XRP Price Prediction – Here’s Why It’s Pumping and Could Reach $3 Soon

The price of US fintech firm Ripple’s XRP cryptocurrency is pumping again and could even reach as high as $3 if Ripple’s legal battle with the SEC turns out favorable for the company.

At press time on Friday (11:40 UTC), XRP still traded just below the $0.48 mark and is up a whopping 9.5% for the day. The gain was enough to make XRP today’s best-performing token among the top 100 cryptoassets by market capitalization and comes after another rally towards the $0.50 level yesterday.

Notably, the strong gain for XRP came on a day with little excitement in the broader crypto market, with both bitcoin (BTC) and ethereum (ETH) more or less unchanged over the same time period.

The massive XRP rally is believed to have been fueled by news from the ongoing Ripple vs SEC court case. A U.S. District Court Judge has overruled the SEC’s attempts to withhold documents in the case. The documents, written by former SEC division director William Hinman, relates to a speech that argues that BTC and ETH are not securities – a key argument that Ripple has also used in relation to XRP’s status.

In addition, the surge in price has also been followed by a marked increase in social media buzz surrounding Ripple and XRP. According to the crypto social tracking platform LunarCrush, XRP-related social engagements are up 38% over the past three months, while the number of social contributors has risen by 8%.

We are noticing increased $XRP social activity along with its price +9.50% today📈#XRP 3-months activity:

— LunarCrush (@LunarCrush) September 29, 2022

Price: $0.4910 +55%

Social engagements: 1.95B +38%

Social contributors: 9.42K +8%

👉Insights: https://t.co/CJ2eQmpKrW pic.twitter.com/Hk5I4VpJP3

What does the future hold for XRP?

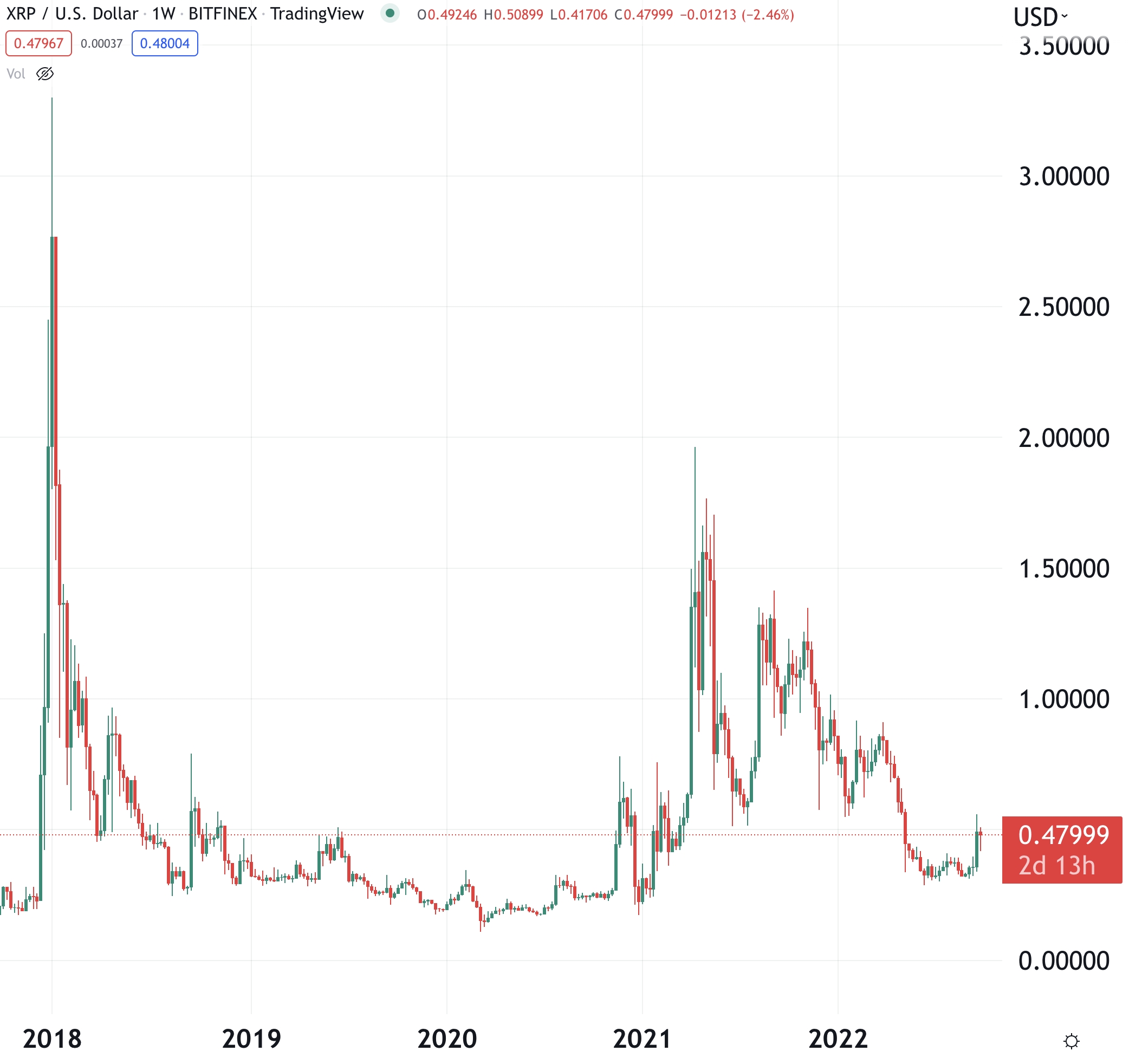

Looking into the future, basic technical analysis now suggests that more upside lies ahead after the price on Wednesday bounced off the $0.42 support level. The next major level to watch to the upside is now $0.55, which marks the high from September 23. Moreover, XRP bulls should also be prepared for the possibility of XRP rallying to as high as $3 over the long term if the bullish momentum continues.

