The Populous Platform and its PPT token were designed to change the invoice financing industry by using blockchain and credit scoring system with the aim to offer a more liquid ecosystem for both the buyers and sellers.

What is Populous?

As a London-based project launched in 2017, the Populous platform has since been developed and promoted as a disruptive solution in the invoice financing market. Running on a peer-to-peer architecture powered by the blockchain’s distributed ledger technology, its broader aim is to globalize invoice trading market which the Populous team sees as being rather limited now. The platform allows invoice buyers and sellers to engage in transactions irrespective of their place of residence, with an added bonus of eliminating third parties from the entire process.

What Is Populous Trying to Achieve?

The Populous’ overall goals focus on streamlining the operation of the invoice discounting industry and getting into the spotlight as a solution to some of the issues the companies face today:

- Populous is supposed to help businesses maintain access to stable cash flows, particularly in the case of small and medium enterprises (SMEs). Keeping a healthy cash flow may become a challenge for businesses, especially at the time of economic hardships. Populous promotes and supports the invoice discounting as a source of funding by utilizing an enterprise’s unpaid accounts receivable as collateral for a loan. Thus, it immediately enables access to the cash which may be prevented from being released as part of the outstanding sales invoices. Company owners allow the invoice buyers to purchase invoices at a discount in order to gain faster access to cash. After the invoices have been paid by debtors, the buyers will receive their compensation.

- Populous aims to level the playing field for all the participants in its invoice discounting ecosystem. This refers to sellers and buyers who are supposed to recognize that having access to a global liquidity market on the Populous should be beneficial to all parties. With Populous, invoice sellers can make their cash flows more flexible, allowing them to expand their business and become more resistant to the losses caused by delayed payments (estimated to go to as far as £2bn a year for the SMEs in the UK only). At the same time, invoice buyers can create a stable source of passive income and use blockchain to make this process more secure and transparent.

- Populous goes for speeding up the invoice financing process by automating it with the help of smart contracts. As the Populous developers decided that invoice discounting can profit from higher transaction speeds, they put in place an automatized smart contracts system which eliminated the need for third parties such as invoice financing companies, banks and other lending organizations. It also allowed for the autonomous collection and release of payments. Potential security breaches should be prevented by having all invoice records stored on the Ethereum blockchain.

- Finally, Populous has implemented additional features to offer access to an analytical engine for the evaluation of credit risks, trading partners, businesses etc. Based on its implementation of the XBRL data framework and Altman Z-Score formula, the Populous platform can gain insights into financial statements and use its smart contracts to give access to its credit rating system which is being billed as more advanced than the current non-blockchain solutions.

How Does Populous Work?

Streamlining the exchange of invoices between buyers and sellers lies at the heart of the efforts undertaken by the Populous developers. The whole process encompasses several stages:

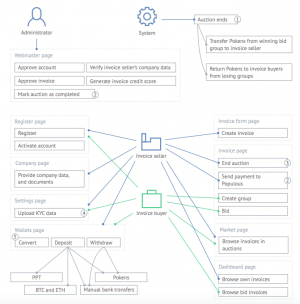

- If users want to start selling their invoices, they first need to register their business. Similarly, buying invoices is done by providing the know-your-customer (KYC) information.

- The Populous administrator initiates the request approval proceedings and the access to the user’s account remains on hold until it is done.

- The user needs to submit an invoice and define the desired minimum sales goal, which also needs to be approved by an administrator.

- Legal stipulations of the invoice settling process are made part of the smart contract code, thus ensuring their automatic execution based on defined terms and enforcing the protection of the contract from duplicate invoice financing. This is done based on the fact that contracts will not allow for the additional financing of invoices after the initial one has been taken care of.

- The platform’s internal tokens called “Pokens” are used to purchase invoices on the lending platform. They are pegged with the fiat currency (at 1:1 ratio) of the country that the invoice originates from. At the same time, the platform’s PPT tokens are used for investing in invoices.

- The waiting time for settling invoices is reduced from the usual 45 to 90 days based on P2P auction based invoice financing system.

What Are the Modules of the Populous Platform?

