World’s Richest Are Dipping into Crypto Without Understanding It

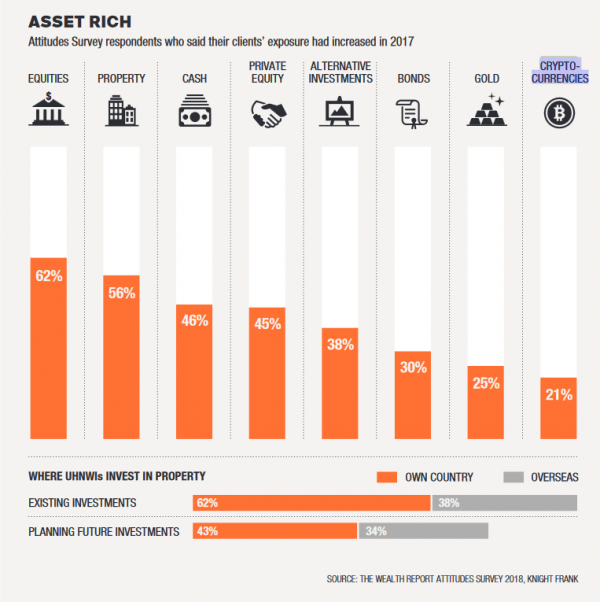

In an annual survey of wealth advisers and private bankers, 21% of respondents said clients had increased their investments in cryptocurrencies in 2017 – even though they may lack sufficient understanding of the technology behind the asset class, according to a Knight Frank’s 2018 edition of its Wealth Report.

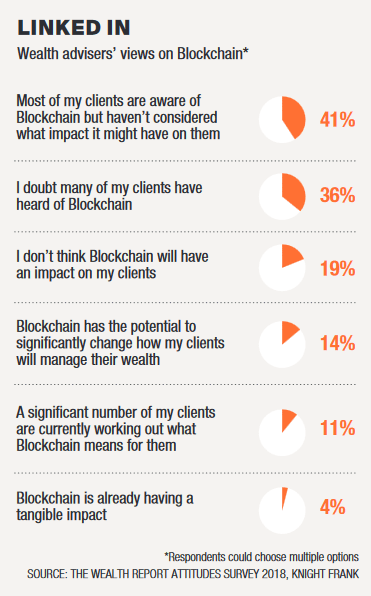

Nicholas Holt, head of research for Asia Pacific at the real estate firm Knight Frank, said to CNBC, “In a separate question, we asked about their understanding of blockchain and there’s still a huge amount of misunderstanding about blockchain. So, although people are getting on the train about investing in cryptocurrencies, perhaps there’s not a full understanding of what this could mean to their wealth portfolio.”

The survey is based on responses from more than 500 private bankers and wealth advisers who collectively represent about 50,000 people with a combined wealth of more than USD 3 trillion. Crypto was best received in Latin America, where 33% more of the ultra wealthy individuals increased their exposure to crypto than decreased it. Asia comes in as the most conservative of all separate territories, having only 5% more increased their exposure than those decreasing it.

However, most of the richest people still prefer going traditional by parking their wealth in stocks and properties. Some 62% of respondents said their clients had increased their exposure to equities in 2017, while 56% said clients increased their exposure to property.

Holt commented on that by saying, “That’s not surprising due to the fact that equities did very well last year. And property still remains the cornerstone of most wealthy individuals’ portfolios, accounting for up to 50% in many portfolios.”