YFI Grabs Yield Farmers’ Attention as DeFi Hits USD 3bn Milestone

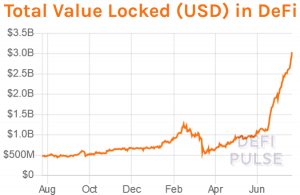

It’s getting busier in the world of decentralized finance (DeFi) every day: the total value locked surpassed USD 3 billion, while a new governance token took the yield farming spotlight.

DeFi has been hitting major milestones over the past few months, with the total value locked (TVL) rising quickly and substantially. In February of this year, DeFi reached USD 1 billion in TVL – the first since DeFi Pulse started tracking it in August 2017. Five months later, it hit its second billion.

Less than a month after that, TLV now stands at USD 3 billion.

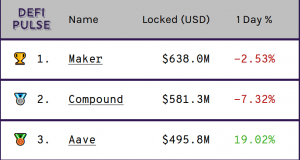

There has been another major change. After taking the throne for a short while, DeFi’s recent craze, Compound, has been pushed out of the first to the second spot by the long-standing dominant force – Maker‘s dominance is now more than 20% of the TVL.

This overall fast rise in TVL is brought in connection with the recently popular yield farming and usage incentives in DeFi. And here, a new contender seems to be grabbing the attention of the space, appreciating over 5,000% in a single day.

YFI is the governance token for yield aggregating platform Yearn.Finance, which can be earned by providing liquidity to one of their five released platforms, but whose creators said it has no value.

“In further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value,” wrote the platform’s developer Andre Cronje. “There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on [Uniswap], no, there won’t be an auction. We don’t have any of it. […] And just because we feel we didn’t stress it enough, 0 value. Don’t buy it. Earn it.”

But the market had other plans. YFI has been listed on decentralized exchange Uniswap.

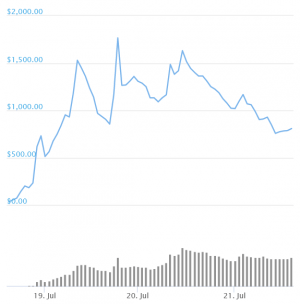

Per CoinGecko, the price of YFI jumped on July 18 from USD 34.5 to USD 1,765 recorded the next day – a whopping 5,091% rise. In the past 24 hours, it dropped nearly 51%.

YFI price chart:

The Cryptoverse was quick to react to this latest shift in the DeFi space. Su Zhu, CEO of Singapore-based investment management firm Three Arrows Capital, described “YFI sudden launch” as “one of the more poetic acts I’ve seen so far in the entire space,” adding that “to be wealthy is dime a dozen but to be legendary is priceless.”

As reported, yield farming – a strategy for earning the most returns by putting one’s capital to productive use in DeFi platforms – has taken the Cryptoverse by storm. Though not a new thing, it’s been boosted by liquidity mining, getting the farmer not only the return, but another (governance) token.

The whole thing really kicked off this June with Compound adding its COMP governance token, and Balancer soon following with BAL, enabling traders to “farm” these tokens, giving them claim on the networks themselves, and providing incentives and rewarding those who borrow or deposit assets.

Meanwhile, Ethereum (ETH) co-founder Vitalik Buterin described yield farming as unsustainable. “It’s just a temporary promotion that was created by printing a bunch of compound tokens, and you can’t just keep printing compound tokens forever,” he said.

Also, ConsenSys’ Codefi unit report found that yield farming has failed to bring large amounts of new people to the DeFi table, and has done little to help the “DeFi community grow beyond its current borders.”

___

Learn more:

Value Locked In DeFi to More Than Double in 2020 – Spartan Capital’s Koh

DeFi on ‘Tesla’s Path’ as Tokens Skyrocket On Hopes, Not Results

DeFi Faces Multiple Challenges On Its Way To Dominate Crypto

___

Other reactions:

__

__

__

__

__