It’s worth noting that XRP has only briefly traded above $3 once in its history. That happened as the major crypto bull market of 2017 peaked late that year, with XRP on Bitfinex reaching an all-time high of $3.3.

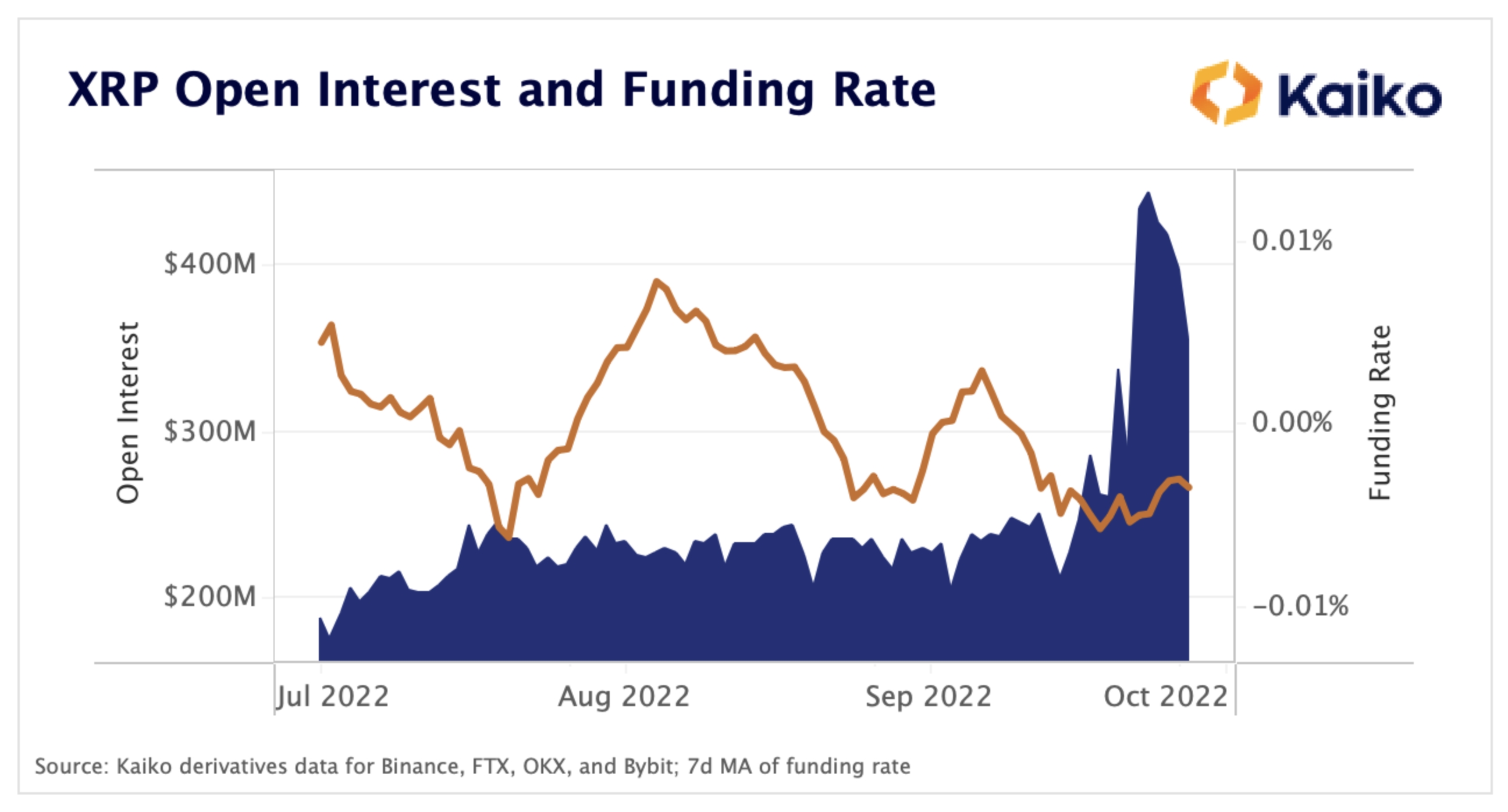

Meanwhile, in a research piece published on Thursday this week, crypto data provider Kaiko said that a negative funding rate on XRP futures contracts suggests high interest in shorting the token among traders. The positive funding rate came together with a spike in open interest, which doubled from $211m to $ 445m in under a week, according to Kaiko.

Commenting on the status of the legal case Ripple is involved in, Kaiko noted in its report that the case has proven that although the SEC can make things difficult for domestic crypto companies, it’s difficult to shut down a crypto project.

“We don’t know how the SEC’s case against Ripple will pan out, but XRP has thus far proved that the SEC has the ability to make it harder for U.S. persons to buy a token, but not the ability to kill a project,” the report said.