as USD.

Can I use Nexo in the US?

Currently, most of Nexo’s services are blocked in the US.