Another Crypto Pop Pushes Bitcoin Close to USD 9,000, Altcoins Rally

As the crypto market rallied sharply in the last hours of Sunday (UTC time), bitcoin reached its new high of 2019, altcoins followed the suit and the total market capitalization increased by almost 8% in the past 24 hours.

At pixel time (04:42 UTC), the average price of bitcoin is up by more than 8% and is trading at around USD 8,670. It reached USD 8,880 earlier today.

Bitcoin price chart:

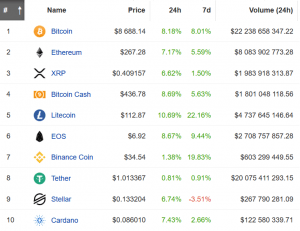

Other major coins from the top 10 by market capitalization rallied by 1%-11%. Binance coin registered the smallest gains, while litecoin is the best performer among major coins.

Also, only stellar is down in the past week.

Top 10 coins by market capitalization:

Some smaller capitalization coins are showing even bigger gains in the past 24 hours, with maximine coin jumping by almost 39%. At pixel time, 12 coins from the top 100 are in red.

The total market capitalization reached almost USD 270 billion, or a level last seen in August 2018.

According to David Tawil, president of crypto hedge fund ProChain Capital, this is still the thawing out from the crypto winter that was.

“There still may be another pullback before we get to fundamentals truly taking over and speculators and frauds being expunged,” he told Bloomberg on Monday, stressing the importance of crypto adoption: “The more merchants that accept crypto encourages more people to adopt it and use it.”

The most recent major example of adoption comes from American telco giant AT&T that started accepting crypto payments.

Also, as reported, preliminary numbers, based on data gathered from twenty merchant service providers, show that in January 2019 more than BTC 32,300 were spent, or 47% more than in January 2018. However, the USD value of bitcoins received by merchant services in January dropped by 70%.

Nic Carter, co-founder of Coin Metrics, a provider of crypto asset market and network data, has also found more signs of increasing bitcoin adoption (based on the Coin Metrics data):

Meanwhile, Juan Villaverde, leader of the Weiss Cryptocurrency Ratings team, in a recent opinion piece argued that next the bitcoin correction “will be the best bitcoin buying opportunity since 2015.”

However, while many industry players claim that this crypto market rally will be different than the last, investors, especially newcomers, need to be aware of the fact that crypto is still a highly volatile asset class that will likely go through its next boom and bust cycle in the coming years.

Peter Brandt, a 40-year veteran of the markets, who correctly predicted the bear market of 2018 and now estimates that Bitcoin might reach USD 50,000 within the next two years, commented on the recent rally: