Demand for Non-Sovereign Safe Havens – Bitcoin & Gold – Expected to Rise

The demand for non-sovereign “safe haven” assets, such as bitcoin (BTC) and gold, to rise considerably as the risk of broad-based currency debasement increases, according to US-based crypto research boutique Delphi Digital.

Gold demand in the past 12-18 months has already been on the rise among central banks and private investors alike, with total holding of gold-backed exchange-traded funds (ETFs) and similar products just hitting a new all time-high of c. 3,355 tonnes, the firm said in their latest report.

Furthermore, Delphi Digital sees a rise in demand for non-correlated alternatives that will be prompted by investors’ increasing awareness “of the secular headwinds facing growth assets.”

According to the researchers, global policymakers are on high alert due to the “extreme monetary intervention,” notably that by the Federal Reserve System (Fed). The amount of monetary and fiscal relief pledge is equal to more than USD 10 trillion globally, while the Fed alone added more than USD 2.5 trillion to its balance sheet in just the last two months.

Also, the European Central Bank said this March that the “governing council will do everything necessary within its mandate” to help the euro.

However, most of the countries don’t have the luxury of issuing an alternative asset that has at the very least a modest demand, Delphi Digital stressed. Therefore, the demand for USD allows the Fed a larger intervention than other central banks. Nonetheless, “souring sentiment towards US dominance has prompted several outspoken political leaders to explore alternatives to today’s US Dollar Standard, which could threaten demand for US Treasuries at the most inopportune time,” it said.

That said, the company believes that Bitcoin is an “extremely attractive” alternative when it comes to a multi-asset portfolio with the goal to maximize risk-adjusted returns. Its volatility works in both directions: there’s higher upside volatility, therefore high downsides are expected. Additionally BTC’s characteristics as an alternative safe haven are superior in a number of ways to gold and other precious metals, the report claims, and these advantages will only become more important in a digital-assets-dominated world, driving BTC to gain greater market share compared to its traditional counterparts.

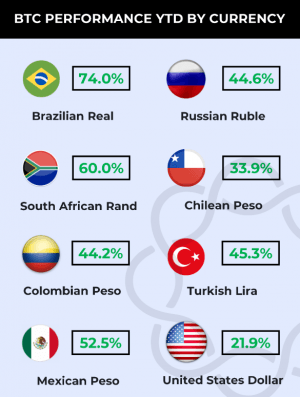

Furthermore, countries still cutting interest rates, will likely drive investors and analysts away, worried for the local currency instability. Much of the money coming out of emerging markets will likely go to dollar-based assets, but “the sheer size of this potential move could serve as another demand source for BTC, especially if tighter capital controls become more commonplace,” the report concluded.

As reported, prominent hedge fund manager Paul Tudor Jones said that 1%-2% of his assets are in BTC, which could be a minimum of USD 210 million.