Bitcoin Bulls Pushing a New Narrative – BTC at USD 100,000

After bitcoin expectedly breached the USD 10,000 level this past weekend and started to playing with USD 11,000, more bitcoin bulls are looking for the new inspiration as FOMO (fear of missing out) “is already in the air.”

Source: iStock/xijian

First, right after bitcoin jumped above USD 10,000, professional career trader Peter Brandt tweeted that “bitcoin takes aim at USD 100,000 target.”

“BTCUSD is experiencing its fourth parabolic phase dating back to 2010. No other market in my 45 years of trading has gone parabolic on a log chart in this manner. Bitcoin is a market like no other,” the trading veteran said. In April he predicted bitcoin at USD 50,000 within the next two years.

Also, Forbes contributor, analyst Naeem Aslam, predicts that the next rally is going to be a lot stronger than the previous.

“One can call it a bubble, but this time the Bitcoin price range could very well be between USD 60,000 to USD 100,000,” he added.

Meanwhile, one of the most famous bitcoin bulls, Anthony Pompliano, co-founder and partner at Morgan Creek Digital, a digital asset management firm, is even more specific.

“I believe that Bitcoin will reach a USD 100,000 price point before December 31, 2021. My current confidence level of this happening is around 70-75%,” he wrote in his daily newsletter.

Pompliano was wrong in 2018 when he predicted that bitcoin could reach USD 50,000 by the end of that year, but he was right when in August of the same year he said that the price is likely to drop by c. 50%, to USD 3,000 before it bounces back to USD 10,000. Bitcoin reached USD 3,200 in December 2018.

_________________________________

_________________________________

Now, after suggesting to do your own research before buying bitcoin and reminding never invest more than you’re willing to lose, Pompliano have also stressed a few things:

- He anticipates that there will be numerous 20-30% drawdowns from new all-time highs.

- The price appreciation will be driven by the supply/demand rule: the demand will increase while the total supply remains fixed and the new daily supply will decrease by 50% in May 2020.

- The increase in demand will come from institutional investors, new retail investment products, increased global instability, lack of performance in traditional markets, and the continued manipulation of markets, economies, and currencies by governments around the world.

- If bitcoin is at USD 100,000, its market capitalization will surpass USD 2 trillion, which is less than 1/3 the market cap of gold and less than 1/40 the global money supply.

However, as history shows, only time will tell who is right. For example, in the beginning of June, multiple analysts and traders advised against buying bitcoin when it dropped below USD 8,000. In 10 days it was above USD 9,000.

“The first time bitcoin breached [USD 10,000] to the upside was in a frenzy of FOMO as most of the world was just learning what this new digital asset is all about. This time however, the rise seems much more sustainable and the current price more justifiable given the current levels of awareness and adoption,” according to Mati Greenspan, Senior Market Analyst at eToro, a trading platform.

At pixel time (14:28 UTC), bitcoin trades at c. USD 10,900 and is up by 1.95% in the past 24 hours, by 17% in the past week, 35% in the past month and by 83% in the past 12 months.

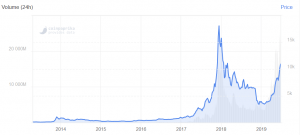

Bitcoin price chart:

Source: coinpaprika.com