Adaptive State Sharding and Secure Proof of Stake technologies should help the Elrond Network bring a decentralized network’s speed and security performance to the levels offered by their centralized counterparts.

What is Elrond?

Elrond Network and its Elrond (ERD) token make up the core of the proprietary public blockchain which is yet another Initial Exchange Offering (IEO) to go live on the Binance Launchpad platform. The Network is built around providing a high-throughput performance paired with interoperability and high-level scalability. The main goal is to bring up the performance levels of a decentralized network and have it compete with the centralized ones on a more equal footing. The key concepts to help the Elrond achieve this are its custom technologies designated as Adaptive State Sharding and Secure Proof of Stake consensus mechanism.

Following the launch of Harmony (ONE), ERD will be the second token to be launched on Binance DEX first, with the help of the Binance Chain. The token sale is supposed to take place on July 1st 2019, with the organizer hoping to raise some USD 3.25 million. The sale will follow a lottery format which includes making records of the Binance Coin (BNB) balances owned by users. A total of 20 billion ERD tokens is expected to be created, of which some 37% are planned to be released initially.

What Is Elrond Attempting To Achieve?

While Elrond is still at the test stage, its developers see it as the future foundation stone of an open, borderless and globally accessible digital economy. This is to be achieved by turning Elrond into a platform with scalable value transfer protocol, paired with easier deployment of decentralized apps (dApps). This is to be helped by the fact that Elrond team features an equal measure of professionals with an entrepreneurial and technical backgrounds, who previously worked at Google, Microsoft and Intel and were part of the NEM blockchain platform.

- Elrond aims to offer linear scaling and near instant transaction performance that should not come at the expense of its other features. As stated on the project’s website, the Elrond platform should be able to process 10 000 transactions per second (tx/sec) with latency kept to a minimum, just the fees on the network. Its Adaptive State Sharding should deliver a top rate throughput performance, based on combining all three existing approaches to sharding (network/communication, transaction/processing, state/storage). The option to change the number of shards dynamically is supposed to improve the communication between them, while the parallel processing should take care of the set performance goals. At the same time, the platform will come with reduced storage requirements and the support for linear scaling as more nodes join the network. This type of scaling, paired with parallelization of the transaction processing, is described as the platform’s trump card which should allow Elrond to challenge and surpass the throughput of centralized solutions.

- Elrond is big on efficiency, with the developers’ hopes being set on minimizing energy and computational requirements for the use of the network services. This is to be achieved by the implementation of the Secure Proof-of-Stake mechanism which combines eligibility based on stake and ratings, randomized validator selection and the optimization of consensus group sizes. It is described as a more advanced version of the existing Proof of Stake (PoS) mechanisms. It is aimed at ensuring distributed fairness and serving as a compromise solution between delivering security and having higher energy and computational demands, such as those found with the Proof of Work solutions.

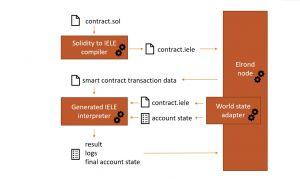

- Elrond wants to combine decentralization with cross-chain interoperability based on their perceived dependence. The Elrond team aims to deliver full decentralization of its platform with the purpose of minimizing the risk of exploitation of a single point of failure. In addition, they want to do away with exchanges and trading platforms as the main points of interoperability between blockchains. Instead, Elrond Network should allow for unlimited communication between various external services, starting with the platform’s implementation of the Elrond Virtual Machine (EVM). It is supposed to offer support for running smart contracts written in Solidity for Ethereum, with little or no modifications. Based on this, the users should be able to make secure transactions between Elrond, Ethereum and ERC20 tokens without the need for a centralized exchange. Also, at its basic level, Elrond Virtual Machine will feature an adapter mechanism which will communicate with other individual adapters for each chain which aims to work with Elrond, even if it is not compatible with its EVM.

