T1Markets

T1Markets is a MetaTrader 4-based derivates exchange that lets you trade forex, cryptocurrency, commodity, indices, stocks, and precious metals contracts for difference (CFDs). When buying CFDs, you don’t actually get the underlying asset but speculate on the price movements of it. This way, profits can be realized (as can losses!) even if the price of an asset goes down. T1Markets is a trusted broker, and is operated by General Capital Brokers Ltd – a company regulated by the Cyprus Securities and Exchange Commission (CySEC).

T1Markets review: key features of the platform

T1Markets users can access the following markets:

- 45+ forex trading CFDs

- 30+ cryptocurrency market CFDs

- 20+ commodity trading CFDs

- 20+ indices trading CFDs

- 45+ stock trading CFDs

- Metal trading CFDs, including gold, silver, and platinum

Other key aspects of the broker include:

- Access to over 350 asset CFDs in more than 10,000 markets. T1Markets connects you to a variety of global markets, thus allowing you to test a variety of unique market strategies.

- Financial education. In case you’re new to CFDs trading, you’re likely to enjoy the T1Markets education section, which teaches you all you need to know about the risks, tactics, and opportunities of contract trading.

- Up to 200x leverage. Professional traders may use up to 200 leverage (for certain markets), while retail traders may leverage their positions up to 30x.

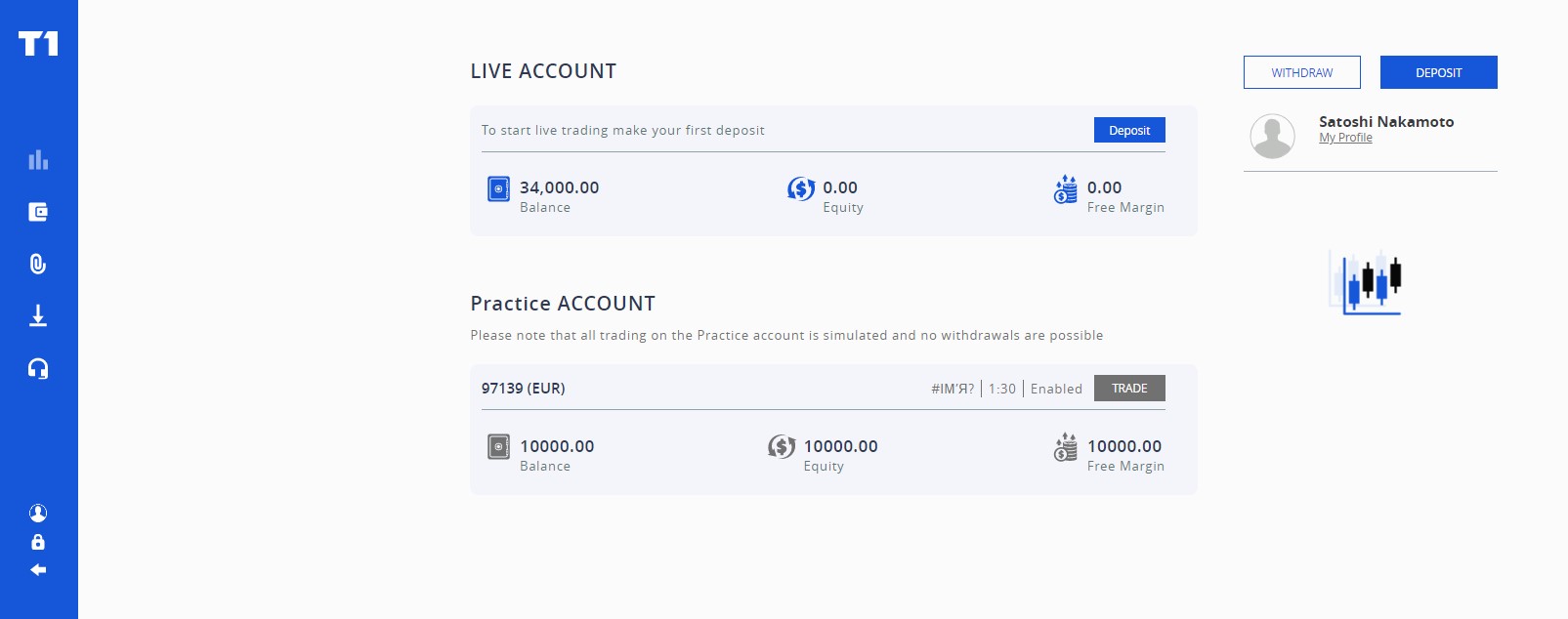

- Practice account. Set up a free practice account to test the platform and your trading strategies before depositing large sums of money.

- Trade on-the-go. You can access the T1Markets trading interface via its webtrader or its MetaTrader4-powered mobile app.

- 24/5 customer support. You can reach T1Markets staff via email, phone, live chat support, or their “Contact Us” form on its website. The support staff is active from Monday to Friday, from 07:00 to 17:00 GMT.

