Fetch.ai combines the blockchain and artificial intelligence to establish a network of autonomous economic agents. These can perform various tasks for their users, while reducing the data acquisition monopoly of the large market players.

What Is Fetch.AI?

Launched in February 2019 as yet another project on the Binance Launchpad, Fetch.AI is a poster child for the technology convergence at the dawn of the fourth industrial revolution. The project emerged as a fusion of two technologies often mentioned in the same breath today – artificial technology (AI) and the blockchain. The idea was born out of the desire to decentralize AI-based systems which are now being increasingly adopted in the form of digital assistants, such as Google’s Home Hub. The Fetch.AI team believe in the vision that the provision of various assisted services does not have to entail the free provision of user-focused data to the increasingly information-hungry companies that want to monopolize this process.

The story of Fetch starts with the establishment of the UK-based startup which emerged in early 2017 after the companies Itzme AI and uVue decided to join forces. The project was picked up by the Binance Launchpad platform which helped organize the token sale, raising USD 6 million in a span of some 10 seconds. The platform’s native FET token is its utility token which was issued on Ethereum for this purpose.

What Is Fetch.AI Trying to Achieve?

Fetch.AI is promoted as the building block of the future decentralized digital data marketplaces. Based on this concept, the majority of the real-life tasks burdening the Fetch.AI users will be actually performed by the so-called autonomous software agents powered by AI technology. In addition, the agents are supposed to streamline the utilization of user-generated data.

- Fetch.AI aims to replace centralized systems tasked with taking care of tasks ranging from data delivery to the provision of everyday services such as hotel room booking. The Fetch developers see an open decentralized system such as theirs as being better positioned for cooperation in the emerging machine-based economy. Their software-based “agents” act as digital entities capable of making autonomous transactions and representing themselves, their devices, services they perform or individual users. Despite not being previously exposed to diverse challenges, the digital agents will be able to utilize AI to engage in decision-making processes both for themselves and on behalf of the Fetch.AI users. These users will be recruited among the individuals, companies and governmental bodies, while the range of tasks the agents can perform is virtually limitless, from checking the availability of flight tickets to developing weather models or supply chain optimization.

- Fetch.AI wants to establish an Open Economic Framework (OEF) as en ecosystem in which the agents and digital data interact while delivering top performance at a lower cost. Adequate utilization of the user-generated data is one of the priority tasks in the Fetch’s digital economy model. Its Open Economic Framework should allow for making the data created by the Internet-of-things (IoT) devices a commodity which can be sold based on the fact that its agents will reside in each of these devices. For example, a Fetch agent can detect weather conditions by being connected to the vehicle’s windscreen wiper and forward that information to the digital ecosystem with the goal of easing the delivery of appropriate services relevant to that information. Fetch’s autonomous agents thus become valuable to those who need their data, without being necessarily aware of it. As the agents become representatives of diverse data, devices and services, they are turned into useful tools for a host of data analysts and market experts looking forward to improving the delivery of various services.

- Fetch.AI and its FET token reduce the need for having human or corporate intermediaries control the access to the hub of knowledge created by the digital datasphere. With the help of machine learning technology linking the ledger with the agents in the field, the data which was previously considered to be of no economic value can now become the foundation of the emerging industries. Freed from the meddling of the intermediaries, both the data and devices which exist on the Fetch.AI platform can now “sell” themselves independently, powered by Fetch Tokens (FET). These tokens function as a digital currency for the transactional and communication operations taking place on it. Agents and nodes that want to perform tasks related to the network operations (such as security) will be able to use FET tokens as the sources of refundable deposits.

How Does Fetch.AI’s Architecture Work?

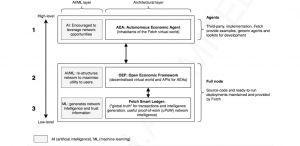

Creating data-based value and making sure that it is pushed to the right addresses prompted the Fetch.AI team to develop a layered architecture for their platform. This has resulted in the creation of three layers, closely intertwined with the platform’s general goals:

- The first layer consists of autonomous economic agents (AEAs). They exist in the environment in which the information related to trust and reputation are circulated to reduce the risk of conducting transactions to a minimum.

