Four Crypto Exchanges Rake In 90% of Bitcoin Trading Volume

While bitcoin (BTC) is as a decentralized asset, trading in and out of the biggest cryptoasset remains a relatively centralized process, according to a new report from crypto data provider Coin Metrics.

Although bitcoin is traded against a range of fiat currencies, stablecoins, and other cryptoassets across both centralized, decentralized, and peer-to-peer markets, major centralized exchanges still control an overwhelming share of the market.

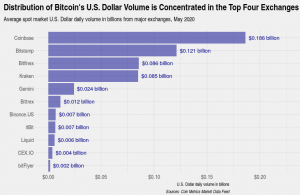

More specifically, these exchanges include the major players Coinbase, Bitstamp, Bitfinex, and Kraken.

“Distribution of US dollar quoted spot market volume follows a power law where roughly 90 percent of the volume is concentrated in the top four exchanges in our sample,” the report said, adding that institutions interested in getting into bitcoin trading should do so through multiple exchanges “to access the full spectrum of trading activity.”

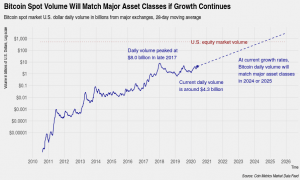

Further, the report also found that although bitcoin’s total trading volume is still “minuscule” compared to for example the US stock market, bond market, or the global foreign exchange (forex) market, it is growing fast.

If the historical growth in bitcoin trading volume can be maintained over the next few years, bitcoin’s spot trading volume could exceed the entire US stock market in less than 4 years, and in less than 5 years it would overtake the large US bond market, the report pointed out.

On the issue of bitcoin’s relatively small trading volume, Coin Metrics also said that bitcoin at its current stage is more “comparable in size to a large capitalization stock rather than a distinct asset class.” As such, the report noted, institutions that are considering bitcoin may find that the investment is only suited to make up “a portion of the already small allocation to alternative assets,” rather than having a separate allocation for bitcoin only.