All in all, T1Markets is a reliable broker for all levels of traders who want to gain exposure to a variety of international markets.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Background of the exchange

T1Markets is a relatively new CFDs broker which opened its “doors” recently in July 2020.

General info

| Web address: | Link |

| Main location: | Limassol, Cyprus |

| Daily volume: | 0.0 BTC |

| Mobile app available: | Yes |

| Is decentralized: | No |

| Parent Company: | General Capital Brokers Ltd | ||

| Transfer types: | Bank Transfer, Credit Card, Debit Card, | ||

| Supported fiat: | USD, EUR | ||

| Supported pairs: | 10000 | ||

| Has token: | -| Fees: | High(Compare rates) | |

Pros & Cons

- Trusted regulated broker Free demo account Education resources Practice account

- Steep learning curve Inactivity fees No crypto deposits

Screenshots

The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) under Registration Number HE345774 via its trading name of General Capital Brokers Ltd. The company is licensed by CySEC under license number 333/17. Due to its regulatory requirements, the broker offers segregated accounts, negative balance protection, and ensures other legal protective measures like know your customer (KYC), anti-money laundering (AML), and European Securities and Markets Authority (ESMA) guidelines.

Here’s the contact information of the company:

- The physical address of the company: 359, 28th October street, Neapolis, WTC Cyprus-Trust Re Building, 1st Floor, 3107 Limassol, Cyprus

- Contact phone number: + 800 4040 8888

- Official website: https://www.T1Markets.com

- Email: [email protected]

- Social media: Twitter

The platform is currently available in seven languages: English, Spanish, Portuguese, Italian, German, Dutch, and Swedish.

As a European broker, T1Markets operates in most European countries, (except for jurisdictions where the use of such services is prohibited by law)

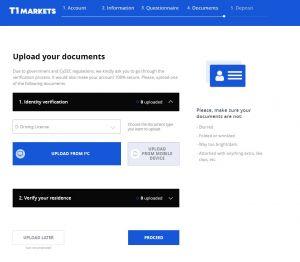

As a regulated broker, T1Markets asks all of its clients to verify their identity.

In order to get your account fully verified, you will be asked to submit the following documents:

- Color copy of a valid passport or ID

- Colour copy of an utility bill

- Proof of Deposit

Upon registration, you will also go through a short questionnaire, which will be used to classify you as either a professional or retail trader. The key differences between are a different degree of available leverage as well as several other features.

| Asset leverage and features | Professional account | Retail account |

|---|---|---|

| Forex Major max. leverage | 200:1 | 30:1 |

| Forex Exotic Pairs max. leverage | 200:1 | 20:1 |

| Gold max. leverage | 125:1 | 20:1 |

| Commodities max. leverage | 125:1 | 10:1 |

| Energy Commodities max. leverage | 125:1 | 10:1 |

| Major Indices max. leverage | 125:1 | 20:1 |

| Minor Indices max. leverage | 125:1 | 10:1 |

| Stocks & Shares max. leverage | 10:1 | 5:1 |

| Cryptocurrencies max. leverage | 1:1 | 2:1 |

| Negative balance protection | Yes | Yes |

| Margin close out rule | 15% | 50% |

| Access to contests and other benefits | Yes | No |

| Dedicated account manager | Yes | Yes |

| Multilingual customer support | 24/5 | 24/5 |

| Access to VIP Platinum education | Yes | No |

T1Markets fees

The T1Markets trading platform does not charge commission and deposit charges but takes a percentage for spreads and swap/rollover fees. Besides, you should be aware of fees associated with dormant accounts, as well as withdrawal processing costs.

T1Markets spread refers to the difference between the buy and ask price, as well as the sell and bid price of a trading instrument.

As such, the spread calculation formula is as follows: Lots * Contract Size * Spread

For example, if you were to open a long position of 0.01 lot on EURUSD market (0.0003 pips)

Spread amount = 0.01 * 100,000 * 0.0003 = USD 0.30

Swap/ rollover fee refers to keeping an open position from one trading day to another. The fee is either credited or debited to your position based on various factors like position and assets being traded.

The swap calculation formula is: Lot size * Days the position is open * (Swap Long/Short in Asset Base Currency)

The latest information about swap charges can be found here.

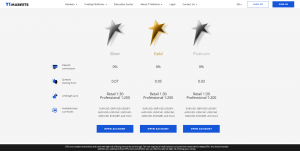

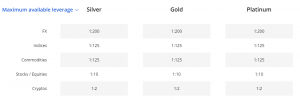

T1Markets also offer the following account types for its users: Silver, Gold, and Platinum. Here are some of the key differences between different level memberships that also affect your fee rates.

As you can see, Platinum members can enjoy lower spreads, but equal leverage (for professional accounts).

Also, Platinum members get a 50% swap discount, while Gold members are eligible for a 25% off. Unlike Gold and Platinum accounts, Silver members don’t get a free VPS and fifth decimal on their trades.

Last but not least, T1Markets charges certain withdrawal fees for requesting funds from your trading account to be sent to your bank account. Typically, a 15 EUR withdrawal fee is charged for bank wire transfers. Furthermore, the broker also reserves the right to charge 50 EUR or its equivalent for withdrawing funds from accounts with no trading activity.