- The second layer is the Open Economic Framework (OEF). It is underpinned by the underlying ledger which is a home to the platform’s FET digital currency and a decentralized transactions system.

- The third layer is the Fetch smart ledger which handles reputation, trust and intelligence to ensure the integrity of the system. It is key to the Fetch’s value proposition since it handles market intelligence which the agents need to access in the most efficient manner. It encompasses the application of machine learning to discover which markets interact with others and in what manner.

How Does Fetch.AI Hope to Achieve Scalability?

Fetch smart ledger is scaled to support theoretical millions of transactions per second and is capable of restructuring itself to connect the OEF with the Fetch agents. Scalability is achieved by combining the transaction chains with some features of the directed acyclic graph (DAG).

Fetch.AI also implements the elements of the sharding process in the form of its “resource lane” approach. While it superficially resembles the classic sharding process found in some blockchain-based solutions, the Fetch platform supports the concurrent assignment of a transaction to several different resource lanes. Lanes are then optimized for use with the help of the pre-evaluation module which identifies which of them are related to a particular transaction. Finally, transactions are grouped via resource identifier hashing, with the system’s capacity being proportional to the number of available lanes.

Distribution of AEAs on Fetch.AI Platform

Fetch’s autonomous agents use their native platform to get in touch with those who may need the data they collect. This means that the delivery of data and the provision of services require some filtering among the agents, at least in the geographical sense, since the information on the weather and traffic, for example, are relevant only to the users in the affected areas. Thus, the agents are divided based on several criteria:

- Geographical locations. All AEAs exist at a specific spatial place, yet they are free to deploy to any other location based on the nodes they are linked with, at no additional cost. Fetch.AI network will limit neither the agents nor nodes to a particular area.

- The more important consideration may be an agent’s economic location i.e. the proximity of the relevant markets for their data. Sorting agents based on these criteria may be advantageous to utilize them to their full capacity.

- The Fetch network will also take note of the distribution of infrastructure in the area covered by agents, such as airports, railway stations etc.

- Despite the spatial filtering, all of the agents need to feature a unique identifier which is derived from their wallets. This is supposed to allow them to both receive and send Fetch tokens. Also, all agents are required to maintain the list of nodes they are related with.

Types of AEAs

Notwithstanding geographical or market criteria for the distribution of the Fetch.AI’s autonomous agents, the predicted use cases for them allow the developers to assign them specific roles in supporting the digital data ecosystem:

- Inhabitants. These agents are linked with the hardware which is operational in the real world. This may include devices such as cameras, sensors or phones, with the same level of support being provided for the platforms such as vehicles or drones. Agents may act as a substitute for human operators of these devices, such as when giving directions to self-driving vehicles without having a direct control over them.

- Interfaces. These agents act as API-based interfaces between the parts of the standard economy and the digital world. The can be linked with the sensors or data to perform mundane economic tasks, such as ticket bookings.

- Software agents exist only in the digital sphere and try to find the best ways to serve their users’ needs.

- Digital data sales agents are attached to the data sources in data marketplaces and try to extract value from the corresponding data.

- Representative agents are stand-ins for individual users and act as their “digital butlers” (as per Fetch whitepaper) in the Fetch ecosystem.

What Is Useful Proof-Of-Work (UPOW)?

The consensus mechanism employed by the Fetch.AI is called the Useful Proof-of-Work (UPoW). With it, new blocks are created in a manner similar to what is found with regular Proof-of-Stake protocols, while the order of transactions is established based on the work taking place between the generation of two blocks.

Specific computing problems are sorted out by difficulty and packaged into proof-of-work packages, allowing even the less powerful nodes to earn their block rewards. The more demanding problems, such as those related to artificial intelligence or scheduling, are to be tackled by the platform based on distributed computing arranged in this manner.

FET Token Availability and Fetch Team

Fetch.AI team is headquartered in Cambridge, UK, and led by its three co-founders: Humayun Sheikh (CEO), Toby Simpson (CTO) and Thomas Hain (CSO).

As of June 2019, the FET token’s market cap was valued at USD 19 million. The number of tokens to be generated is capped at 1.1 billion FET, with 81 million of them being in circulation at this time.

The tokens are available for trade on the cryptocurrency exchanges such as Binance and KuCoin.