XRP Price Prediction – Is XRP Going to Go Up?

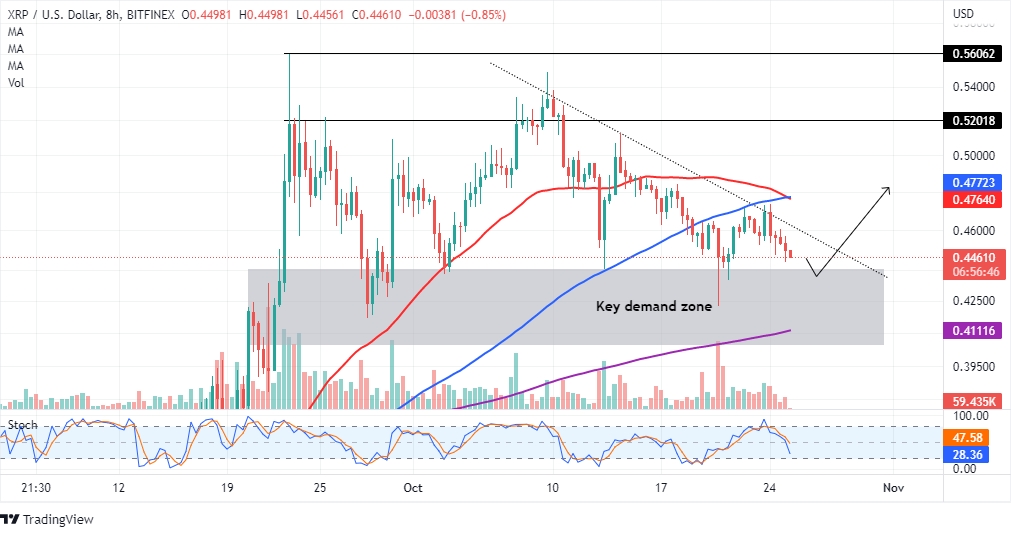

XRP, the token used for cross-border money remittance, appears to be at the tail end of a retracement from its October peak at $0.5488. A substantial demand area sits at $0.4200, where the XRP price is expected to start a new rally.

This is a minor dip from XRP’s current price, $0.4455, but investors should not fret because such a move could allow for liquidity collection ahead of a rebound to $1.

XRP Price Ready to Push Forward

The region between $0.4000 and $0.4400 represents the most robust demand area, helping XRP price to stay afloat. This support has been respected since September 28, when the token pulled back from its monthly top at $0.5606.

A descending trend line currently limits XRP price movement to the upside, leaving buyers with no option but to consider new entries downstream. In other words, immense liquidity awaits the international money remittance token within the rectangle pattern highlighted on its daily chart.

XRP price trades near oversold conditions based on the slippery slope followed by the Stochastic Oscillator. As overhead pressure engulfed XRP, the Stochastic diverged further from the price.

It is worth mentioning that prices do not dwell in the oversold region for long as markets often correct back to the fair value. Therefore, XRP must be at the threshold – ready to roll down the runway and take off.

According to insight from on-chain data, the XRP price is back in the buy zone. The MVRV (Market Value Realized Value) by Santiment affirms the available buying opportunities with a negative reading, precisely -5.41%.

This on-chain index tracks the average profit or loss of XRP holders based on the price at which each token last moved. Movement below the equilibrium line (0.00) infers that the XRP price is overvalued – the opposite is also true (XRP will be considered overvalued as the MVRV ratio shoots into the positive territory).

Simply put, investors experience an unrealized loss as the ratio flips negative. Hence, they prefer HODLing until the market recovers. As selling pressure diminishes, the tail force on the XRP price will increase and eventually force a rebound.