Dormant account policy

Further to the regular fees, inactive accounts left with T1Markets incur an inactivity fee, which is calculated as follows:

- Inactive for over 61 days. An inactivity fee of 160 EUR is imposed retroactively for the whole dormant period.

- Inactive for over 91 days. An inactivity fee of 120 EUR or its equivalent will be charged retroactively for the whole dormant period.

- Inactive for over 121 days. An inactivity fee of 120 EUR or its equivalent will be imposed retroactively for the whole dormant period.

- Inactive for over 151 days. An inactivity fee of 120 EUR or its equivalent will be imposed retroactively for the whole dormant period.

- Inactive for over 181 days. An inactivity fee of 200 EUR or its equivalent will be imposed for the whole period of inactivity.

- Inactive for over 211 days. An inactivity fee of 200 EUR or its equivalent will be imposed for the whole period of inactivity.

- Inactive for over 241 days. An inactivity fee of 200 EUR or its equivalent will be imposed for the whole period of inactivity.

- Inactive for over 271 days. An inactivity fee of 500 EUR or its equivalent will be imposed for the whole period of inactivity.

- Inactive for over 301 days. An inactivity fee of 500 EUR or its equivalent will be imposed for the whole period of inactivity.

- Inactive for over 331 days. An inactivity fee of 500 EUR or its equivalent will be imposed for the whole period of inactivity.

The fixed fee for dormant accounts will be charged yearly for the maintenance of the account. As such, be sure to inform the broker if you decide to stop using your T1Markets account to avoid unexpected consequences.

All in all, T1Markets fees can be complicated but should not be an issue for experienced traders. Besides, your dedicated account manager may help you to improve your trading knowledge in the most efficient manner.

Usability of the platform

Users can access T1Markets either via its WebTrader or mobile trading app powered by MetaTrader 4 – one of the most popular trading applications in the market.

It provides a wide range of professional trading tools, including more than 60 indicators, an economic calendar, price alerts and real-time quotes, platform support, multiple execution modes, technical analysis tools, and much more. The platform is extremely intuitive. However, it can be somewhat confusing if you’re new – in that case, be sure to check the T1Markets education section to learn more about using MetaTrader 4.

You don’t need to download the platform’s webtrader and can trade directly from the browser. However, you can download MetaTrader 4 client on your computer and mobile phone if you want to. It can be found in the download section of your account management panel.

When it comes to trading on-the-go, MetaTrader 4 mobile app is available for both iOS and Android devices. The mobile app supports the key functions of the exchange, making it easy to trade and adjust positions on the go.

Last but not least, T1Markets lets you open a practice account to test various trading strategies and tactics. As such, you can practice using the platform before investing larger sums of money in trading.

Here is a quick video walkthrough over the T1Markets platform by FX Empire:

Customer support

T1Markets customer support is active from Monday to Friday, 7 AM to 5 PM GMT. The support team is quick to respond, though you will have to wait until the next working day if you encounter issues outside working hours.

The support desk can be reached via the following channels:

- Phone: +80040408888

- Email: [email protected]

- Website livechat.

- Customer help center.

- Contact us form.

Security

Trading contracts for difference means that you don’t actually acquire the underlying asset but can profit (or lose!) from the exposure to price fluctuations. As such, unlike buying and holding cryptocurrencies, you don’t risk losing them to hackers and other malicious actors.

T1Markets platform utilizes the following security measures:

- Strict firewalls and Secure Sockets Layer (SSL) software to protect data during transmission.

- All transactions are under Level 1 PCI compliance services.

- T1Markets trading servers are located in SAS 70 certified data centers.

- Moderation.

- All transactions and communication data between servers are encrypted.

- All customer funds are held in segregated bank accounts with first-class, global banking institutions.

As per the platform’s documentation, the company also participates in the Investor Compensation Fund for clients of Investment Firms that are regulated in the Republic of Cyprus, meaning that all retails clients may be eligible for compensation of up to EUR 20,000 in case the company fails. You can learn more about the Investor Compensation Fund policy here.

Considering these security measures employed by T1Markets, it is safe to say that it is a secure, regulated, and trusted platform.

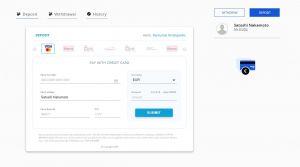

Deposit and withdrawal methods

Currently supported deposit and withdrawal methods include:

- Wire transfer

- Credit or debit card (Visa/Mastercard)

- Klarna

- EPS

- Przelewy24

- Giropay

Withdrawals from the broker account may take up to 5 days for both retail and professional Silver, Gold, or Platinum users.

The broker does not accept cryptocurrency deposits and withdrawals.

Conclusion

T1Markets provides a simple yet efficient and robust trading platform suitable for both beginners as well as seasoned traders. You can access more than 300 assets and commission-free trading, including hottest stocks, commodities, metals, cryptocurrencies, and forex, and learn to trade on your own pace.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.