Overview of Elrond’s Architecture

The architecture keeping the Elrond’s nuts and bolts together is made up of several key components:

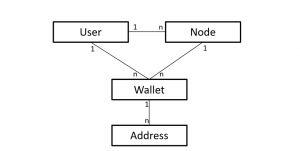

- Users and nodes exist as two main entities on the Network. Users are tasked with deploying signed transactions for two main activities taking place on the Network – value transfers and execution of smart contracts. Each user has a number of public/private key pairs and is identified by its account address which, in turn, is derived from the public key. Nodes are devices on the Elrond Network which are further divided into those that handle tasks assigned to them in an active or a passive manner.

- Validators participate actively in the operation of the Elrond Network. They handle consensus building, block generation and maintenance of the state for which they receive rewards. Eligible validators are identified by a public key derived from the address associated with a required stake.

- Shards are small units comprising the heart of the Network’s sharding system. Validators are assigned to shards via an automatic process that ensures a balanced distribution of shards across the nodes. While block proposers aggregate transaction into blocks, validators remain in charge of rejecting, approving and validating them before they are made parts of the blockchain.

- ERD tokens act as the gateway for gaining access to the Elrond Network and the meat-and-potatoes of its fee, payment and balance structures. They are the main means of payment for the transaction processing, deployment of dApps, storage fees, execution of smart contracts and rewards for contributions made to the network. A percentage of transaction fees is earmarked for validators, while the rest of the funds are set aside to be either burned or donated to the Elrond Community Fund.

How Does Elrond’s Adaptive State Sharding Work?

Elrond Network prides itself on its unique approach to the sharding technology, a long-present database optimization technique slowly establishing itself as part of some blockchain-based solutions. Elrond’s approach to the sharding implementation is informed by key goals it aims to achieve:

- Scalability is achieved at no expense of availability. Whatever the fluctuations in the numbers of shards are, they should have little or no effect on downtimes or state updates.

- Instant traceability and dispatching. Identification of the transaction destination shards is deterministic and easy to calculate.

- Adaptability. Shards should be balanced in all situations.

- Dynamic model. Elrond’s state sharding can adapt to population and demand changes with no impact on security or availability.

The chronology on the Elrond Network is organized around a timeline which is divided into epochs and rounds. While epochs can be modified together with the system’s architecture, they have a largely fixed duration whose expiry triggers the reorganization and pruning of shards. Rounds also exist within a fixed time span. As part of each round, a new consensus group is randomly selected for a shard and tasked with committing one block per the shard’s ledger.

How Does Secure Proof of Stake Work?

Elrond’s SPoS mechanism is developed as an improvement over the existing solutions found in the blockchain tech market:

- With Elrond, latency is reduced and each node in the shard may determine the members of the consensus group at the beginning of a round. The aggregated signature from the last block is used as a randomization factor. All of this should reduce the time needed to elect a consensus group, down to less than 100 ms.

- Elrond introduces a weight factor of rating to the mix, with the goal of promoting meritocracy among the nodes in addition to taking the stakes in consideration.

- Elrond introduced Bellare and Neven multisignature scheme which is supposed to reduce the number of communication rounds as part of the signing algorithm.

Future Plans and Potential Competitors

Based on the existing projections, the Elrond Network project will be ultimately focused on establishing an internet-based ecosystem with expanding global functionality and the range of use cases. Upon the planned launch in the second quarter of 2019, the Network is supposed to feature support for mobile wallets, hardware wallet integration, secure P2P messaging, token swaps and participation incentives. This is to be followed by the work on consolidating the Network’s MainNet.

The so-called real world integration of the Network is planned to revolve around promoting the project’s interoperable blockchain architecture, while banking on its scalability and efficiency. Both startups and larger business systems will be approached with an offer to use the Elrond Network as the platform for the decentralized application development and deployment, with the added option of integrating its components with its products and services.

At the same time, Elrond is already facing some strong competition, consisting of well-established projects such as Ethereum and Zilliqa. To counter Ethereum, for example, Elrond will have to play to some of its strengths, such as its reduction of energy waste stemming from the use of Proof-of-Work, paired with parallel transaction processing with the help of sharding. The sharding card will probably be played in case of Zilliqa as well, as Elrond’s sharding implementation is not limited only to transactions (as it is the case with Zilliqa), but to the state as well. Also, Elrond has a theoretical advantage of stronger support for the blockchain interoperability.