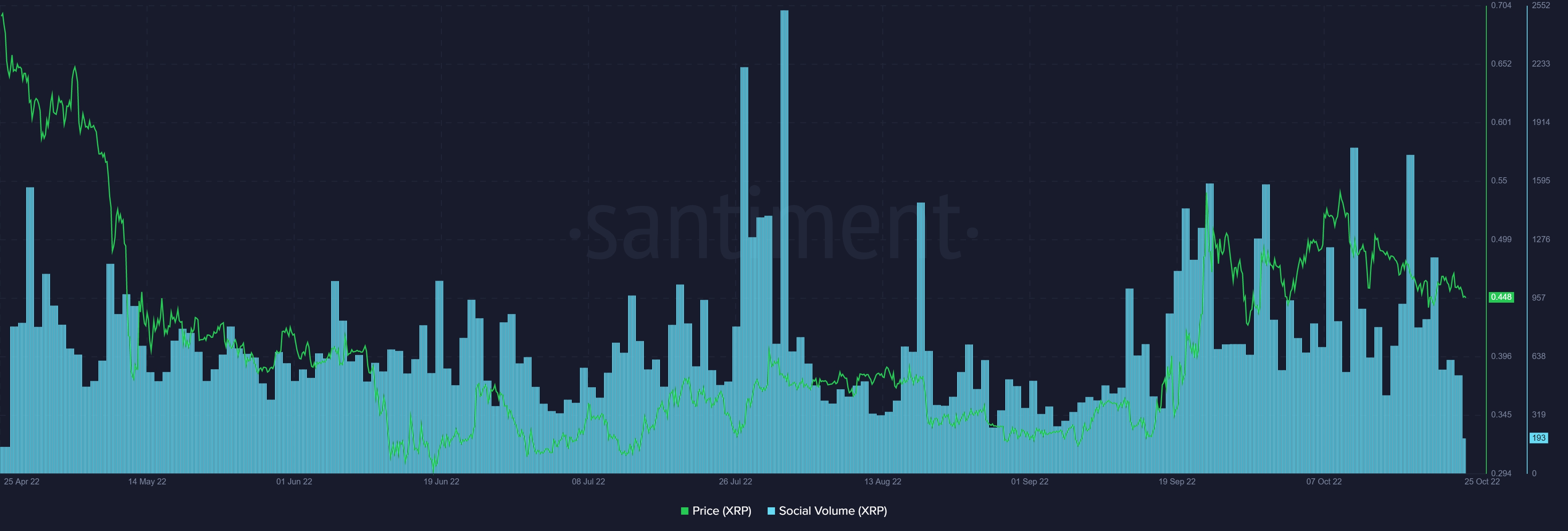

XRP is one of the hottest topics in the crypto industry, thanks to the ongoing lawsuit. The social volume model by Santiment highlights the mentions the token has been attracting over the last six months.

Investors usually pay attention to a trending cryptocurrency due to the possibility of sudden price pumps. The chart below shows that XRP price tends to react positively to surging social volumes.

Ripple Vs. SEC: What’s Next After the Hinman Documents

Ripple has bagged a huge win against the SEC (Securities and Exchange Commission). The regulator complied with the court order to release documents related to a 2018 speech by its former director of finance, Willian Hinman.

The documents contain details of how Ethereum was declared not a security. According to a Twitter communication by Ripple’s general counsel, Stuart Alderoty, the battle for the documents was long but reckoned that it was worth it.

“While they remain confidential for now (at the SEC’s insistence),” he added, “I can say that it was well worth the fight to get them.”

Ripple’s attorneys have not shared the contents of the documents related to the Hinman speech. It is still unclear how the speech will influence the High Court to rule in their favor, keeping in mind that the law has not deviated from the Howey Test for over 70 years.

Meanwhile, the SEC has requested the court to dismiss Ripple’s motion for summary judgment. The move by the regulator comes barely a day after the blockchain start-up filed a similar motion.

The SEC filing on Friday outlines that Ripple’s motion should be thrown out “because the undisputed evidence shows that defendants engaged in unregistered offers and sales of securities to public investors.”

XRP is expected to regain its past glory by reclaiming the third spot in terms of market capitalization t if Ripple wins the lawsuit. As outlined in this analysis, XRP price uptrend could hit $50 in a few years.

Moreover, such a win will be positive for the larger cryptocurrency industry and may set the precedence for determining crypto assets that are securities. Now the ball is in the court’s hands.

Why Should You Consider IMPT While Diversifying Your Portfolio In 2022?

Investors are still wading in the murky waters of the 2022 bear market. Although XRP price has the potential to outperform many of its peers, a diversified portfolio is a crucial risk management strategy.

IMPT, a crypto token packaged as the “greenest cryptocurrency,” is suitable for ESG investors. As a champion for climate change, IMPT was built on the Ethereum PoS blockchain.

IMPT stands out from its peers due to its technology that gives users opportunities to fund and support green initiatives. Investors will be able to buy carbon credits as a way of countering their carbon footprint.

The token is currently available on presale and has, so far, sold nearly $9 million worth of tokens in just over three weeks. IMPT is currently selling for $0.018, but the price will go up to $0.023 in the next presale stage.