While the smart contracts on the Populous function as a sort of an application layer, the platform is actually built on the modular architecture featuring three main modules which provide the main interface for interacting with it:

- Bank Module. This module handles the internal ledger for platform accounts and maintains links between the ledger and external tokens.

- Auction Module. This segment manages invoice auctions on the platform. Each auction includes hash references to the relevant records and documents existing on the InterPlanetary File System network.

- External Tokens Module. Each supported currency is assigned an appropriate smart contract on this model, with all the contracts featuring an implementation of the Ethereum ERC 20 standard. Based on this, the users can withdraw their funds existing outside of Populous to these contracts and gain access to the tokens.

How Are Participants Evaluated for Auctions?

The process of approving invoices for sale brings to the fore the analytical engine featured on the Populous platform. An administrator will use the platform’s internal system to create a credit score for the seller’s invoice. This process involves the use of the XBRL data and the Altman Z-Score formula:

- XBRL data are used as a source of information by which the Populous evaluates the associated credit risk. The analysis is performed in real time and involves the use of the Altman Z-score formula.

- The gathered data is made publicly available and this information can refer to the amount of immediately available cash, debtor’s worth and the due amounts within a set timeframe.

- Based on this, working with the Populous removes the need for using the services of external credit rating organizations, thus saving the users both time and money.

The features by which the credit risk is determined include three main factors which are analyzed based on the Altman Z-Score system:

- The probability of bankruptcy for the enterprise being evaluated

- The probability for a business to default on its obligations

- The state of measures which may be instituted at the time of financial pressure

The auction process starts immediately after the applicant’s invoice is approved and it will last for 24 hours. Buyers can both launch their own bids or decide to become part of the bidding groups. In case they go for the group option, they will join a host of other bidders and make their bid as a single entity.

If approved, the auctions are usually completed based on three possible outcomes:

- A bid is verified as being in line with the defined sales goal within 24 hours of the auction launch. Funds are returned to the losing group or buyer.

- If no bid matches the set sales goal within 24 hours, the user has an option to accept the best available bid or restart the auction process.

- Auctions can be canceled even before the expiry of the 24-hour interval. Funds are returned to the participants in the canceled auctions.

Role of Tokens on the Populous Platform

The Populous platform features three token types performing various roles on it. If an auction has been completed successfully, the invoice seller will receive funds from an individual buyer or group which won the auction. The funds are distributed in the form of the Pokens which are ERC-20 tokens functioning as the internal currency. Pokens are used to purchase invoices. They are pegged to the equivalent fiat currency and the sellers can convert them to fiat if this type of exchange suits their immediate needs.

Based on their link with fiat currencies, Pokens are bought from the Populous in EUR, USD, GBP or Yen, with other currencies being converted to GBP based on the London Stock Exchange exchange rate at the moment of purchase. At the same time, Pokens can be freely bought with cryptocurrencies such as Ethereum and Bitcoin and stored in wallets which offer support for ERC-20 tokens.

PPT tokens primarily serve as vehicles for investments in invoices with the help of the platform’s liquidity pools. Once invested, the tokens assume the role of collateral, with the users receiving Pokens in exchange. After invoices have been repaid, the investors are entitled to what they originally invested in PPT as well as to the profit in Pokens. As of March 2019, the Populous market cap was valued at USD 87 million, down from its historic high of more than USD 2 billion in January 2018. At the same time, more than 53 million PPT were in circulation and the amount actually refers to their total cap as well. PPT tokens are traded on the crypto exchanges such as Binance.

Finally, there is also a Populous XBRL Token (PXT) which is used to pay for gaining access to the business intelligence data featured on the Populous platform, such as information which could be used for a financial health evaluation, SWOT analyses and credit scoring.

The Populous Team

The Populous platform has been developed as a pet project of the data expert Stephen Williams who wanted to combine invoice discounting, blockchain and big data in a single system. He was the founder of the Olympus Research company which worked with the commercial data and business analytics.

The Populous ICO took place in mid-2017, with more than USD 10 million worth of tokens being sold. In May 2018, the company launched its public beta. Since the platform operates in a sort of niche in the crypto market, it currently faces no direct competitors in this field, with the team’s only concern being drawing the users away from the traditional invoice financing systems.